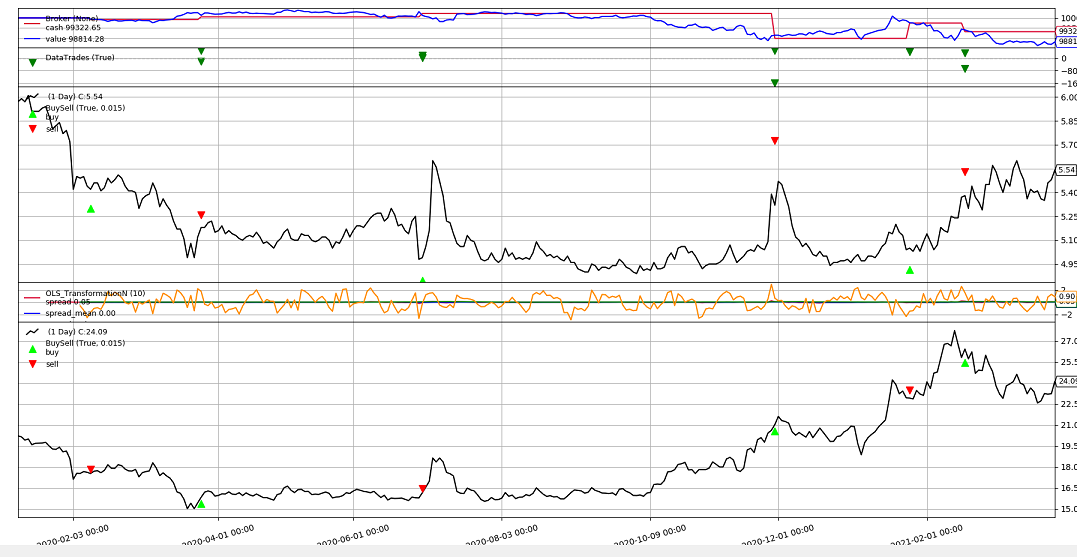

backtrader学习之二-配对交易策略回测

用backtrader做股票数据的配对策略回测,这次用配对策略对工商银行、兴业银行的数据进行回测。逻辑

是当zcore值大于2.1,卖股票1买股票2,zcore小于-2.1,卖股票2买股票1

数据源来自baostock.com,数据按照时间,holc排序。由于数据没有进行复权,貌似也不准,仅用于练手。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime

import pandas as pd

from pylab import mpl

import numpy as np

# The above could be sent to an independent module

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class PairTradingStrategy(bt.Strategy):

params = dict(

period=10,

stake=10,

qty1=0,

qty2=0,

printout=True,

#设置上限为2.1

upper=2.1,

#设置下限为-2.1

lower=-2.1,

up_medium=0.5,

low_medium=-0.5,

status=0,

portfolio_value=10000,

)

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders 允许开新单

self.orderid = None

def __init__(self):

# To control operation entries

self.orderid = None

self.qty1 = self.p.qty1

self.qty2 = self.p.qty2

self.upper_limit = self.p.upper

self.lower_limit = self.p.lower

self.up_medium = self.p.up_medium

self.low_medium = self.p.low_medium

self.status = self.p.status

self.portfolio_value = self.p.portfolio_value

# Signals performed with PD.OLS : 计算data0上data1的回归和zscord值

self.transform = btind.OLS_TransformationN(self.data0, self.data1,

period=self.p.period)

self.zscore = self.transform.zscore

# Checking signals built with StatsModel.API :

# self.ols_transfo = btind.OLS_Transformation(self.data0, self.data1,

# period=self.p.period,

# plot=True)

def next(self):

if self.orderid:

return # if an order is active, no new orders are allowed

if self.p.printout:

print('Self len:', len(self))

print('Data0 len:', len(self.data0))

print('Data1 len:', len(self.data1))

print('Data0 len == Data1 len:',

len(self.data0) == len(self.data1))

print('Data0 dt:', self.data0.datetime.datetime())

print('Data1 dt:', self.data1.datetime.datetime())

print('status is', self.status)

print('zscore is', self.zscore[0])

# Step 2: Check conditions for SHORT & place the order 检查是否需要卖出

# Checking the condition for SHORT

if (self.zscore[0] > self.upper_limit) and (self.status != 1):

# Calculating the number of shares for each stock 计算股票的数量

value = 0.5 * self.portfolio_value # Divide the cash equally

x = int(value / (self.data0.close)) # Find the number of shares for Stock1

y = int(value / (self.data1.close)) # Find the number of shares for Stock2

print('x + self.qty1 is', x + self.qty1)

print('y + self.qty2 is', y + self.qty2)

# Placing the order 下单,卖1买2

self.log('SELL CREATE %s, price = %.2f, qty = %d' % ("PEP", self.data0.close[0], x + self.qty1))

self.sell(data=self.data0, size=(x + self.qty1)) # Place an order for buying y + qty2 shares

self.log('BUY CREATE %s, price = %.2f, qty = %d' % ("KO", self.data1.close[0], y + self.qty2))

self.buy(data=self.data1, size=(y + self.qty2)) # Place an order for selling x + qty1 shares

# Updating the counters with new value 更新持仓值

self.qty1 = x # The new open position quantity for Stock1 is x shares

self.qty2 = y # The new open position quantity for Stock2 is y shares

self.status = 1 # The current status is "short the spread"

# Step 3: Check conditions for LONG & place the order 检查是否买入

# Checking the condition for LONG

elif (self.zscore[0] < self.lower_limit) and (self.status != 2):

# Calculating the number of shares for each stock 计算买入数量

value = 0.5 * self.portfolio_value # Divide the cash equally

x = int(value / (self.data0.close)) # Find the number of shares for Stock1

y = int(value / (self.data1.close)) # Find the number of shares for Stock2

print('x + self.qty1 is', x + self.qty1)

print('y + self.qty2 is', y + self.qty2)

# Place the order 下单买入股票1,卖出股票2

self.log('BUY CREATE %s, price = %.2f, qty = %d' % ("PEP", self.data0.close[0], x + self.qty1))

self.buy(data=self.data0, size=(x + self.qty1)) # Place an order for buying x + qty1 shares

self.log('SELL CREATE %s, price = %.2f, qty = %d' % ("KO", self.data1.close[0], y + self.qty2))

self.sell(data=self.data1, size=(y + self.qty2)) # Place an order for selling y + qty2 shares

# Updating the counters with new value 刷新持仓值

self.qty1 = x # The new open position quantity for Stock1 is x shares

self.qty2 = y # The new open position quantity for Stock2 is y shares

self.status = 2 # The current status is "long the spread"

# Step 4: Check conditions for No Trade 检查是否无需交易

# If the z-score is within the two bounds, close all

"""

elif (self.zscore[0] < self.up_medium and self.zscore[0] > self.low_medium):

self.log('CLOSE LONG %s, price = %.2f' % ("PEP", self.data0.close[0]))

self.close(self.data0)

self.log('CLOSE LONG %s, price = %.2f' % ("KO", self.data1.close[0]))

self.close(self.data1)

"""

def stop(self):

print('==================================================')

print('Starting Value - %.2f' % self.broker.startingcash)

print('Ending Value - %.2f' % self.broker.getvalue())

print('==================================================')

def runstrategy():

args = parse_args()

# Create a cerebro 建立大脑

cerebro = bt.Cerebro()

# Get the dates from the args 从csv取数据

dataframe0 = pd.read_csv(r"C:\load\gsyh.csv", index_col=0, parse_dates=True)

dataframe0['openinterest'] = 0

data0 = bt.feeds.PandasData(dataname=dataframe0,

fromdate = datetime.datetime(2020, 1, 1),

todate = datetime.datetime(2021, 3, 31)

)

dataframe1 = pd.read_csv(r"C:\load\xyyh.csv", index_col=0, parse_dates=True)

dataframe1['openinterest'] = 0

data1 = bt.feeds.PandasData(dataname=dataframe1,

fromdate = datetime.datetime(2020, 1, 1),

todate = datetime.datetime(2021, 3, 31)

)

# fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

# todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# Add the 1st data to cerebro 引入数据

cerebro.adddata(data0)

# Add the 2nd data to cerebro

cerebro.adddata(data1)

# Add the strategy 引入策略

cerebro.addstrategy(PairTradingStrategy,

period=args.period,

stake=args.stake)

# Add the commission - only stocks like a for each operation 假如资金量

cerebro.broker.setcash(args.cash)

# Add the commission - only stocks like a for each operation 引入佣金率

cerebro.broker.setcommission(commission=args.commperc)

# And run it 运行

cerebro.run(runonce=not args.runnext,

preload=not args.nopreload,

oldsync=args.oldsync)

# Plot if requested 绘图

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False, zdown=False)

if __name__ == '__main__':

runstrategy()

执行后,1万变成了9932,貌似亏了。有问题请留言。