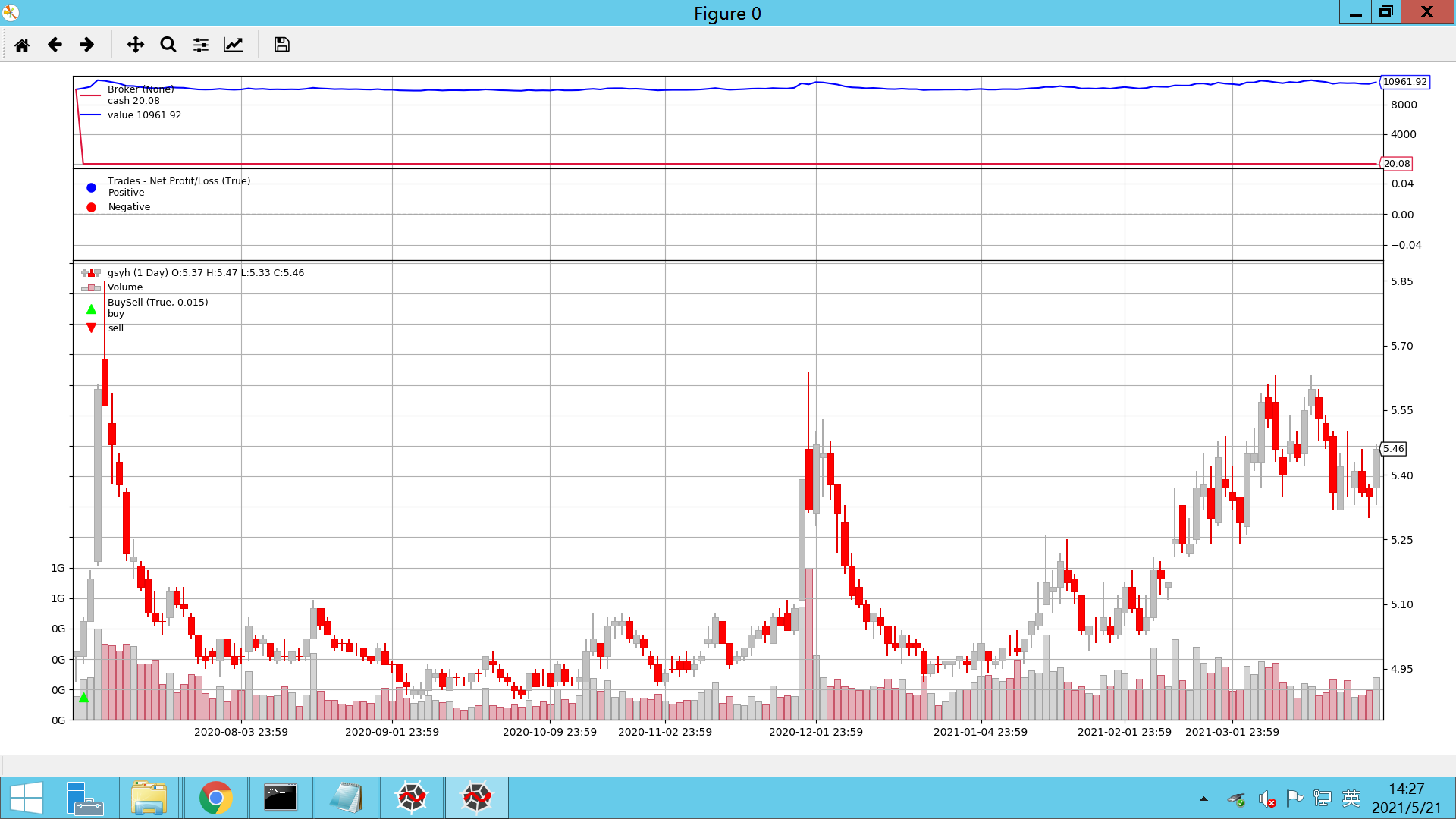

backtrader学习之四-买入并持有策略回测

这次选择最简单的买入并持有,买入工商银行一直持有。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime # For datetime objects

import backtrader as bt

import backtrader.feeds as btfeed

import math

class BSCSVData(btfeed.GenericCSVData):

params = (

("fromdate", datetime.datetime(2020, 7, 1)),

("todate", datetime.datetime(2021, 3, 30)),

('dtformat', ('%Y/%m/%d')),

('openinterest', -1)

)

# Create a Stratey

class BahStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

def next(self):

# self.log('Close, %.2f' % self.dataclose[0])

if not self.position:

self.buy(size=math.floor(self.broker.get_cash() / self.dataclose[0]))

if __name__ == '__main__':

filename = 'gsyh.csv'

cerebro = bt.Cerebro()

# 加载自定义策略

cerebro.addstrategy(BahStrategy)

# 设置金额为一百万

cerebro.broker.set_cash(10000.0)

# 加载历史数据

data = BSCSVData(dataname="c:\{0}".format(filename))

cerebro.adddata(data)

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.run()

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

# 计算总回报率和年度回报率

return_all = cerebro.broker.getvalue()/1000000.0

print('Total ROI: {0}%, Annual ROI{1}%'.format(

round((return_all - 1.0) * 100, 2),

round((pow(return_all, 1.0 / 10) - 1.0) * 100, 2)

))

cerebro.plot(style='candlestick')