TA-lib 指标详解与实践

初试 TA-lib

TA-Lib(Technical Analysis Library, 即技术分析库)是Python金融量化的高级库,涵盖了150多种股票、期货交易软件中常用的技术分析指标,如MACD、RSI、KDJ、动量指标、布林带等。官方文档参见:

可通过一下命令安装:

pip install ta-libOverlap Studies(重叠指标)

BBANDS Bollinger Bands (布林带)

DEMA Double Exponential Moving Average (双指数移动平均线)

EMA Exponential Moving Average (指数移动平均线)

HT_TRENDLINE Hilbert Transform - Instantaneous Trendline

KAMA Kaufman Adaptive Moving Average

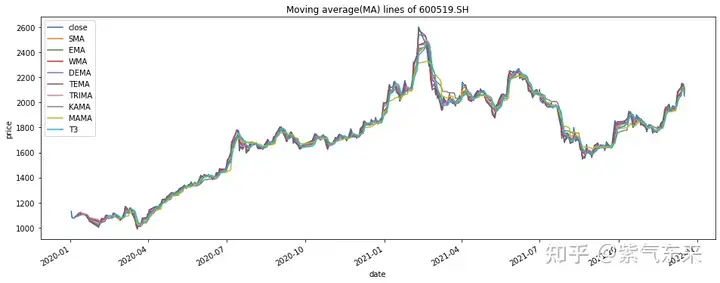

MA Moving average(移动平均线)

MAMA MESA Adaptive Moving Average(自适应移动平均)

MAVP Moving average with variable period(变周期移动平均)

MIDPOINT MidPoint over period

MIDPRICE Midpoint Price over period

SAR Parabolic SAR

SAREXT Parabolic SAR - Extended

SMA Simple Moving Average(简单移动平均线)

T3 Triple Exponential Moving Average (T3)

TEMA Triple Exponential Moving Average (三重指数移动平均线)

TRIMA Triangular Moving Average

WMA Weighted Moving Average(加权移动平均线)各类移动平均线的计算

仍使用tushare数据

import tushare as ts

import pandas as pd

ts.set_token('ca1ee4****************9cac82')

pro = ts.pro_api()

df = pro.query('daily', ts_code='600519.SH', start_date='20200101', end_date='20211217')

df.index=pd.to_datetime(df['trade_date'])

df=df.sort_index()调用TA-lib并计算MA

import talib as ta

# MA

types=['SMA','EMA','WMA','DEMA','TEMA','TRIMA','KAMA','MAMA','T3']

df_ma=pd.DataFrame(df.close)

for i in range(len(types)):

df_ma[types[i]]=ta.MA(df.close,timeperiod=5,matype=i)

df_ma.plot(figsize=(16,6),title='Moving average(MA) lines of 600519.SH',

xlabel='date', ylabel='price')

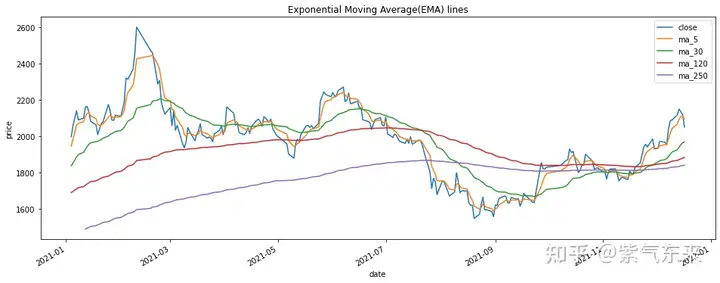

计算EMA

# EMA

N=[5,30,120,250]

for i in N:

df['ma_'+str(i)]=ta.EMA(df.close,timeperiod=i)

df.loc['2021-01-01':,['close','ma_5','ma_30','ma_120','ma_250']].plot(figsize=(16,6),title='Exponential Moving Average(EMA) lines', xlabel='date', ylabel='price')

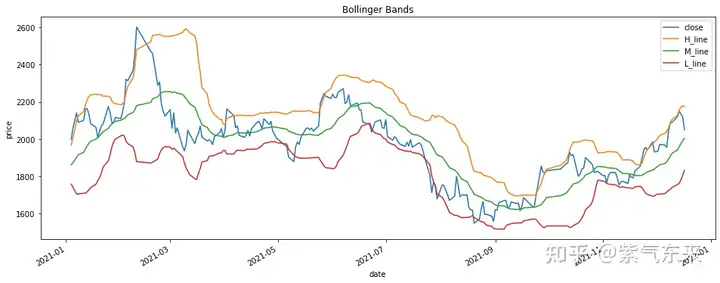

计算布林带

布林带(Bollinger Bands)由约翰·布林先生创造,其利用统计原理,求出股价的标准差及其信赖区间,从而确定股价的波动范围及未来走势,利用波带显示股价的安全高低价位。其上下限范围不固定,随股价的滚动而变化。布林指标属于路径指标,股价波动在上限和下限的区间之内,这条带状区的宽窄,随着股价波动幅度的大小而变化,股价涨跌幅度加大时,带状区变宽,涨跌幅度狭小盘整时,带状区则变窄。

- 中轨线 = N日的移动平均线

- 上轨线 = 中轨线 + K倍的标准差

- 下轨线 =中轨线 - K倍的标准差(K为参数,一般默认为2)

- 股价高于这个波动区间,即突破阻力线,说明股价虚高,卖出信号

- 股价低于这个波动区间,即跌破支撑线,说明股价虚低,买入信号

# BBANDS

H_line,M_line,L_line=ta.BBANDS(df.close, timeperiod=20, nbdevup=2, nbdevdn=2, matype=0)

df1=pd.DataFrame(df.close,index=df.index,columns=['close'])

df1['H_line']=H_line

df1['M_line']=M_line

df1['L_line']=L_line

df1.loc['2021-01-01':].plot(figsize=(16,6),title='Bollinger Bands', xlabel='date', ylabel='price')

Momentum Indicators(动量指标类)

ADX Average Directional Movement Index(平均趋向指数)

ADXR Average Directional Movement Index Rating

APO Absolute Price Oscillator

AROON Aroon

AROONOSC Aroon Oscillator

BOP Balance Of Power

CCI Commodity Channel Index

CMO Chande Momentum Oscillator

DX Directional Movement Index

MACD Moving Average Convergence/Divergence (平滑异同移动平均线)

MACDEXT MACD with controllable MA type

MACDFIX Moving Average Convergence/Divergence Fix 12/26

MFI Money Flow Index

MINUS_DI Minus Directional Indicator

MINUS_DM Minus Directional Movement

MOM Momentum

PLUS_DI Plus Directional Indicator

PLUS_DM Plus Directional Movement

PPO Percentage Price Oscillator

ROC Rate of change : ((price/prevPrice)-1)*100

ROCP Rate of change Percentage: (price-prevPrice)/prevPrice

ROCR Rate of change ratio: (price/prevPrice)

ROCR100 Rate of change ratio 100 scale: (price/prevPrice)*100

RSI Relative Strength Index (相对强弱指数)

STOCH Stochastic

STOCHF Stochastic Fast

STOCHRSI Stochastic Relative Strength Index

TRIX 1-day Rate-Of-Change (ROC) of a Triple Smooth EMA

ULTOSC Ultimate Oscillator

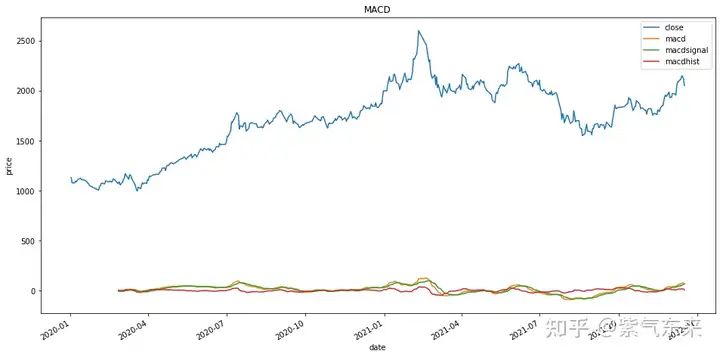

WILLR Williams' %R计算MACD

MACD的原理介绍参见

df['macd'], df['macdsignal'], df['macdhist'] = ta.MACD(df.close, fastperiod=12, slowperiod=26, signalperiod=9)

df[['close','macd','macdsignal','macdhist']].plot(figsize=(16,8),title='MACD', xlabel='date', ylabel='price')

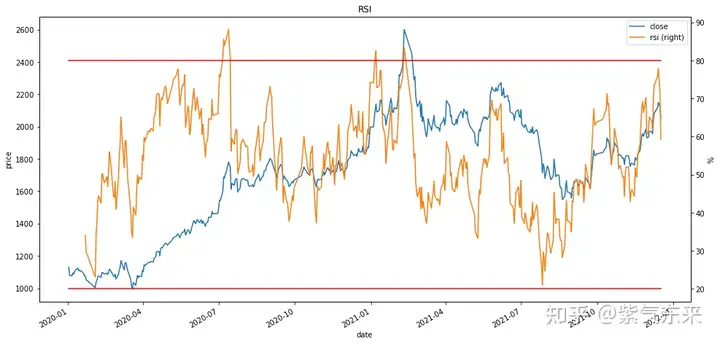

计算RSI

相对强弱指标(RSI)是根据股票市场上供求关系平衡的原理,通过比较一段时期内单个股票价格的涨跌的幅度或整个市场的指数的涨跌的大小来分析判断市场上多空双方买卖力量的强弱程度,从而判断未来市场走势的一种技术指标。

计算方法

N日RS=[A÷B]×100%

公式中,A——N日内收盘涨幅之和

B——N日内收盘跌幅之和(取正值)

N日 RSI = A/(A+B)×100RSI的变动范围在0—100之间,强弱指标值一般分布在20—80。RSI值市场特征投资操作:

80—100极强卖出

50—80强买入

20—50弱观望

0—20极弱买入代码实现:

df["rsi"] = ta.RSI(df.close, timeperiod=14)

ax = df[["close","rsi"]].plot(secondary_y=['rsi'],figsize=(16,8),title='RSI',xlabel='date', ylabel='price')

ax.right_ax.plot(df.index, [80]*len(df), '-', color='r')

ax.right_ax.plot(df.index, [20]*len(df), '-', color='r')

ax.right_ax.set_ylabel('%')

Volume Indicators(交易量指标)

AD Chaikin A/D Line

ADOSC Chaikin A/D Oscillator

OBV On Balance Volume (能量潮)计算OBV

能量潮指标(On Balance Volume,OBV)是葛兰维(Joe Granville)于上世纪60年代提出的,并被广泛使用,算是比较冷门的指标,虽然冷门,但是却威力巨大!股市技术分析的四大要素:价、量、时、空。OBV指标就是从“量”这个要素作为突破口,来发现热门股票、分析股价运动趋势的一种技术指标。它是将股市的人气—成交量与股价的关系数字化、直观化,以股市的成交量变化来衡量股市的推动力,从而研判股价的走势。关于成交量方面的研究,OBV能量潮指标是一种相当重要的分析指标之一。

计算公式:

当日OBV=前一日OBV+今日成交量

需要注意的是,如果当日收盘价高于前日收盘价取正值,反之取负值,平盘取零。- 当股价上升而OBV线下降,表示买盘无力,股价可能会回跌。

- 股价下降时而OBV线上升,表示买盘旺盛,逢低接手强股,股价可能会止跌回升。

代码实现:

obvta = ta.OBV(df['close'], df['vol'])

obv=[]

for i in range(0,len(df)):

if i == 0:

obv.append(df['vol'].values[i])

else:

if df['close'].values[i]>df['close'].values[i-1]:

obv.append(obv[-1]+df['vol'].values[i])

if df['close'].values[i]<df['close'].values[i-1]:

obv.append(obv[-1]-df['vol'].values[i])

if df['close'].values[i]==df['close'].values[i-1]:

obv.append(obv[-1])

df['obv'] = obv

ax1 = df[["close","obv"]].plot(secondary_y=['obv'],figsize=(16,8),title='OBV',xlabel='date', ylabel='price')

ax1.right_ax.set_ylabel('OBV')

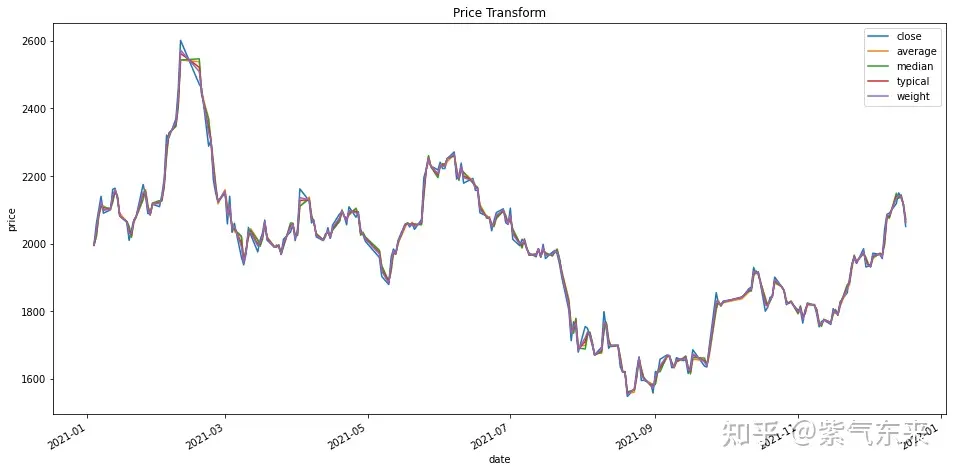

Price Transform(价格变换)

AVGPRICE Average Price

MEDPRICE Median Price

TYPPRICE Typical Price

WCLPRICE Weighted Close Price计算各种价格

#开盘价,最高价,最低价,收盘价的均值

df['average']=ta.AVGPRICE(df.open,df.high,df.low,df.close)

#最高价,最低价的均值

df['median']=ta.MEDPRICE(df.high,df.low)

#最高价,最低价,收盘价的均值

df['typical']=ta.TYPPRICE(df.high,df.low,df.close)

#最高价,最低价,收盘价的加权

df['weight']=ta.WCLPRICE(df.high,df.low,df.close)

df.loc['2021-01-01':,['close','average','median','typical','weight']].plot(figsize=(16,8),title='Price Transform', xlabel='date', ylabel='price')

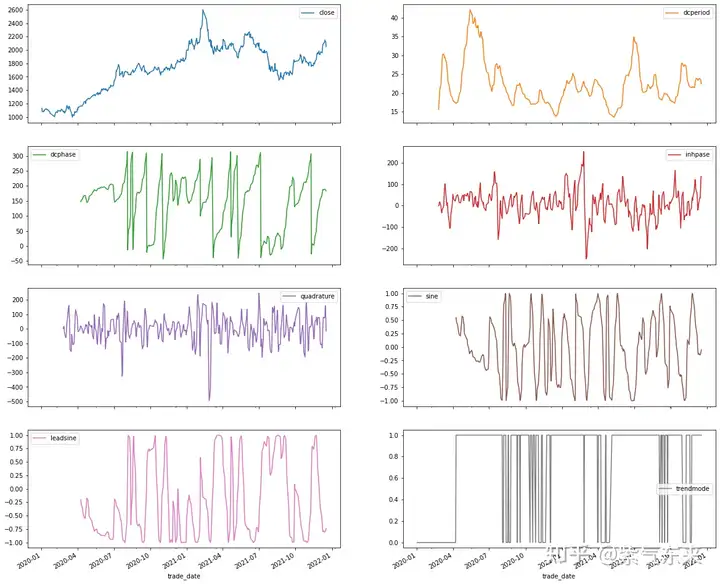

基于上述两条性质,我们可以分别采用

作为实轴、作为虚轴,构造正交复平面。

希尔伯特变换可实现价格序列瞬时信号的提取。

HT_DCPERIOD Hilbert Transform - Dominant Cycle Period(希尔伯特变换-主导周期)

HT_DCPHASE Hilbert Transform - Dominant Cycle Phase(希尔伯特变换-主导循环阶段)

HT_PHASOR Hilbert Transform - Phasor Components(希尔伯特变换-相位构成)

HT_SINE Hilbert Transform - SineWave(希尔伯特变换-正弦波)

HT_TRENDMODE Hilbert Transform - Trend vs Cycle Mode(希尔伯特变换-趋势与周期模式)计算方式如下:

df['dcperiod']=ta.HT_DCPERIOD(df.close)

df['dcphase']=ta.HT_DCPHASE(df.close)

df['inhpase'],df['quadrature']=ta.HT_PHASOR(df.close)

df['sine'],df['leadsine']=sine, leadsine = ta.HT_SINE(df.close)

df['trendmode']=ta.HT_TRENDMODE(df.close)

df[['close','dcperiod','dcphase','inhpase','quadrature','sine','leadsine','trendmode']].plot(figsize=(20,18),

subplots = True,layout=(4, 2))

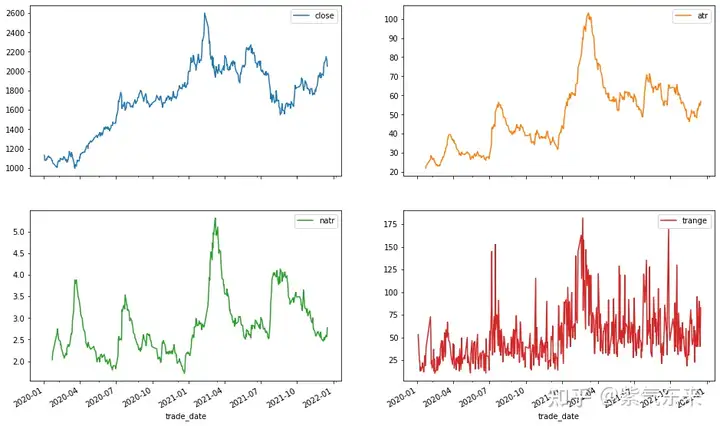

Volatility Indicators(波动率指标)

ATR Average True Range

NATR Normalized Average True Range

TRANGE True Range计算如下:

df['atr']=ta.ATR(df.high, df.low, df.close, timeperiod=14)

df['natr']=ta.NATR(df.high, df.low, df.close, timeperiod=14)

df['trange']=ta.TRANGE(df.high, df.low, df.close)

df[['close','atr','natr','trange']].plot(figsize=(16,10),subplots = True,layout=(2, 2))

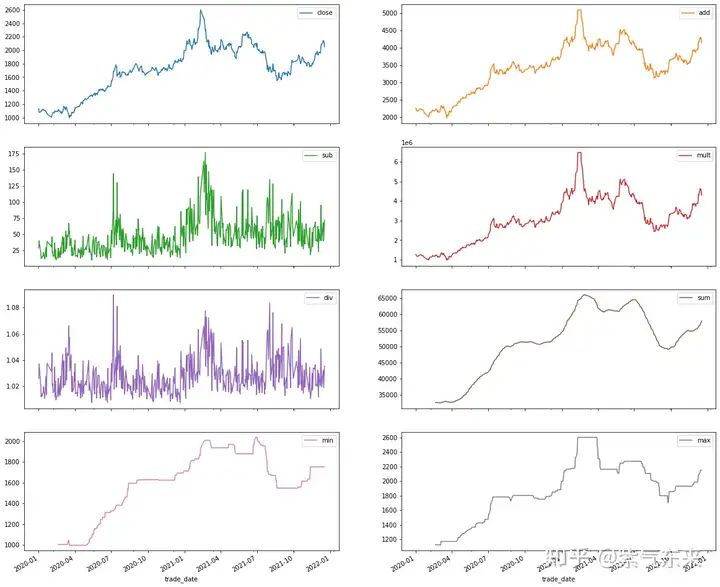

Math Operators(数学运算)

ADD Vector Arithmetic Add

DIV Vector Arithmetic Div

MAX Highest value over a specified period

MAXINDEX Index of highest value over a specified period

MIN Lowest value over a specified period

MININDEX Index of lowest value over a specified period

MINMAX Lowest and highest values over a specified period

MINMAXINDEX Indexes of lowest and highest values over a specified period

MULT Vector Arithmetic Mult

SUB Vector Arithmetic Substraction

SUM Summation计算如下:

df['add']=ta.ADD(df.high,df.low)

df['sub']=ta.SUB(df.high,df.low)

df['mult']=ta.MULT(df.high,df.low)

df['div']=ta.DIV(df.high,df.low)

df['sum']=ta.SUM(df.close, timeperiod=30)

df['min'], df['max'] = ta.MINMAX(df.close, timeperiod=30)

#收盘价的每30日内的最大最小值对应的索引值(第N行)

df['minidx'], df['maxidx'] = ta.MINMAXINDEX(df.close, timeperiod=30)

df[['close','add','sub','mult','div','sum','min','max']].plot(figsize=(20,18), subplots = True, layout=(4, 2))

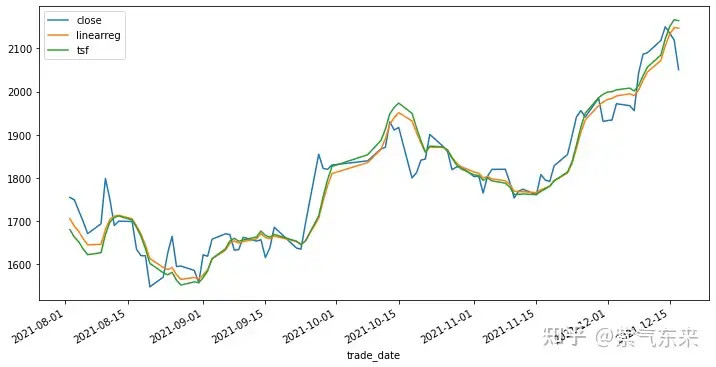

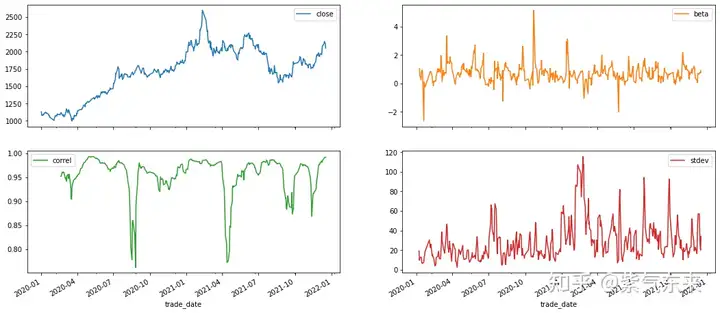

Statistic Functions(统计函数)

BETA Beta (贝塔系数)

CORREL Pearson's Correlation Coefficient (r) (皮尔逊相关系数)

LINEARREG Linear Regression

LINEARREG_ANGLE Linear Regression Angle(线性回归正切角)

LINEARREG_INTERCEPT Linear Regression Intercept(线性回归截距)

LINEARREG_SLOPE Linear Regression Slope(线性回归斜率)

STDDEV Standard Deviation

TSF Time Series Forecast(时序预测)

VAR Variance计算如下:

df['linearreg']=ta.LINEARREG(df.close, timeperiod=14)

df['tsf']=ta.TSF(df.close, timeperiod=14)

df.loc['2021-08-01':,['close','linearreg','tsf']].plot(figsize=(12,6))

df['beta']=ta.BETA(df.high,df.low,timeperiod=5)

df['correl']=ta.CORREL(df.high, df.low, timeperiod=30)

df['stdev']=ta.STDDEV(df.close, timeperiod=5, nbdev=1)

df[['close','beta','correl','stdev']].plot(figsize=(18,8),subplots = True,layout=(2, 2))

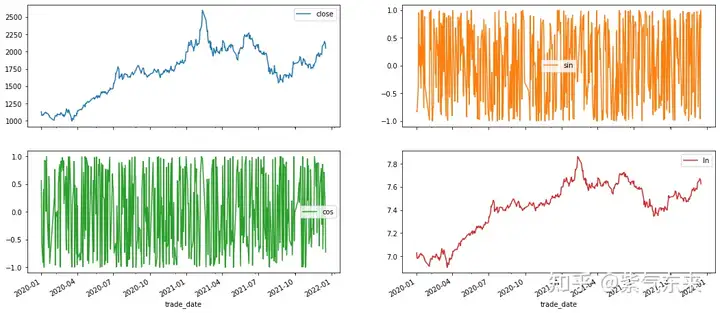

Math Transform(数学变换)

ACOS Vector Trigonometric ACos

ASIN Vector Trigonometric ASin

ATAN Vector Trigonometric ATan

CEIL Vector Ceil

COS Vector Trigonometric Cos

COSH Vector Trigonometric Cosh

EXP Vector Arithmetic Exp

FLOOR Vector Floor

LN Vector Log Natural

LOG10 Vector Log10

SIN Vector Trigonometric Sin

SINH Vector Trigonometric Sinh

SQRT Vector Square Root

TAN Vector Trigonometric Tan

TANH Vector Trigonometric Tanh计算如下:

df['sin']=ta.SIN(df.close)

df['cos']=ta.COS(df.close)

df['ln']=ta.LN(df.close)

df[['close','sin','cos','ln']].plot(figsize=(18,8),subplots = True,layout=(2, 2))

浙公网安备 33010602011771号

浙公网安备 33010602011771号