后续:尝试交易策略

根据上文写的统计规律,我设计了一个特别简单粗暴的交易策略,本质上是追涨:

临近收盘时,从当天涨幅5%以上的股票中随机选取一些股票买入,第二天只要盈利x%就卖掉。如果第二天没有涨到x%就在收盘时卖掉。并把收益曲线作图画出来。

mybacktest.py

1 # 自己写一个回测检验我的致富密码 2 # 用的是样本外最新数据 3 import pandas as pd 4 import random 5 import matplotlib.pyplot as plt 6 import numpy as np 7 #读入需要数据:高开低收和当天涨幅 8 datapath = r'D:\MyIntern\example\newdata\\' 9 plt.rcParams['font.sans-serif'] = ['SimHei'] 10 plt.rcParams['axes.unicode_minus'] = False 11 startdate = 20190102 12 enddate = 20200630 13 low = pd.read_pickle(datapath+'low.pkl').loc[:, startdate: enddate].T 14 high = pd.read_pickle(datapath+'high.pkl').loc[:, startdate: enddate].T 15 open = pd.read_pickle(datapath+'open.pkl').loc[:, startdate: enddate].T 16 close = pd.read_pickle(datapath+'close.pkl').loc[:, startdate: enddate].T 17 18 # cur_increase = (close-open)/open 19 # high_increase = (high-close.shift())/close.shift() 20 # pd.to_pickle(cur_increase, datapath+'increase.pkl') 21 # pd.to_pickle(high_increase, datapath+'high_increase.pkl') 22 # close_increase = (close-close.shift())/close.shift() 23 # pd.to_pickle(close_increase, datapath+'close_increase.pkl') 24 # low_decrease = (low-close.shift())/close.shift() 25 # pd.to_pickle(low_decrease, datapath+'low_decrease.pkl') 26 27 cur_increase = pd.read_pickle(datapath+'increase.pkl') 28 high_increase = pd.read_pickle(datapath+'high_increase.pkl') 29 close_increase = pd.read_pickle(datapath+'close_increase.pkl') 30 low_decrease = pd.read_pickle(datapath+'low_decrease.pkl') 31 date = open.index 32 33 # limit_up_stocks = [] 34 # for i in date: 35 # curdata = cur_increase.loc[i, :] # 当天数据 36 # condition1 = curdata >= 0.05 37 # condition2 = curdata <=0.092 38 # curdata = curdata[condition1 & condition2] 39 # limit_up_stocks.append(len(curdata)) 40 # print(pd.Series(limit_up_stocks).min()) 41 # # 经过统计,过去的一年半时间里符合要求的股票每天最少为15支 考虑每天随机选取十只股票以收盘价买入 42 43 # 选股 44 select_stock_list = [] #每一日选出的股票代码汇总 45 for i in date: 46 curdata = cur_increase.loc[i, ] # 当天数据 47 condition1 = curdata >= 0.05 48 condition2 = curdata <=0.092 49 curdata = curdata[condition1 & condition2] 50 select_stock = random.sample(list(curdata.index),len(list(curdata.index))) #从符合要求的股票中随机挑选10支 51 select_stock_list.append(select_stock) 52 53 # 计算收益率, 假设等权重买入这些股票 54 count = 0 55 ori = 100 56 earnings = [] 57 for i in date[1:]: 58 select_stock = select_stock_list[count] 59 payoff = high_increase[select_stock].loc[i, :] 60 close_payoff = close_increase[select_stock].loc[i, :] 61 payoff[payoff>0.03] = 0.03 #在涨了3%的时候卖掉 62 payoff[payoff<0.03] = close_payoff # 如果全天都没涨到3%,就收盘时卖掉 63 ori = ori * (1+payoff.mean()) #当天的收益率就是每只股票收益率的均值 64 earnings.append(ori) 65 count = count + 1 66 67 date = [str(i) for i in date] 68 plt.plot(date[1:], earnings) 69 plt.xticks(date[1::20],(date[1::20]),rotation=60) 70 plt.xlabel('时间') 71 plt.ylabel('净值(初始为100)') 72 plt.show()

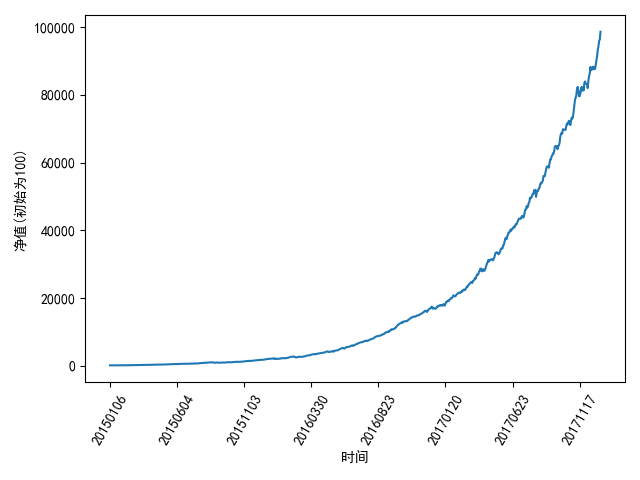

我本来特别惊喜,因为画出来的收益曲线难以置信的美好:

我特别激动,觉得发财怎么这么简单。后来发现我代码写错了。按照我写的代码,每天上涨了1%的股票可以用5%卖出去。。。怪不得收益那么好。

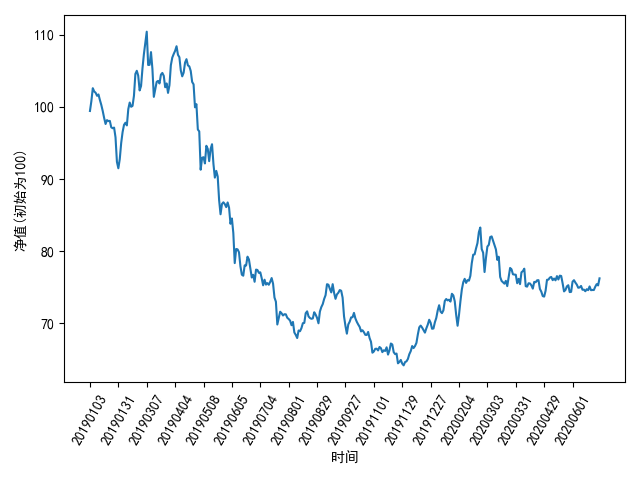

当我修正了这个策略以后我的策略就变得十分不靠谱了。

而这个时间段里大盘的走势是这样的:

我这个策略都跑不赢大盘,太沮丧了。

折腾这么一圈,最大的收获是学会了用plt画折线统计图并且设置坐标轴间距。。

1 plt.xticks(date[1::20],(date[1::20]),rotation=60)

第一个data[1::20]是画刻度(每隔20个日期画一个刻度),后面一个data[1::20]是设置标签,rotation则是标签的的旋转角度,旋转90度显然可以放下更多的标签。