[Machine Learning for Trading] {ud501} Lesson 17: 02-07 Dealing with Data | Lesson 18: 02-08 Efficient Markets Hypothesis

How data is aggregated

tick interval can be day, mintue, ... etc.

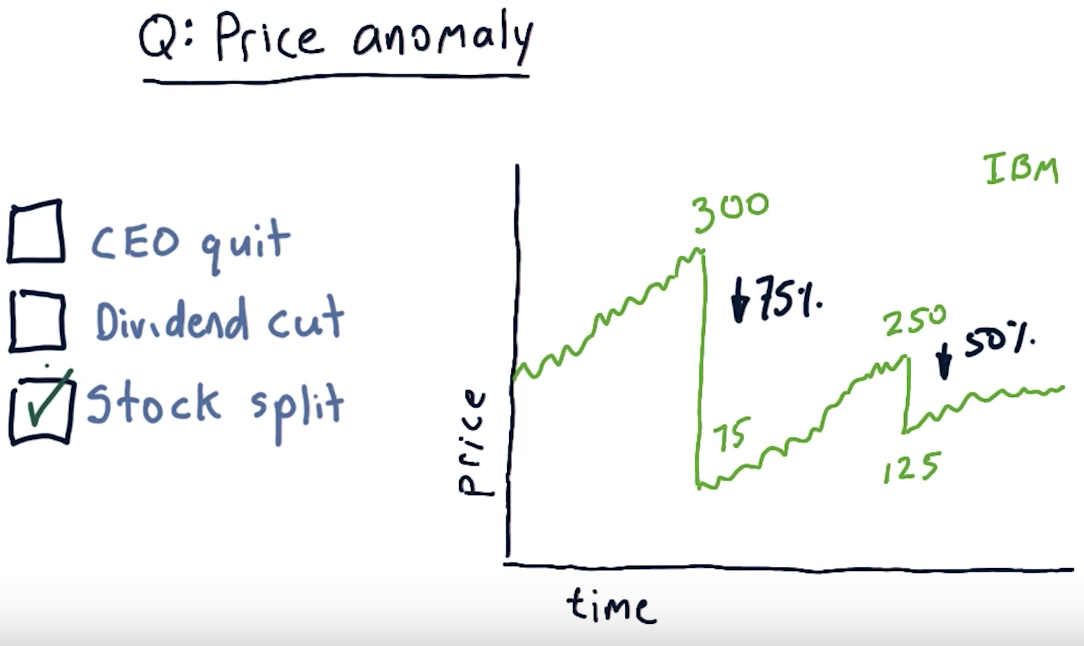

Price anomaly

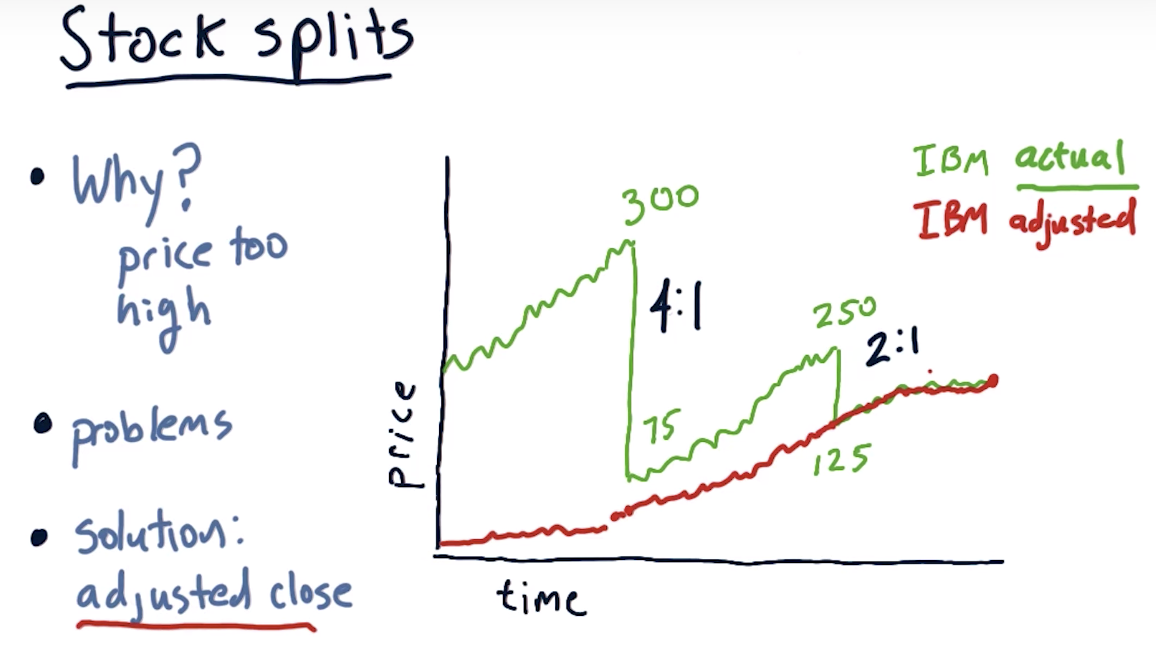

Stock splits

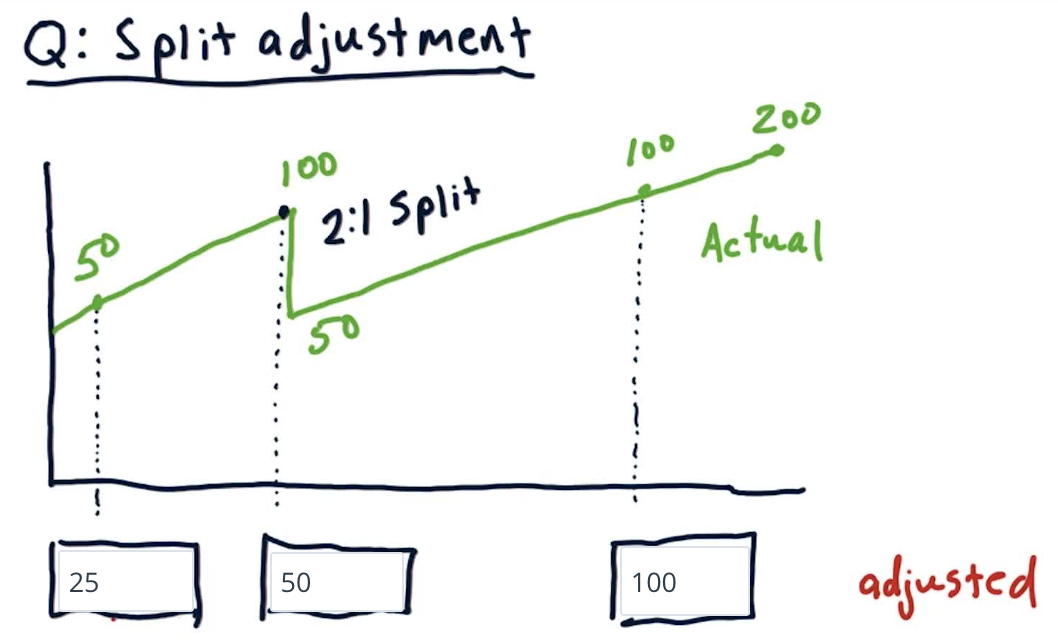

Split adjustment

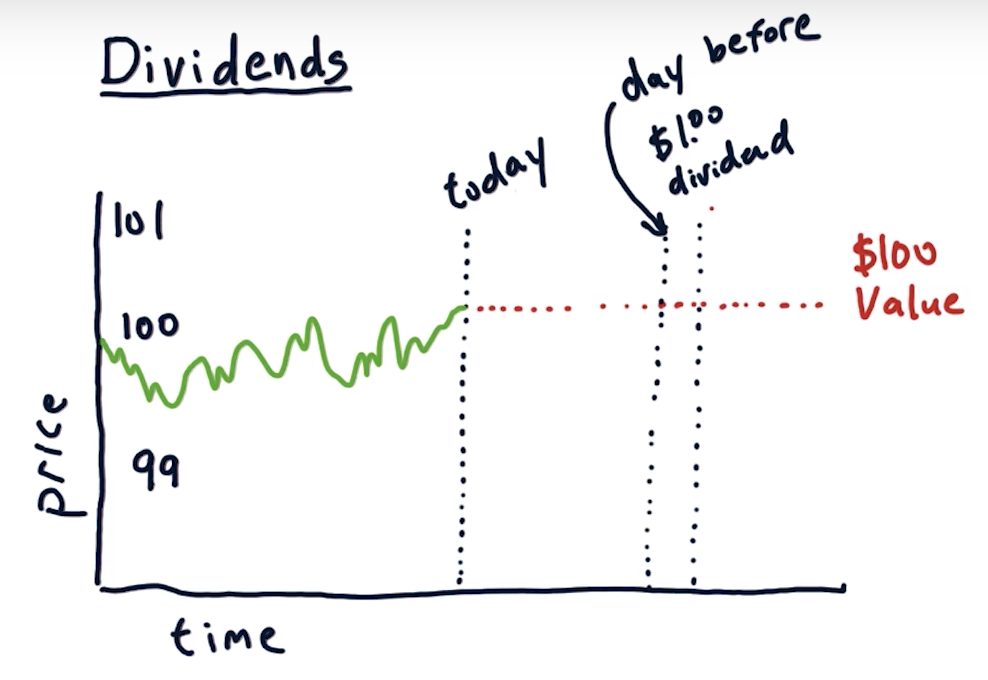

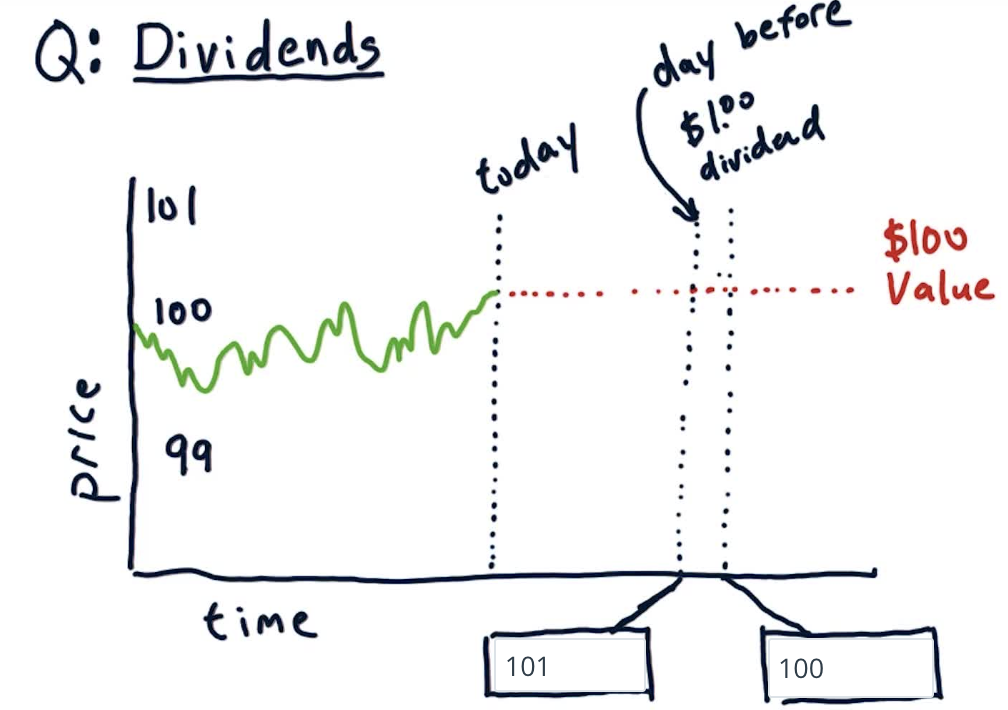

Dividends

Adjusting for dividends

the close price of 2010 watched in 2012 is lower than the one watched in 2015 => due to the adjustment

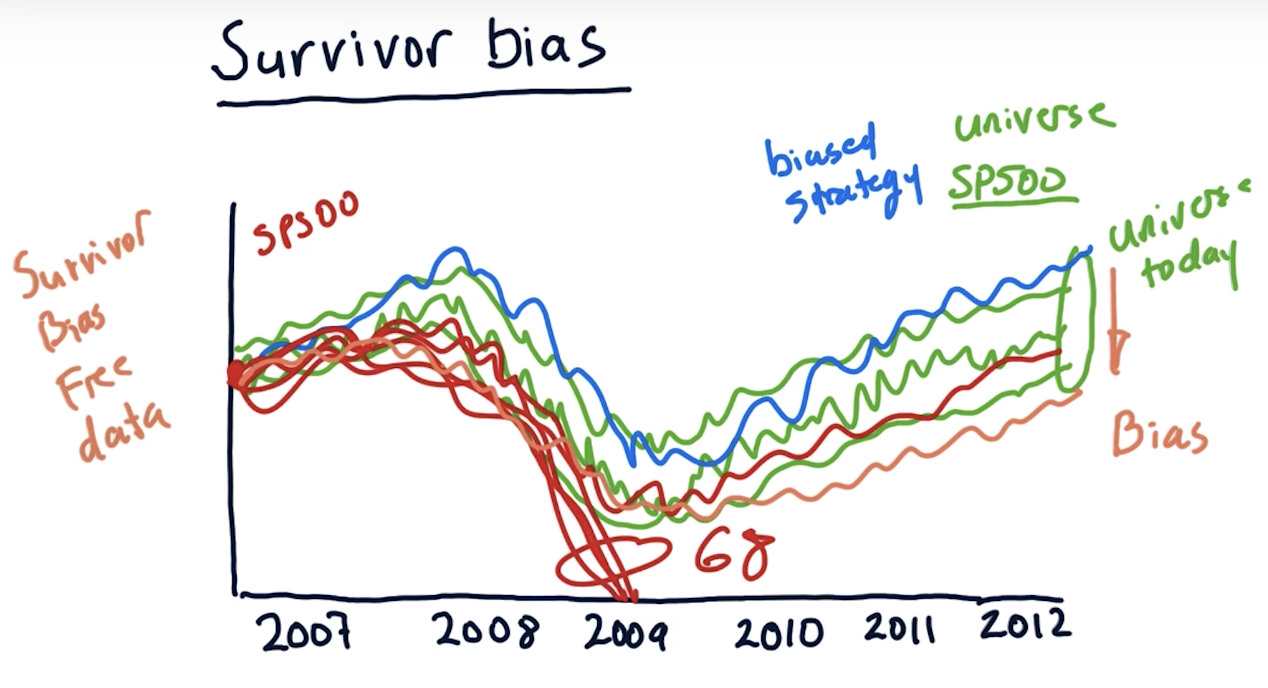

Survivor bias

one common mistake is that they look at the membership of that universe as of today

then they go back in time and they use that list of stocks for their strategy

built-in bias => some stocks dies in SP500 and the current stocks in SP500 actually survives during these years!

the strategy trained without considering the survival bias => blue curve => used in real life => brown curve (lower performance)

=> eager for the survival-bias-free data => not free

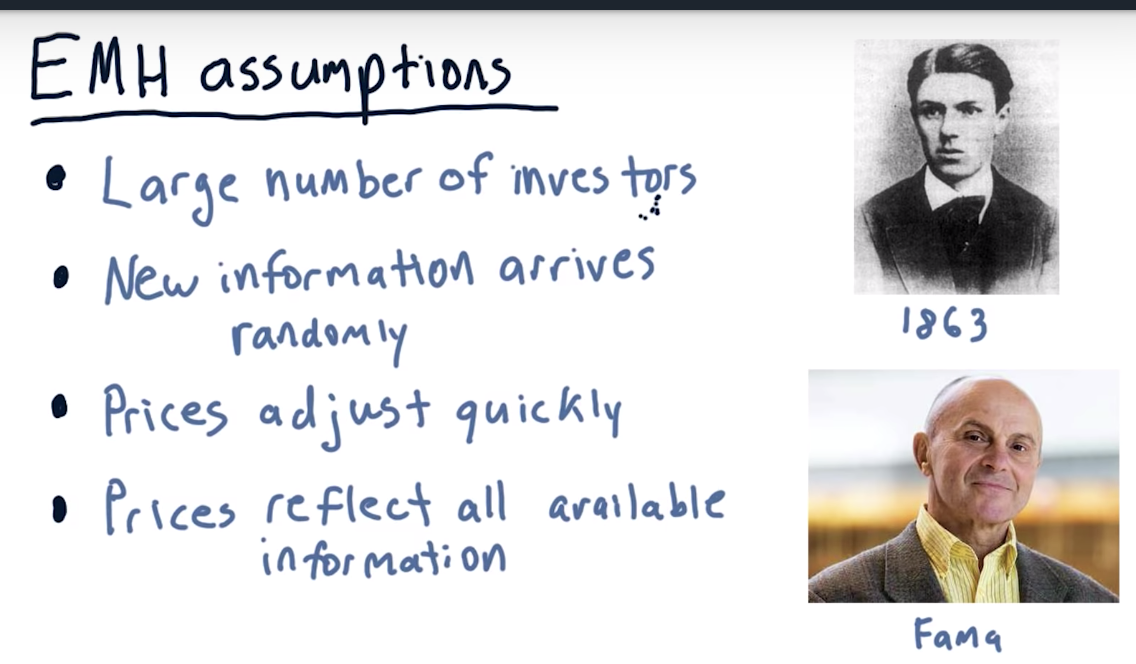

Efficient Markets Hypothesis

EMH assumptions

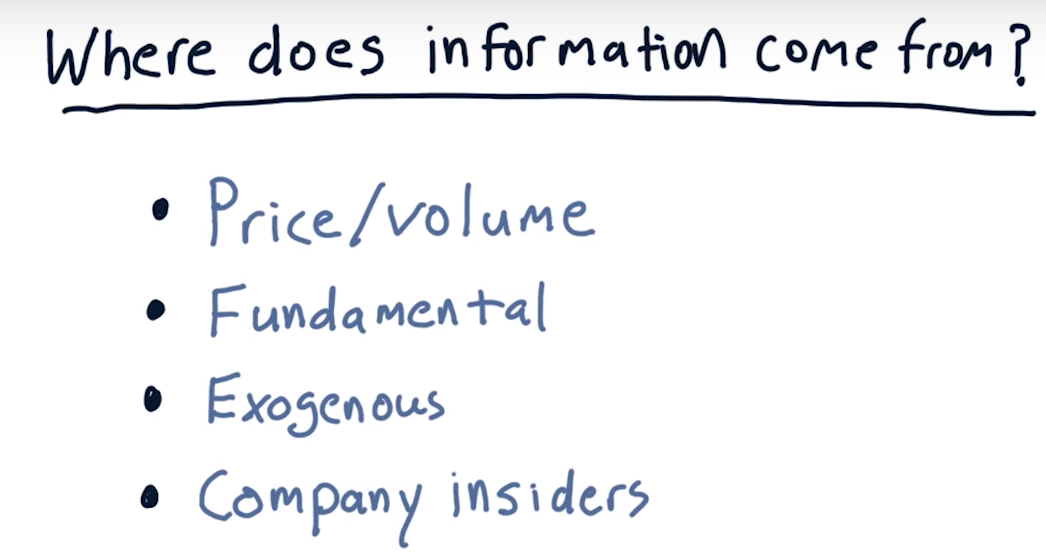

Origin of information

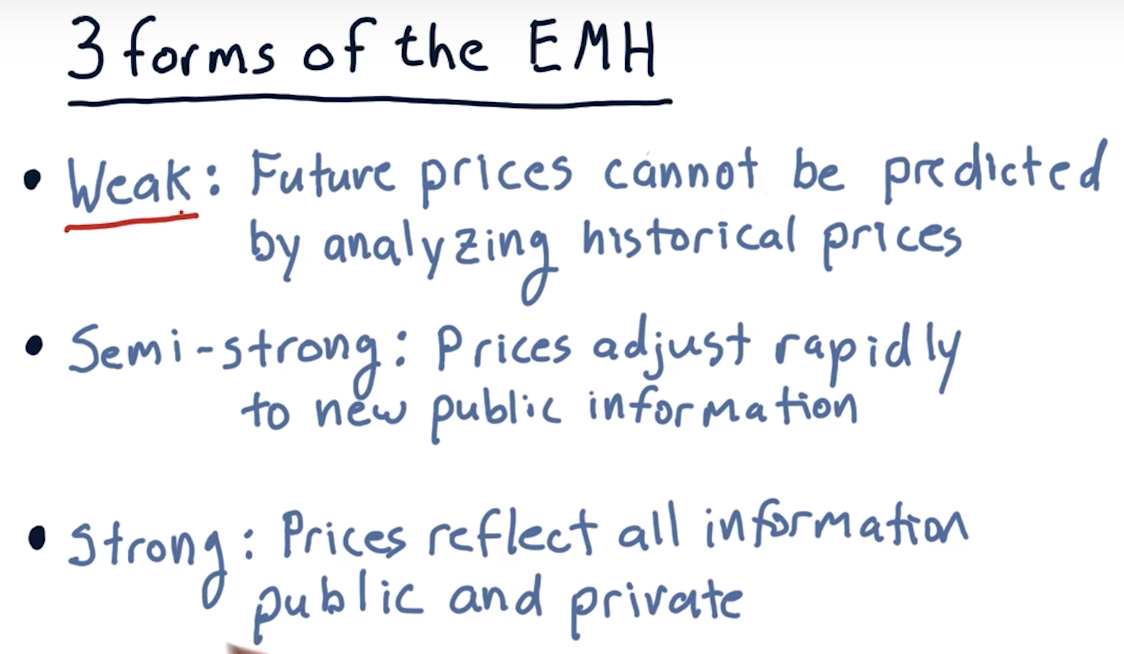

3 forms of the EMH

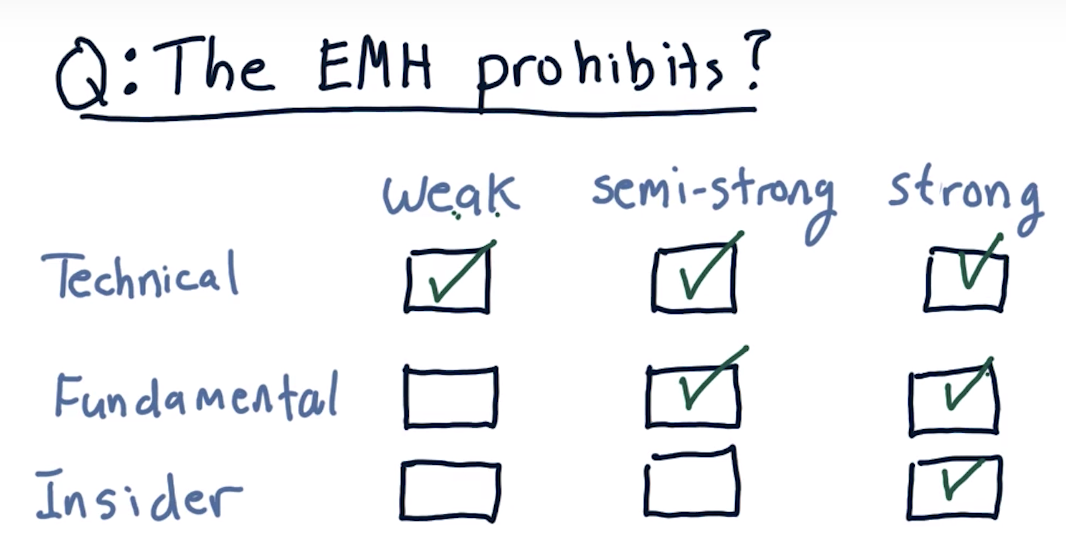

The EMH prohibits

weak => only technical analysis can't make profit

strong => any one of three types can't make profit

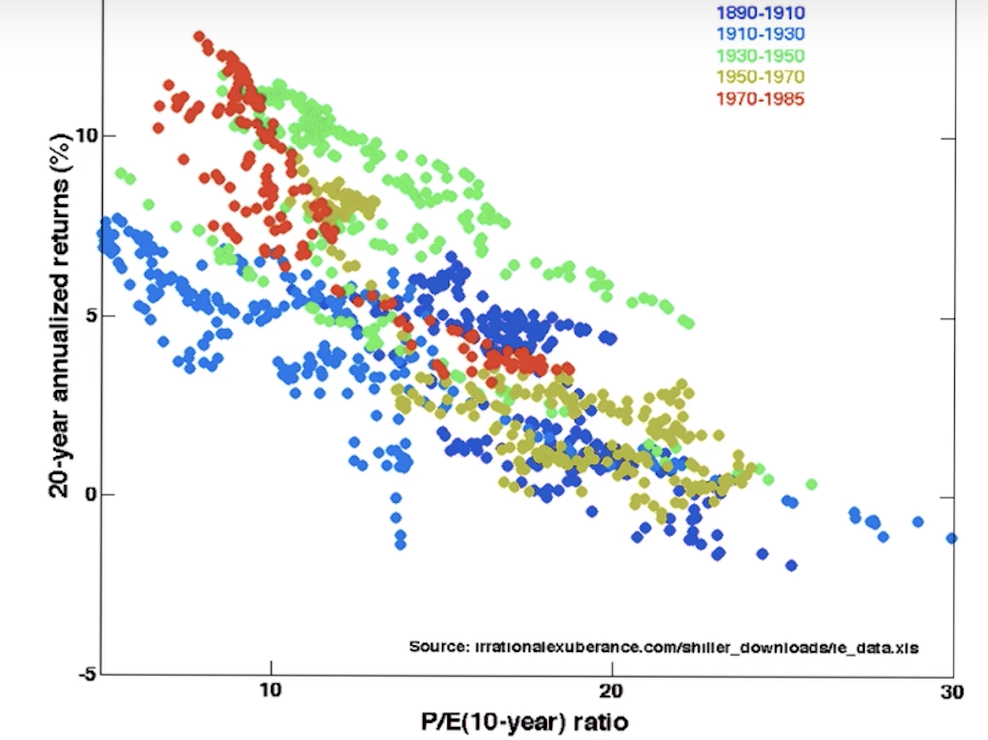

Is the EMH correct? => at least from data, the strong EMH is incorrect

浙公网安备 33010602011771号

浙公网安备 33010602011771号