Finance Theory

Finance Theory

ref: https://ocw.mit.edu/courses/15-401-finance-theory-i-fall-2008/resources/

Ses 1 - Introduction

Challenges of Finance:

- valuation of assets

- management of assets

The framework of Financial Analysis:

-

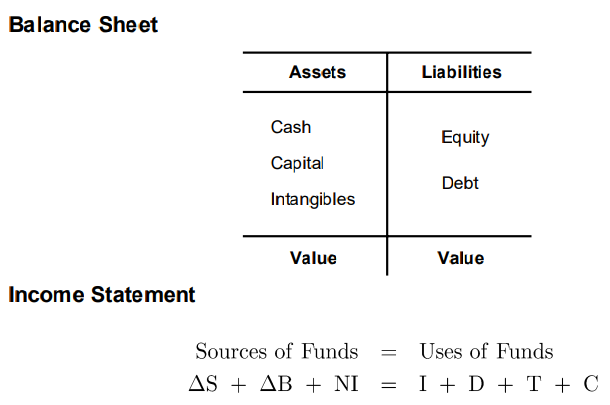

Accounting: the language of finance

- stock

- flow(derivative)

-

Balance Sheet and Income Statement Perspectives

-

Balance Sheet(资产负债表): snapshot of financial status quo(stock): Financial status

-

Income statement: snapshot of change of the status quo(flow): Financial decisions

![]()

-

-

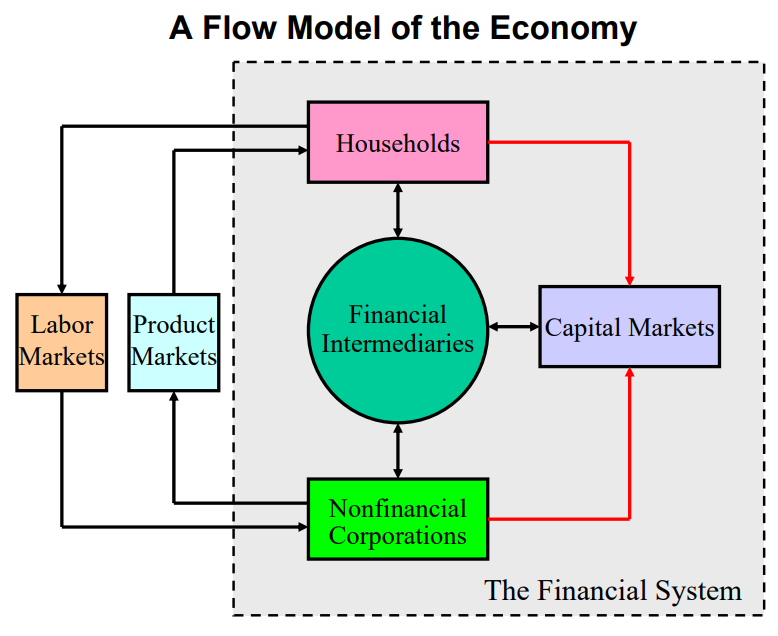

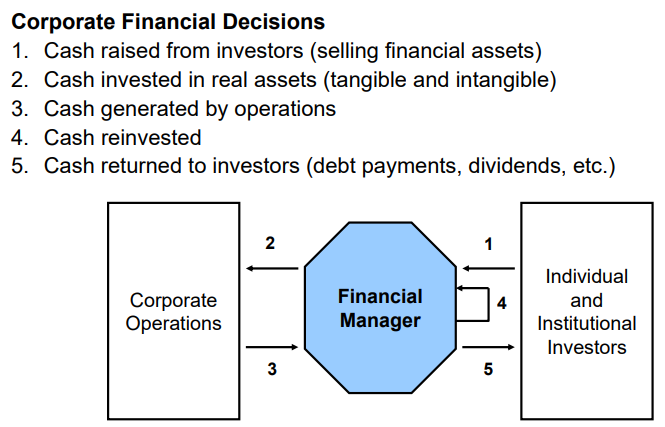

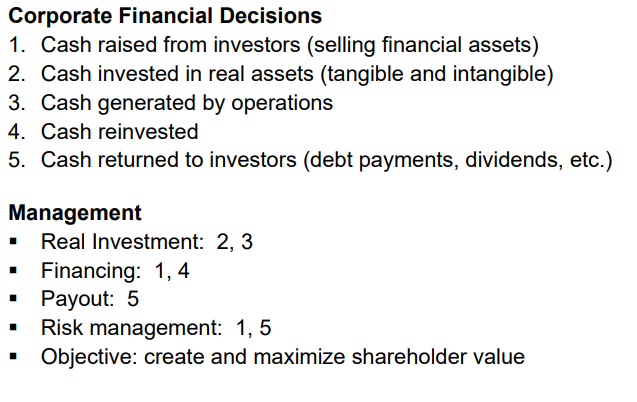

Corporate financial decisions - cash flow in corporation

![]()

![]()

-

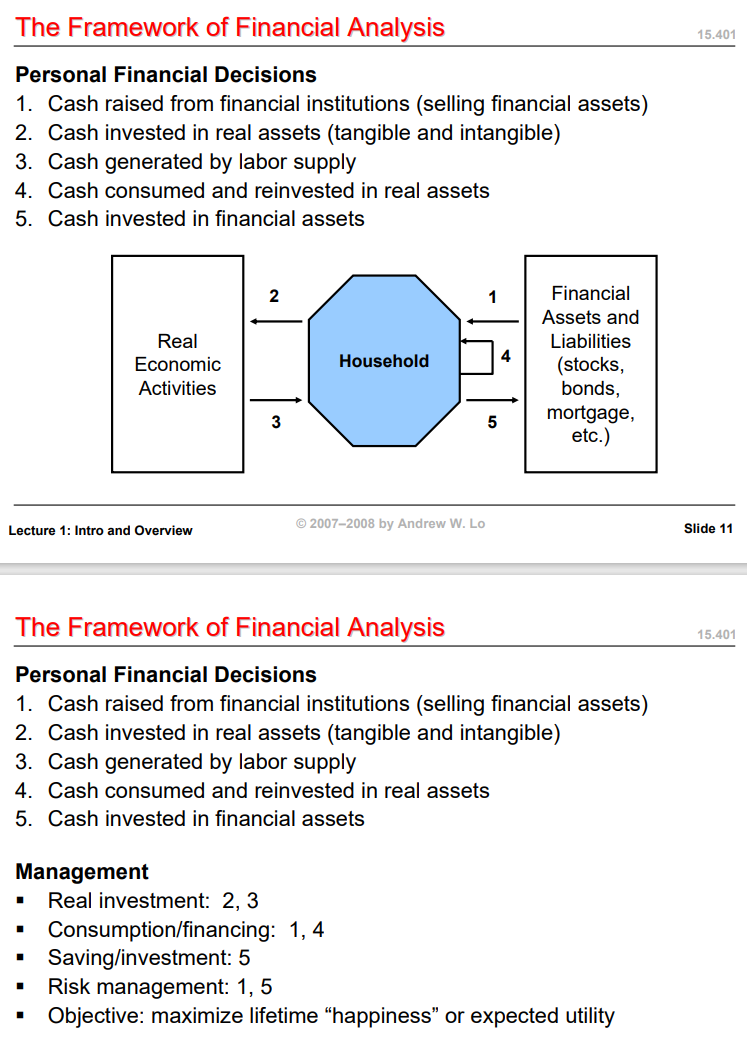

Personal Financial Decisions - cash flow in person

![]()

Time and Risk

comes up with modern economics

Six Fundamental Principles of Finance

- There is no such thing as a free lunch

- Other things equal, individuals:

- prefer more money than less(non-satiation)

- prefer money now to later(impatience)

- prefer to avoid risk (risk aversion)

- All agents act to further their own self-interest.

- Financial Market Prices Shift to Equalize Supply and Demand

- Financial Markets Are Highly Adaptive and Competitive

- Risk-Sharing and Frictions Are Central to Financial Innovation

We should pull the knowledge from other into ourself.(that means you should know what are you eager for)

Ses 2 - Present Value Relations

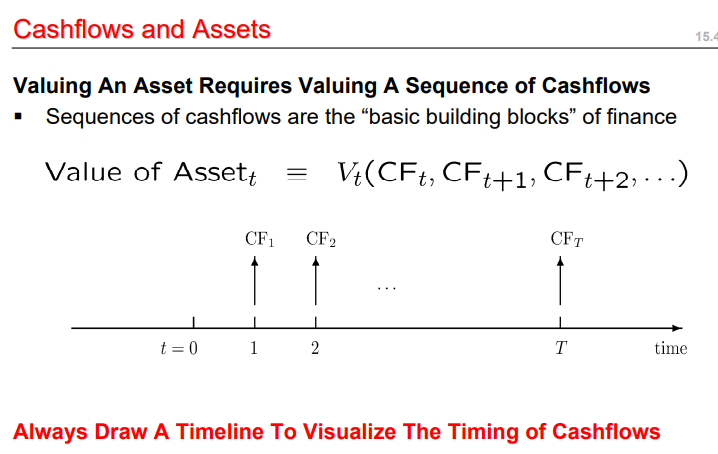

CashFlows and Asset

An interesting sentence make me shocked:

An Asset is a Sequence of current and future Cashflows.

Asset_t = {CF_t, CF_t+1, CF_t+2, ...}

Value of Asset:

Always draw a timeline to visualize the timing of cashflows.

浙公网安备 33010602011771号

浙公网安备 33010602011771号