金融量化分析【day113】:PGEC策略

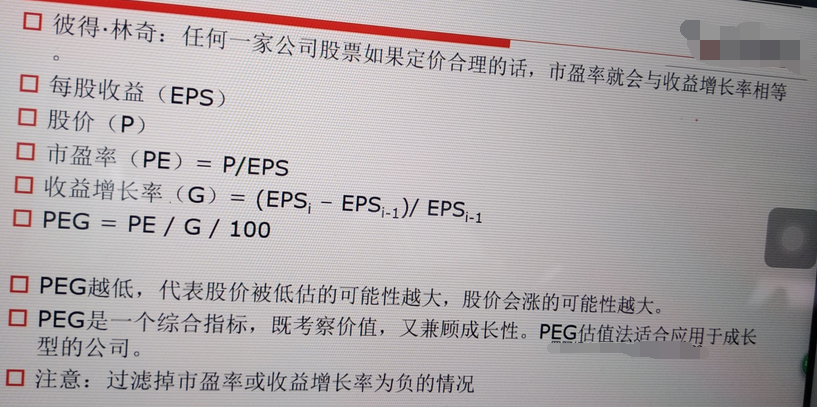

一、PGE简介

二、PGE代码

# 导入函数库

import jqdata

import pandas as pd

def initialize(context):

set_benchmark('000300.XSHG')

set_option('use_real_price', True)

set_order_cost(OrderCost(close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock')

g.security = get_index_stocks('000300.XSHG')

g.N = 20

g.q = query(valuation.code, valuation.pe_ratio, indicator.inc_net_profit_year_on_year).filter(valuation.code.in_(g.security))

run_monthly(handle, 1)

def handle(context):

df = get_fundamentals(g.q)

df = df[(df['pe_ratio']>0) & (df['inc_net_profit_year_on_year']>0)]

df['peg'] = df['pe_ratio'] / df['inc_net_profit_year_on_year'] / 100

df = df.sort(columns='peg')

tohold = df['code'][:g.N].values

for stock in context.portfolio.positions:

if stock not in tohold:

order_target_value(stock, 0)

tobuy = [stock for stock in tohold if stock not in context.portfolio.positions]

if len(tobuy) > 0:

cash = context.portfolio.available_cash / len(tobuy)

cash_every_stock = cash / len(tobuy)

for stock in tobuy:

order_value(stock, cash_every_stock)

三、长线测试

作者:罗阿红

出处:http://www.cnblogs.com/luoahong/

本文版权归作者和博客园共有,欢迎转载,但未经作者同意必须保留此段声明,且在文章页面明显位置给出原文连接。