去中心化金融-Lec2

Finance

Finance is the process that involves the creation, management, and

investment of money and financial assets

Financial assets

non-physical, like Bank deposits, stocks, bonds, loans, derivatives

Financial services

banking, lending/borrowing, securi0es, insurance, trusts, funds

Financial markets

marketplace for trading financial assets

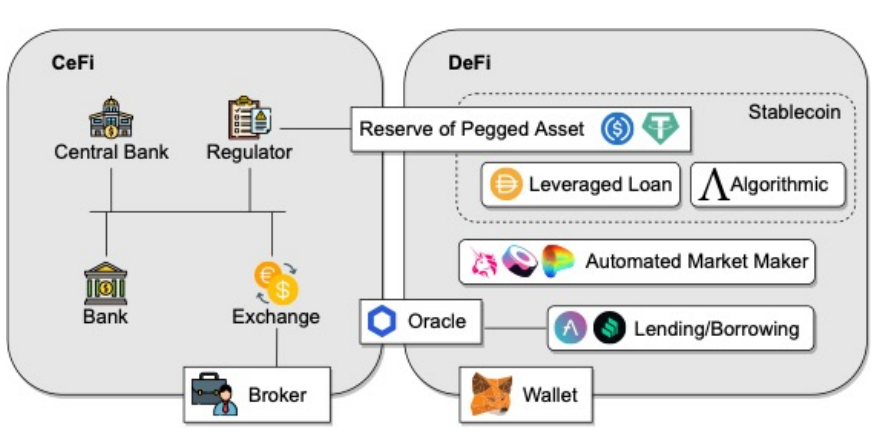

传统金融(中心化金融) v.s. 去中心化金融

Traditional Finance (CeFi)

- Hold custodies of customers’ funds/assets

- Serves as intermediaries for transactions

- Adhere to strict on-boarding & continuous compliance rules (regulation)

- Customer has no privacy to service provider

- Opaque (不透明), siloed (独立的)databases and applications

- Need to be trusted to operate correctly and securely

Bitcoin

随着Bitcoin的诞生,区块链这个技术也同步产生。

Bitcoin: A Peer-to-Peer Electronic Cash System

以太坊 Ethereum

为了实现更加复杂的功能,以太坊(Ehereum, smart contract platform 更像是ecosystem)被发明了。就可以实现 借贷、等高级功能。

DeFi

Financial infrastructure as

an open, permissionless,

and highly interoperable (可交互的) protocol stack built on

public smart contract

platforms

主要关注三个点:

- Custody & settlement (托管和结算)

- Transaction execution (对应于 CeFi Intermediary (中介), DeFi Settlement)

- Protocol governance (对应于 Centrally governed DeFi)

要三个同时满足才是DeFi

CeFi v.s. DeFi

Tradional finance

- Permissioned

- Custodial (保管人)

- Centralized trust & governance

- Real identity

Decentralized finance

- Permissionless

- Non-custodial

- Decentralized trust & governance; Trustless

- Pseudonymous (匿名); privacy

DeFi Advantages

- Efficiency

- Open finance and universal accessibility

- Transparency and public verifiability

- Self custody and censorship resistant

- Automation & programmability

- Composability and interoperability

- Innovation

- Fast Growth

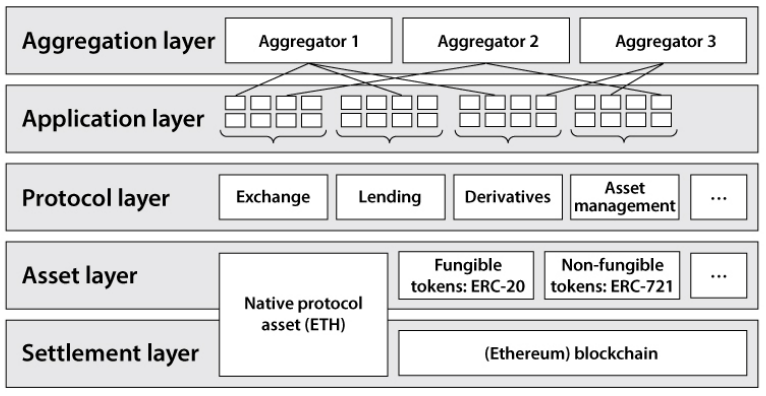

DeFi Stack

DeFi is enabled by a decentralized smart contract platform

pegged asset(挂钩资产): 其实就是稳定币

leveraged Loan: 杠杆贷

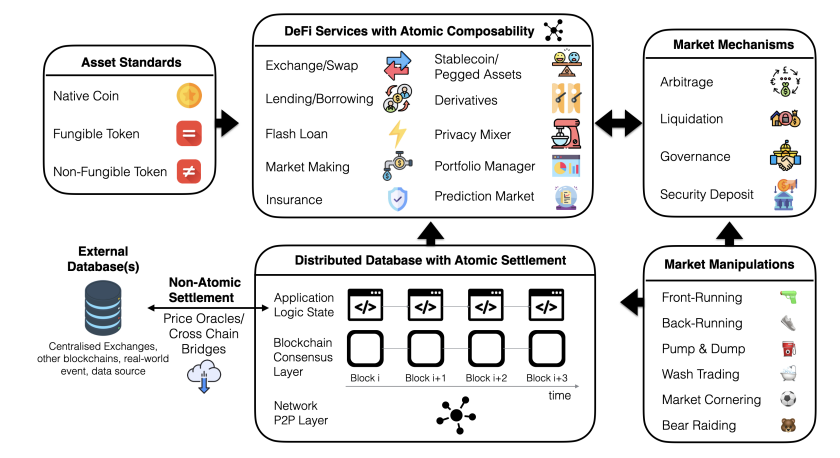

DeFi Building Blocks and Services

Asset Tokenization

就是把现实的资产变成链上的资产

Tokenization: process of adding new assets to a blockchain

Token: the blockchain representation of the asset

Make assets more accessible, easy to transfer, programmable

Governance token, security tokens (tokenized real estate), Nonfungible token (NFT), stablecoin

Nonfungible token (NFT):常见的应用是 艺术品、数字藏品

Stablecoin

- Offchain (centralized) collateral [fiat (法定货币), precious metal]

- Onchain (decentralized) collateral (抵押品) [crypto assets]

- Algorithmic (non-collateral) stable coin (算法稳定币,据说很坑)

Decentralized Exchange

Centralized exchange (CEX)

- Custodial (保管)

- Non-transparency

- Order Book (证券交易所常见,就是 证券数量和买方或卖方对特定证券的出价/要价)

Decentralized exchange (DEX)

- Non-custodial

- Transparency

Decentralized Lending

Lending in CeFi

- Processing default(违约) is expensive; under-collaterization(质押)(under collaterization 就是说抵押的资产的价值小于得到的资产)

- Credit-worthiness (信誉度)

Collateralized loans in DeFi

- Over collateralization; not based on credit

- Collateralized debt positions

- Collateralized debt markets

Flash Loans 闪电贷

- Blockchains enable atomic transactions (要么全部按顺序执行,要么全部不执行)

- Pools lend assets within one transaction (即借出的资产在transaction结束钱被偿还,否则该交易不上链;附加利息)

- Does not exist in CeFi

主要用于 套利

Other DeFi Building Blocks and Services

- Decentralized derivatives

- On-chain asset management

Risks in DeFi

DeFi Security

- Network atacks

- Consensus atacks (共识攻击,就是拿到51%的投票权)

- Smart Contract code bugs

- DeFi Protocol Composability atacks

- Bridge atacks

- Governance atacks

Front-running Attacks

https://defi-learning.org/f22 是这门课的笔记呀!