Subsequent debit/credit & Credit Memo

credit memo和debit memo是对企业向顾客已经交付的货物的价值进行调整的单据类型。

举个例,如果您已经就所交付的货物向买主开具了100元的发票,可是由于货物质量的瑕疵,买主主张“货接受但必须削价10元”,如果您接受了这个主张,那您就得开具10元的credit memo(即实际业务中的所谓“红字发票”)。总之,与原始invoice的价值相比,增价用debit memo,降价用credit memo,两者都是billing document type。

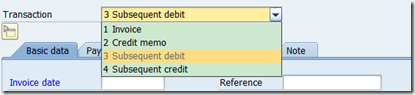

在做IR时操作上相对比较简单,只要选择不同的选项。

subsequent credit和credit memo的区别是,前者只能对发票或者PO的总价值进行减少,而后者可以减少数量来相应的减少价值。credit memo的另一个情况就是发票开完之后发现一个物品坏了,要求供应商退款。

A subsequent debit/credit arises if a transaction has already been settled, and a further invoice or credit memo is received afterwards.

A subsequent debit/credit changes the total invoice value of a purchase order item; the total invoice quantity remains unchanged. Therefore, only a value-based update of the purchasing transaction takes place. There is no quantity-based

update.

1. Subsequent Debit :-You must enter an invoice as a subsequent debit if a purchase order item has already been invoiced and further costs are now incurred. (Example: A vendor has inadvertently invoiced you at too low a price and then sends a

second invoice for the difference.)

2. Subsequent Credit :- You must enter a credit memo as a subsequent credit if a purchase order item was invoiced at too high a price and you have now received a credit memo. (Example: A vendor has inadvertently invoiced you at too high a price and then sends a credit memo for the difference.)

If you enter a subsequent debit/credit, the system suggests the entire invoiced quantity, but no value. The maximum quantity that you can subsequently debit or credit is the quantity that has already been invoiced. You can only enter a subsequent debit/credit for a purchase order item if an invoice has already been posted for this item.

A subsequent debit/credit cannot refer to a particular invoice.

Subsequent debits and credits are listed separately in the PO history.

3. Credit Memo :- You usually receive a credit memo from a vendor if you were overcharged. As is the case for invoices, credit memos refer to purchase orders or goods receipts.

You post a credit memo if too large an amount has been invoiced. When you post the credit memo, the total invoiced quantity in the PO history is reduced by the credit memo quantity. The maximum quantity you can make a credit for is the quantity that has already been invoiced.

In the same way as the corresponding goods receipt is expected or posted for the invoice, in the case of a credit memo, the system assumes that the credit memo belongs to a return delivery or reversal of the goods receipt. This means that the credit memo is settled using the GR/IR clearing account.

Valuation & Stock Account Updates

When a material is valuated at Moving Average Price, based on the quantity specified, while entering a subsequent debit/credit, the system checks for availability of quantity in the stock, if sufficient stock is available then subsequent debit/credit is posted to stock account and if sufficient coverage does not exist for this quantity, only the portion for the available stock is posted to the stock account. The rest is posted to a price difference account. This way, the posting does cause a change in value in the material master record to the tune of amount posted to stock account.

When a material is valuated at a standard price, the subsequent debit/credit is posted to a price difference account. This way, the posting does not cause a change in value in the material master record.

Valuation & Stock Account Updates

When a material is valuated at Moving Average Price, based on the quantity specified, while entering a subsequent debit/credit, the system checks for availability of quantity in the stock, if sufficient stock is available then subsequent debit/credit is posted to stock account and if sufficient coverage does not exist for this quantity, only the portion for the available stock is posted to the stock account. The rest is posted to a price difference account. This way, the posting does cause a change in value in the material master record to the tune of amount posted to stock account.

When a material is valuated at a standard price, the subsequent debit/credit is posted to a price difference account. This way, the posting does not cause a change in value in the material master record.

Related Content

Related Content

Subsequent Debits/Credits are used in cases where the quantity is in the original invoice is to remain the same.

Example:

PO 10 - $10

GR 10 - $10

LIV 10 - $11 (Logistics Invoice Verification)

The vendor invoice is more than that in the Purchase Order.

In order to correct, the Vendor may send in another invoice for the Increased amountor a credit memo for the reduce amount.

If you approve of the price increase,

post the subsequent invoice received as a Subsequent Debit Invoice.

If it is a credit memo that has been received for reducing $1 of invoice price,

then post the credit memo as Subsequent Credit.

This would retain the quantity but reduce the amount.

Subsequent Debit/Credit is for the case when the credit is not for the full amount

eg. if the Vendor decided to credit & only the $1 overcharged.

Credit memo is for the credit of the full amount and value.