QuantLib 金融计算——随机过程之 Heston 过程

如果未做特别说明,文中的程序都是 Python3 代码。

QuantLib 金融计算——随机过程之 Heston 过程

载入模块

import QuantLib as ql

import pandas as pd

import numpy as np

import seaborn as sn

print(ql.__version__)

1.12

Heston 过程

著名的 Heston 模型描述了下列 SDE:

\[\begin{aligned}

d S_t & = \mu S_t d t + \sqrt { V_t } S_t d W_t^S \\

d V_t & = \kappa \left( \theta - V_t \right) d t + \sigma \sqrt { V_t } d W_t^V \\

d W_t^S d W_t^V & = \rho d t

\end{aligned}

\]

quantlib-python 中 Heston 过程的构造函数如下:

HestonProcess(riskFreeRate,

dividendYield,

s0,

v0,

kappa,

theta,

sigma,

rho)

其中,

riskFreeRate:YieldTermStructureHandle对象,描述无风险利率的期限结构;dividendYield:YieldTermStructureHandle对象,描述股息率的期限结构;s0:QuoteHandle对象,资产价格的起始值;v0:浮点数,波动率的起始值;kappa、theta、sigma:浮点数,描述波动率的 SDE 的参数;rho:浮点数,模型中两个布朗运动之间的相关性

除了一些检查器之外,HestonProcess 没有提过其他特别的成员函数。

由于方程没有显式解,因此必须在 evolve 函数中使用算法进行离散化。quantlib-python 默认的离散化方法是 Quadratic Exponential Martingale 方法,具体的算法细节请查看参考文献(Andersen 和 Leif,2008)

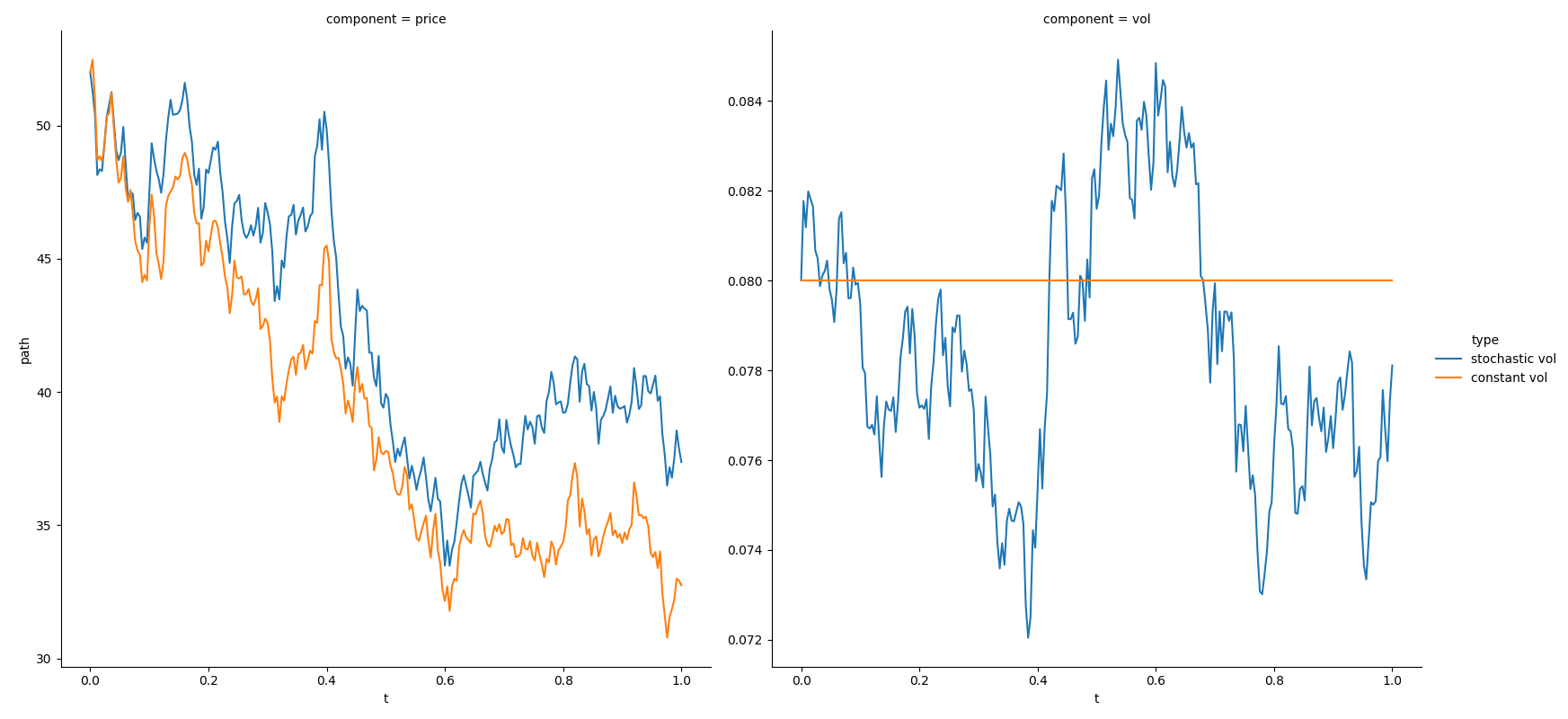

由于 evolve 函数将离散化计算中对布朗运动的离散化以参数形式暴露了出来,使得用户可以容易地显现出随机波动率对资产价格序列的影响。下面的例子比较了一般 Black Scholes 过程和 Heston 过程,所模拟的资产价格除了波动率结构以外,都完全一致。

def testingStochasticProcesses2(seed):

refDate = ql.Date(27, ql.January, 2019)

riskFreeRate = 0.0321

dividendRate = 0.0128

spot = 52.0

cal = ql.China()

dc = ql.ActualActual()

rdHandle = ql.YieldTermStructureHandle(

ql.FlatForward(refDate, riskFreeRate, dc))

rqHandle = ql.YieldTermStructureHandle(

ql.FlatForward(refDate, dividendRate, dc))

spotHandle = ql.QuoteHandle(

ql.SimpleQuote(spot))

kappa = 1.2

theta = 0.08

sigma = 0.05

rho = -0.6

v0 = theta

hestonProcess = ql.HestonProcess(

rdHandle, rqHandle, spotHandle, v0,

kappa, theta, sigma, rho)

volHandle = ql.BlackVolTermStructureHandle(

ql.BlackConstantVol(refDate, cal, np.sqrt(v0), dc))

bsmProcess = ql.BlackScholesMertonProcess(

spotHandle, rqHandle, rdHandle, volHandle)

unifMt = ql.MersenneTwisterUniformRng(seed)

bmGauss = ql.BoxMullerMersenneTwisterGaussianRng(unifMt)

dt = 0.004

numVals = 250

dw = ql.Array(2)

x = ql.Array(2)

x[0] = spotHandle.value()

x[1] = v0

y = x[0]

htn = pd.DataFrame(

dict(

t=np.linspace(0, dt * numVals, numVals + 1),

price=np.nan,

vol=np.nan))

bsm = pd.DataFrame(

dict(

t=np.linspace(0, dt * numVals, numVals + 1),

price=np.nan,

vol=v0))

htn.loc[0, 'price'] = x[0]

htn.loc[0, 'vol'] = x[1]

bsm.loc[0, 'price'] = y

for j in range(1, numVals + 1):

dw[0] = bmGauss.next().value()

dw[1] = bmGauss.next().value()

x = hestonProcess.evolve(htn.loc[j, 't'], x, dt, dw)

y = bsmProcess.evolve(bsm.loc[j, 't'], y, dt, dw[0])

htn.loc[j, 'price'] = x[0]

htn.loc[j, 'vol'] = x[1]

bsm.loc[j, 'price'] = y

htn = htn.melt(

id_vars='t',

var_name='component',

value_name='path')

htn['type'] = 'stochastic vol'

bsm = bsm.melt(

id_vars='t',

var_name='component',

value_name='path')

bsm['type'] = 'constant vol'

htn_bsm = pd.concat([htn, bsm])

sn.relplot(

x='t',

y='path',

data=htn_bsm,

col='component',

hue='type',

kind="line",

height=8,

facet_kws=dict(sharey=False))

testingStochasticProcesses2(100)

参考文献

- Andersen, Leif. 2008. Simple and efficient simulation of the Heston stochastic volatility model. Journal of Computational Finance 11: 1–42.

扩展阅读

★ 持续学习 ★ 坚持创作 ★