金融数据分析| JoinQuant 量化策略

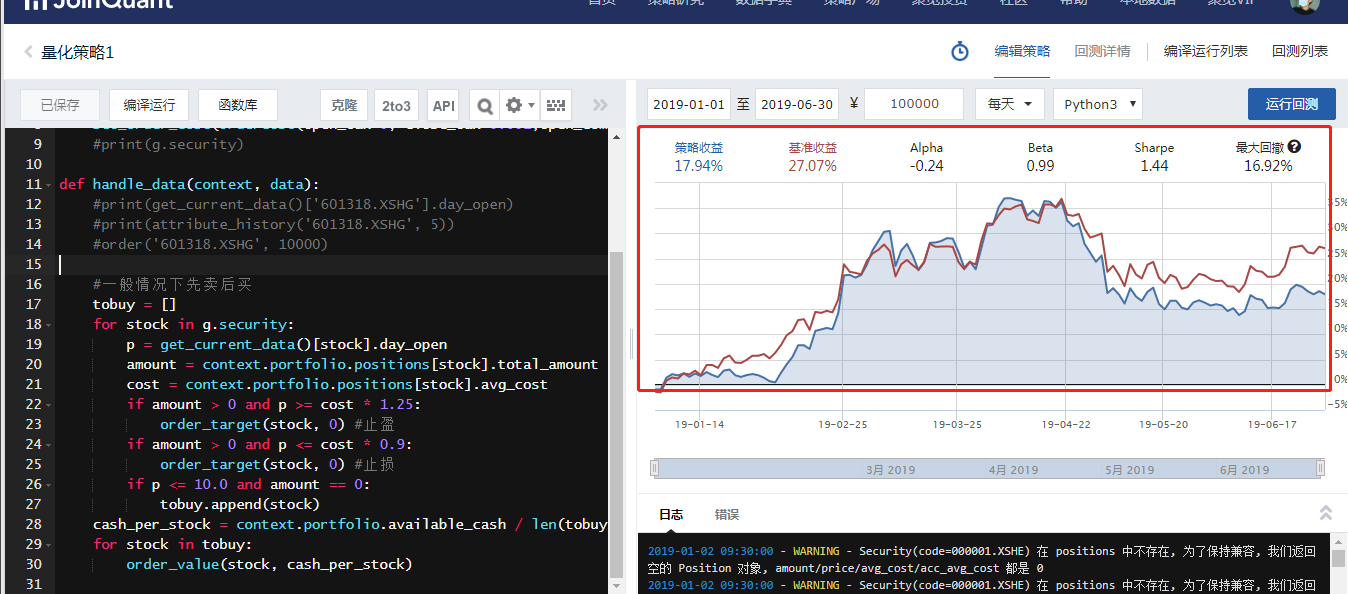

第一个量化策略:

设置股票池为沪深300的所有成分股,

如果当前股价小于10元/股且当前不持仓, 则买入;

如果当前股价比买入时上涨了25%, 则清仓止盈;

如果当前股价比买入时下跌了10%, 则清仓止损。

https://www.joinquant.com/algorithm/index/list

import jqdata

def initialize(context):

#g.security = '601318.XSHG'

set_benchmark('000300.XSHG')

g.security = get_index_stocks('000300.XSHG')

set_option('use_real_price', True)

set_order_cost(OrderCost(open_tax=0, close_tax=0.001,open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock')

#print(g.security)

def handle_data(context, data):

#print(get_current_data()['601318.XSHG'].day_open)

#print(attribute_history('601318.XSHG', 5))

#order('601318.XSHG', 10000)

#一般情况下先卖后买

tobuy = []

for stock in g.security:

p = get_current_data()[stock].day_open

amount = context.portfolio.positions[stock].total_amount

cost = context.portfolio.positions[stock].avg_cost

if amount > 0 and p >= cost * 1.25:

order_target(stock, 0) #止盈

if amount > 0 and p <= cost * 0.9:

order_target(stock, 0) #止损

if p <= 10.0 and amount == 0:

tobuy.append(stock)

cash_per_stock = context.portfolio.available_cash / len(tobuy)

for stock in tobuy:

order_value(stock, cash_per_stock)

【推荐】国内首个AI IDE,深度理解中文开发场景,立即下载体验Trae

【推荐】编程新体验,更懂你的AI,立即体验豆包MarsCode编程助手

【推荐】抖音旗下AI助手豆包,你的智能百科全书,全免费不限次数

【推荐】轻量又高性能的 SSH 工具 IShell:AI 加持,快人一步

· AI与.NET技术实操系列:向量存储与相似性搜索在 .NET 中的实现

· 基于Microsoft.Extensions.AI核心库实现RAG应用

· Linux系列:如何用heaptrack跟踪.NET程序的非托管内存泄露

· 开发者必知的日志记录最佳实践

· SQL Server 2025 AI相关能力初探

· winform 绘制太阳,地球,月球 运作规律

· 震惊!C++程序真的从main开始吗?99%的程序员都答错了

· 【硬核科普】Trae如何「偷看」你的代码?零基础破解AI编程运行原理

· AI与.NET技术实操系列(五):向量存储与相似性搜索在 .NET 中的实现

· 超详细:普通电脑也行Windows部署deepseek R1训练数据并当服务器共享给他人

2019-05-13 Fink| 实时热门商品

2019-05-13 Fink| CEP

2019-05-13 Fink| source| transform| sink

2018-05-13 JavaScript