MM-IV Starter Level 3

PART I

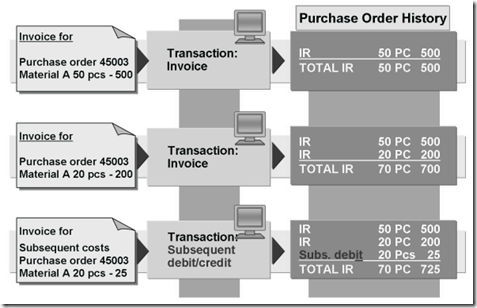

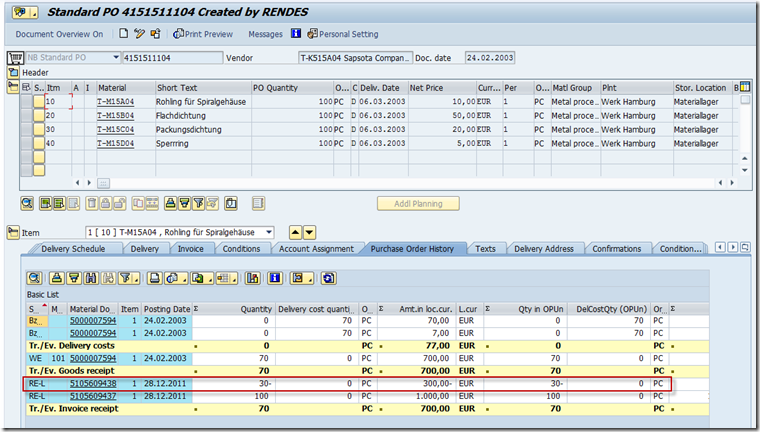

Subsequent Debits/Credits

Subsequent debit/credit变更的是采购单的总价值,而不是数量.

Subsequent debit: 之前的发票金额低了,供应商补一张将差额补上.

Subsequent credit: 之前的发票金额高了,供应商补一张credit memo作为Subsequent credit将差额去除.

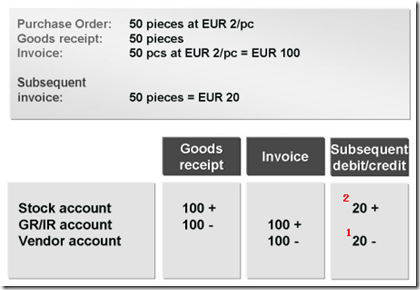

Subsequent debit/credit的科目移动

1. When you post a subsequent debit/credit, the system posts the invoice amount to the vendor account. (debit + credit -)

2. If the quantity to be subsequently debited or credited has already been delivered, the system makes the offsetting entry to the stock account or the price difference account, depending on the type of price control used. For purchase order items with account assignment, the system makes the offsetting entry to the consumption account.

3. If the quantity for subsequent debit/credit has not yet been delivered, the system makes the offsetting entry to the GR/IR clearing account. Later, when the goods receipt is posted the system posts the debit/credit to the stock account or the price difference account, depending on the price control, or for PO items with account assignment, it posts to the consumption account.

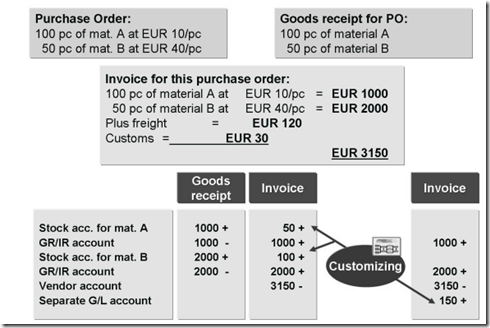

Delivery Costs

- 计划内运费:做采购单时就知道的部分,在下单时输入. (会列在PO history中)

好处是在做收货时,运费就成为物料价值计算的一部分,或者当订单有科目分配时,运费就借记到科目分配对象

计划内运费可不绑定特定供应商.做订单时就可以换一个对应该运费的供应商,如货运公司或航空公司.对发票校验就是同样.

又可按固定值/数量百分比/金额百分比来定运费.

Account Movements with planned Delivery Costs

- 计划外运费:做发票过帐才知道的部分,在发票过帐时输入. (不会列在PO history中)

(可以与物品一起过帐)

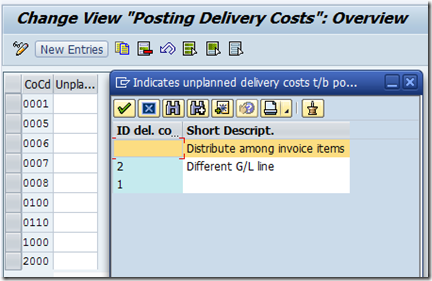

配置时就定义是自动按百分比分配计划外运费到各个行项目中,当然手动分配也是可以的. 手动和自动分配都认为是价格差异,所以要做价格检查..超过限制的则当blocked invoice处理.

或是分配到一个单独的G/L科目.

(也可以单独提供一张运费的发票过帐)

这样操作的话,就根据订单,做一笔 subsequent debit/credit (前提是之前已经有一张发票过帐了,不然做不出来)

Account Movements with Unplanned Delivery Costs

If the automatic distribution of unplanned delivery costs is active in Customizing for the company code, the partial amounts allocated to the items are updated as

price variances:

For a material with moving average price, the system posts to the stock account as long as there is a stock coverage.

For a material with standard price, the system posts the unplanned delivery costs to the price difference account you have set up.

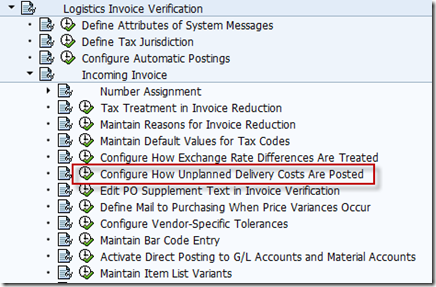

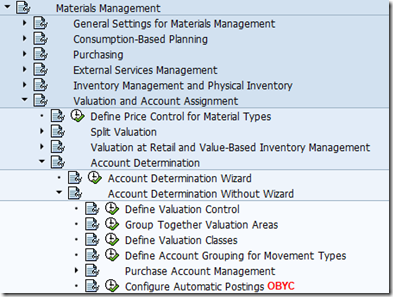

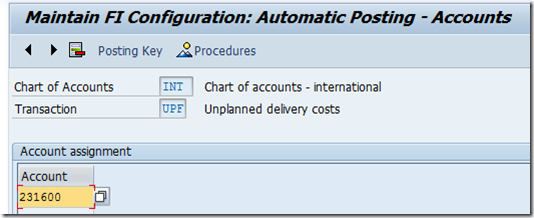

However, if you selected posting to a separate G/L account in Customizing, then you must also define this G/L account that is to be posted to automatically in

Customizing. For this, maintain transaction UPF (Unplanned Delivery Costs) in the automatic account determination. The total amount of the unplanned delivery

costs is then posted to this G/L account when you post the invoice.

You can maintain a default value for each company code in Customizing for the tax code of the separate posting line.

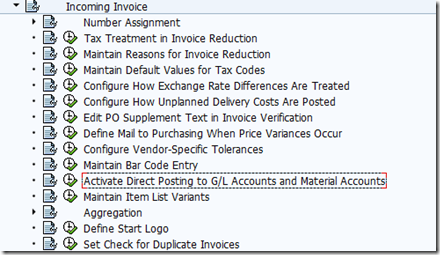

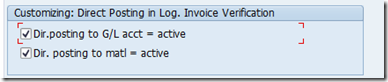

配置

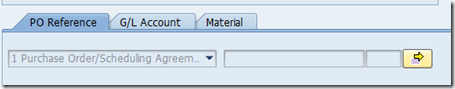

Invoices Without Reference to Purchase Orders

前提:

then you can see

- Posting to a G/L account

When posting directly to a G/L account, no posting is made to a GR/IR clearing account. The system posts manually entered G/L account lines directly to the

G/L account specified. Of course, the control specified in the master record of the G/L account is taken into account. A check is therefore made to see whether

manual postings can be made to the account or whether it is subject to account assignment requirement.

- Posting to a material account

You post to material accounts if, for example, you want to post a subsequent credit or debit to a material, without an existing PO reference.

When posting directly to a material, no posting is made to a GR/IR clearing account. The system posts manually entered material lines directly to the stock

account or price difference account, depending on price control and stock coverage. You must specify the plant as well as the material number and amount

in order for the system to determine the data for the material valuation and stock quantity. The system determines the existing stock quantities automatically. The user can overwrite these entries.

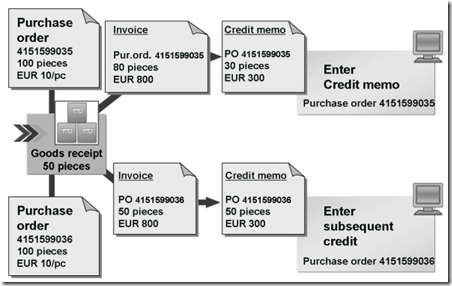

Credit Memos

- You post a credit memo if too large an amount has been invoiced. When you post the credit memo, the total invoiced quantity in the PO history is

reduced by the credit memo quantity. The maximum quantity you can make a credit for is the quantity that has already been invoiced.

In the same way as the corresponding goods receipt is expected or posted for the invoice, in the case of a credit memo, the system assumes that the

credit memo belongs to a return delivery or reversal of the goods receipt. This means that the credit memo is settled using the GR/IR clearing account.

(PO history中的数量降低,价格也下降)

- You post a subsequent credit if the price in the invoice is too high. The total quantity invoiced for the purchase order item remains the same, but the total

value invoiced is reduced.

(PO history中的数量不变,只修改价格)

The account movements made when you post a credit memo or subsequent credit are made according to the same rules as when you post an invoice or subsequent debit. The system posts to the same accounts, but with the opposite +/- sign next to the entry.

Reversals

Either invoices or credit memos, can be subsequently canceled:

If you cancel an invoice, the system automatically generates a credit memo.

If you cancel a credit memo, the system automatically generates an invoice.

When you reverse an invoice, the account movements made when the invoice was posted cannot always simply be reversed. For example, if there was sufficient

stock coverage when you posted an invoice with a price variance for a material with moving average price, but when you reverse the invoice there is insufficient

stock coverage, the system posts the price difference in the credit memo to a price difference account. This occurs even though the price variance was debited to the stock account when you posted the invoice.