[QUANTAXIS量化分析]三因素模型(ZZ)

基本原理

三因素模型表达式:

E(Rit) − Rft = βi[E(Rmt − Rft] + siE(SMBt) + hiE(HMIt)

根据一篇文章,选择三个因子作测试:

财务因子:EPS

成交量因子:log(30日日均交易量/昨日交易量)

反转因子:(ma10-ma5)/ma5

综合选取这三个因子,0.3,0.4,0.3的权值加和,选取较高的股票并持仓。综合选取这三个因子,0.3,0.4,0.3的权值加和,选取较高的股票并持仓。

策略实现

初始资金100万,20万无明显效果差异,时间段为2017-01-01~2018-01-01.

选取市盈率0~20之间的股票,每日对三因子加和进行排序

每天进行判断,选取三因子加和排名前n的股票,若已持股,继续买入,未持股则买入,已持股中有不在排名前n中的,卖出。

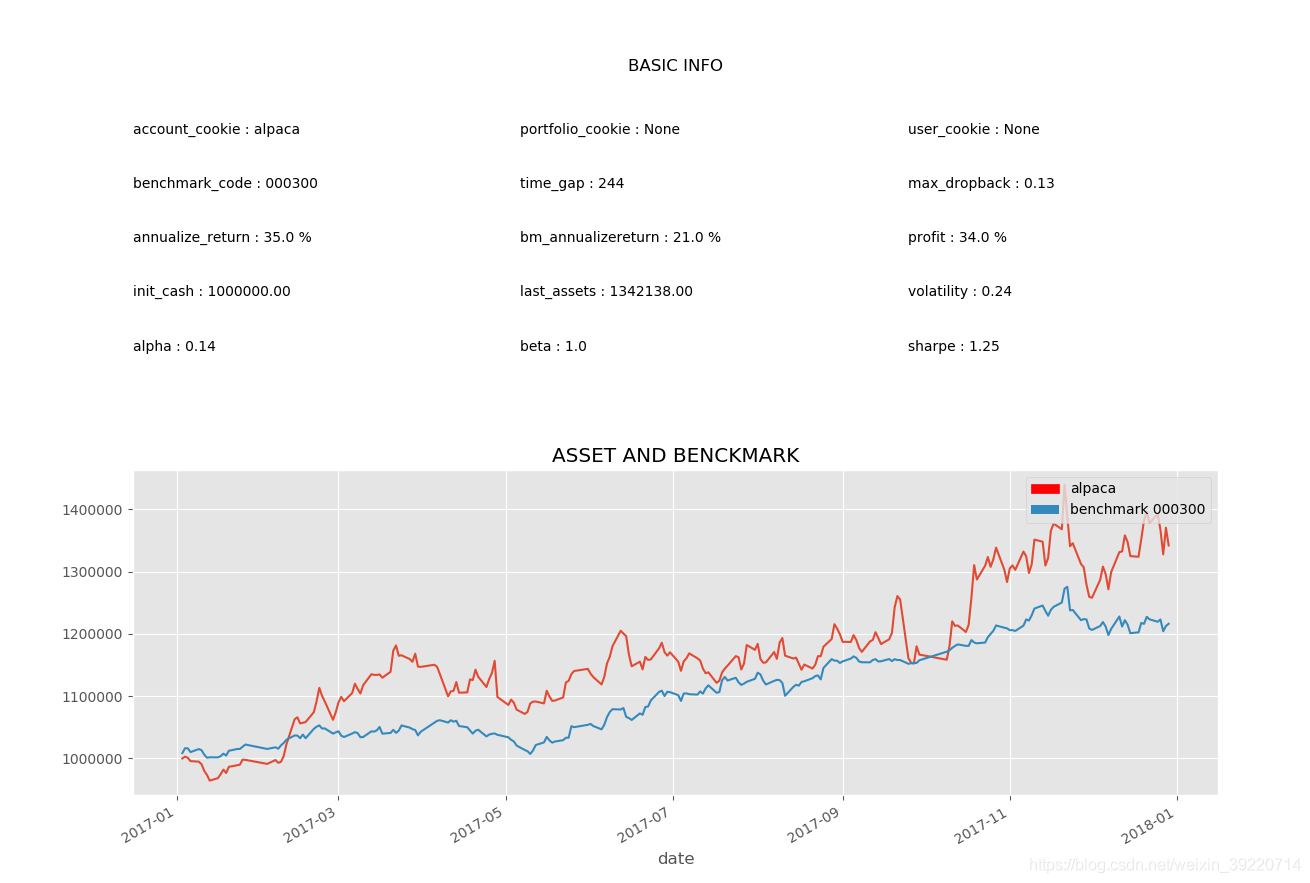

(每日操作10只股票)运行截图(忽略曲线名):

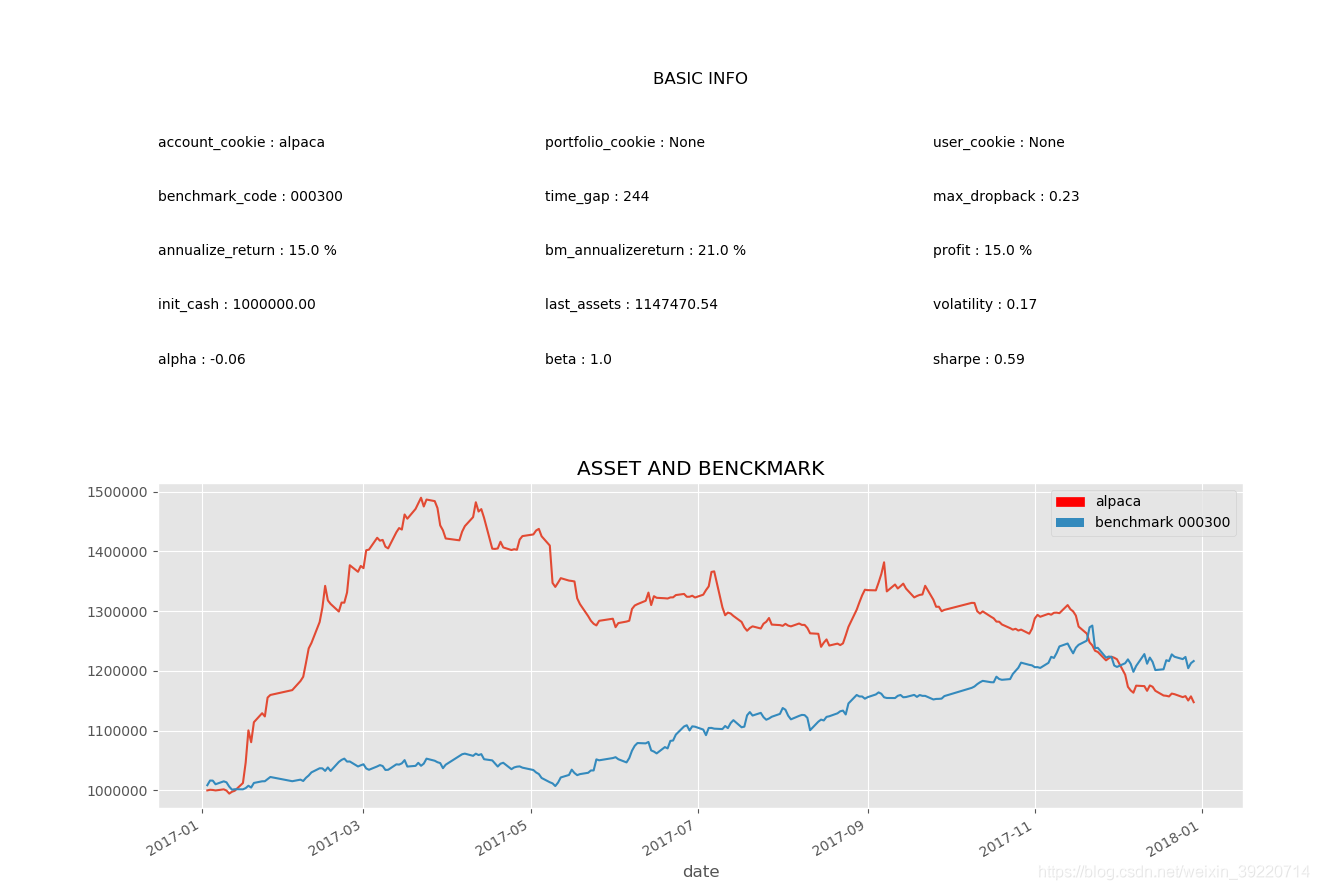

(每日操作20只股票)运行截图(忽略曲线名):

遇到的问题及改进:

- 采用的三个因子或许还能有其他财务因子进行代表

- 本次代码中取得EPS的时间有些过长,有点想法,等我后面改进(已改进,不必每只股票每天的eps都获取一次)

# coding: utf-8 # @author: lin # @date: 2018/11/20 import QUANTAXIS as QA import datetime import pandas as pd import time import math import matplotlib.pyplot as plt import numpy as np pd.set_option('max_colwidth', 5000) pd.set_option('display.max_columns', 5000) pd.set_option('display.max_rows', 5000) class ThreePara: def __init__(self, start_time, stop_time, n_stock=10, stock_init_cash=1000000, n_days_before=1): self.Account = QA.QA_Account() # 初始化账户 self.Account.reset_assets(stock_init_cash) # 初始化账户 self.Account.account_cookie = 'three_para' self.Broker = QA.QA_BacktestBroker() self.time_quantum_list = ['-12-31', '-09-30', '-06-30', '-03-31'] self.start_time = start_time self.stop_time = stop_time self.n_days_before = n_days_before self.stock_pool = [] self.data = None self.ind = None self.n_stock = n_stock self.get_stock_pool() def get_financial_time(self): """ 得到此日期前一个财务数据的日期 :return: """ year = self.start_time[0:4] while (True): for day in self.time_quantum_list: the_financial_time = year + day if the_financial_time <= self.start_time: return the_financial_time year = str(int(year) - 1) def get_assets_eps(self, stock_code, the_financial_time): """ 得到高级财务数据 :param stock_code: :param the_financial_time: 离开始时间最近的财务数据的时间 :return: """ financial_report = QA.QA_fetch_financial_report(stock_code, the_financial_time) if financial_report is not None: return financial_report.iloc[0]['totalAssets'], financial_report.iloc[0]['EPS'] return None, None def get_stock_pool(self): """ 选取哪些股票 """ stock_code_list = QA.QA_fetch_stock_list_adv().code.tolist() the_financial_time = self.get_financial_time() for stock_code in stock_code_list: # print(stock_code) assets, EPS = self.get_assets_eps(stock_code, the_financial_time) if assets is not None and EPS != 0: data = QA.QA_fetch_stock_day_adv(stock_code, self.start_time, self.stop_time) if data is None: continue price = data.to_pd().iloc[0]['close'] if 0 < price / EPS < 20: # 满足条件才添加进行排序 # print(price / EPS) self.stock_pool.append(stock_code) def cjlyz(self, data, n=20): # log(30日日均交易量/昨日交易量) data['cjlyz'] = 0 data['n_days_vol_ave'] = QA.MA(data['volume'], n) data = data.fillna(0) last_index = 0 for index, row in data.iterrows(): if last_index != 0: data.loc[index, 'cjlyz'] = row['n_days_vol_ave'] / data.loc[last_index, 'volume'] last_index = index for index, row in data.iterrows(): if row['cjlyz'] != 0: data.loc[index, 'cjlyz'] = math.log10(row['cjlyz']) return data # 反转因子 def fzyz(self, data, n=10, m=5): # (ma10-ma5)/ma5 data['ma_10'] = QA.MA(data['close'], n) data['ma_5'] = QA.MA(data['close'], m) data['fzyz'] = (data['ma_10'] - data['ma_5']) / data['ma_5'] data = data.fillna(0) return data def get_EPS(self, stock_code, the_time): # 由财政数据中得到EPS,是上个季度的 year = the_time[0:4] if_break = False n_EPS_list = [] while (True): for day in self.time_quantum_list: date = year + day if date < the_time: financial_report = QA.QA_fetch_financial_report(stock_code, date) if financial_report is not None: return financial_report.iloc[0]['EPS'] if if_break: # 触发,则跳出循环 break year = str(int(year) - 1) def three_para(self, data): # 整合三个因子 data = self.cjlyz(data) data = self.fzyz(data) data['EPS'] = 0 if_first = True last_index = None for index, row in data.iterrows(): if_value_equal = True # 值是否跟上次值相同 the_time = str(index[0])[:10] if not if_first: last_time = str(last_index[0])[:10] for time_quantum in self.time_quantum_list: middle_time = last_time[:4] + time_quantum # 得到判断的分界点 if last_time < middle_time < the_time: # 有一次处于分界点左右,则需要重新计算 if_value_equal = False break if if_value_equal: data.loc[index, 'EPS'] = data.loc[last_index, 'EPS'] if if_first or not if_value_equal: stock_code = str(index[1]) # print(stock_code) value = self.get_EPS(stock_code, the_time) data.loc[index, 'EPS'] = value if_first = False last_index = index # 把当次索引加入,下次调用则为上次索引 data['decided_para'] = 0.3 * data['EPS'] + 0.4 * data['cjlyz'] + 0.3 * data['fzyz'] return data def solve_data(self): self.data = QA.QA_fetch_stock_day_adv(self.stock_pool, self.start_time, self.stop_time) self.ind = self.data.add_func(self.three_para) def run(self): self.solve_data() print(self.ind) for items in self.data.panel_gen: today_time = items.index[0][0] one_day_data = self.ind.loc[today_time] # 得到有包含因子的DataFrame one_day_data['date'] = items.index[0][0] one_day_data.reset_index(inplace=True) one_day_data.sort_values(by='decided_para', axis=0, ascending=False, inplace=True) today_stock = list(one_day_data.iloc[0:self.n_stock]['code']) one_day_data.set_index(['date', 'code'], inplace=True) one_day_data = QA.QA_DataStruct_Stock_day(one_day_data) # 转换格式,便于计算 bought_stock_list = list(self.Account.hold.index) print("SELL:") for stock_code in bought_stock_list: # 如果直接在循环中对bought_stock_list操作,会跳过一些元素 if stock_code not in today_stock: try: item = one_day_data.select_day(str(today_time)).select_code(stock_code) order = self.Account.send_order( code=stock_code, time=today_time, amount=self.Account.sell_available.get(stock_code, 0), towards=QA.ORDER_DIRECTION.SELL, price=0, order_model=QA.ORDER_MODEL.MARKET, amount_model=QA.AMOUNT_MODEL.BY_AMOUNT ) self.Broker.receive_order(QA.QA_Event(order=order, market_data=item)) trade_mes = self.Broker.query_orders(self.Account.account_cookie, 'filled') res = trade_mes.loc[order.account_cookie, order.realorder_id] order.trade(res.trade_id, res.trade_price, res.trade_amount, res.trade_time) except Exception as e: print(e) print('BUY:') for stock_code in today_stock: try: item = one_day_data.select_day(str(today_time)).select_code(stock_code) order = self.Account.send_order( code=stock_code, time=today_time, amount=1000, towards=QA.ORDER_DIRECTION.BUY, price=0, order_model=QA.ORDER_MODEL.CLOSE, amount_model=QA.AMOUNT_MODEL.BY_AMOUNT ) self.Broker.receive_order(QA.QA_Event(order=order, market_data=item)) trade_mes = self.Broker.query_orders(self.Account.account_cookie, 'filled') res = trade_mes.loc[order.account_cookie, order.realorder_id] order.trade(res.trade_id, res.trade_price, res.trade_amount, res.trade_time) except Exception as e: print(e) self.Account.settle() Risk = QA.QA_Risk(self.Account) print(Risk.message) # plt.show() Risk.assets.plot() # 总资产 plt.show() Risk.benchmark_assets.plot() # 基准收益的资产 plt.show() Risk.plot_assets_curve() # 两个合起来的对比图 plt.show() Risk.plot_dailyhold() # 每只股票每天的买入量 plt.show() start = time.time() sss = ThreePara('2017-01-01', '2018-01-01', 10) stop = time.time() print(stop - start) print(len(sss.stock_pool)) sss.run() stop2 = time.time() print(stop2 - stop)

————————————————

版权声明:本文为CSDN博主「Trident_lin」的原创文章,遵循CC 4.0 BY-SA版权协议,转载请附上原文出处链接及本声明。

原文链接:https://blog.csdn.net/weixin_39220714/article/details/87826136

浙公网安备 33010602011771号

浙公网安备 33010602011771号