seaborn基本使用(二)

客户贷款风险评估

数据预处理

# 因为需要进行聚类,所以需要对数据进行初步处理,这里对数值型数据,进行标准化,对分类变量处理为有序变量。

# 选择特征 把文本类型转化为数值类型 方便计算比较 数据预处理

features = ['Age', 'Sex', 'Job', 'Housing', 'Saving accounts', 'Checking account', 'Credit amount', 'Duration']

new_data = data[features].copy()

# 对类别型特征进行有序编码

new_data['Sex'] = new_data['Sex'].map({

'female': 0,

'male': 1})

new_data['Housing'] = new_data['Housing'].map({

'free': 0,

'rent': 1,

'own': 2})

# 这行代码的作用是将 'Housing' 列中的字符串值 'free' 替换为 0,'rent' 替换为 1,'own' 替换为 2。这种操作通常用于将分类变量(categorical variable)转换为数值型变量,以便在机器学习模型中使用。

# 'Housing' 列的字符串值被映射为相应的数字

new_data['Saving accounts'] = new_data['Saving accounts'].map({

'unknown': 0,

'little': 1,

# 'moderate': 2,

'quite rich': 3,

'rich': 4})

new_data['Checking account'] = new_data['Checking account'].map({

'unknown': 0,

'little': 1,

'moderate': 2,

'rich': 3})

# 标准化数值型特征 正则化 标准正态分布

scaler = StandardScaler()

num_features = ['Age', 'Credit amount', 'Duration']

new_data[num_features] = scaler.fit_transform(new_data[num_features])

print(new_data.head(10))

# 划分高风险客户和低风险客户

# 假设 df 是你的 DataFrame,'column_name' 是要处理的列名

new_data['Age'] = new_data['Age'].round(2)

new_data['Duration'] = new_data['Duration'].round(2)

new_data['Credit amount'] = new_data['Credit amount'].round(2)

new_data['Saving accounts'].fillna(0, inplace=True)

print("整理后查看各列缺失值",new_data.isna().sum())

# 假设 df 是你的 DataFrame

new_data.to_csv('./out/output_new_data.csv', index=False)

查看详情

- 控制台打印

Age Sex Job ... Checking account Credit amount Duration

0 2.766456 1 2 ... 1 -0.745131 -1.236478

1 -1.191404 0 2 ... 2 0.949817 2.248194

2 1.183312 1 1 ... 0 -0.416562 -0.738668

3 0.831502 1 2 ... 1 1.634247 1.750384

4 1.535122 1 2 ... 1 0.566664 0.256953

5 -0.048022 1 1 ... 0 2.050009 1.252574

6 1.535122 1 2 ... 0 -0.154629 0.256953

7 -0.048022 1 3 ... 2 1.303197 1.252574

8 2.238742 1 1 ... 0 -0.075233 -0.738668

9 -0.663689 1 3 ... 2 0.695681 0.754763

[10 rows x 8 columns]

整理后查看各列缺失值 Age 0

Sex 0

Job 0

Housing 0

Saving accounts 0

Checking account 0

Credit amount 0

Duration 0

dtype: int64

案例1

# 导入需要的库

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

from sklearn.preprocessing import StandardScaler

from sklearn.cluster import KMeans

from sklearn.metrics import silhouette_score

from sklearn.model_selection import train_test_split

from sklearn.utils import resample

from sklearn.ensemble import RandomForestClassifier

from sklearn.metrics import classification_report,confusion_matrix

new_data = pd.read_csv("./out/output_new_data.csv")

data = pd.read_csv("./german_credit_data.csv")

# 模型选择:使用KMeans进行聚类

kmeans = KMeans(n_clusters=2, random_state=15)

from sklearn.cluster import KMeans

# 检查无穷大值: 使用 Pandas 的 replace() 方法,可以将无穷大值替换为其他值。

new_data.replace([np.inf, -np.inf], np.nan, inplace=True)

print(new_data.describe(include='all'))

clusters = kmeans.fit_predict(new_data)

# 将聚类结果添加到数据中

data['Risk Group'] = clusters

print(data.head(10))

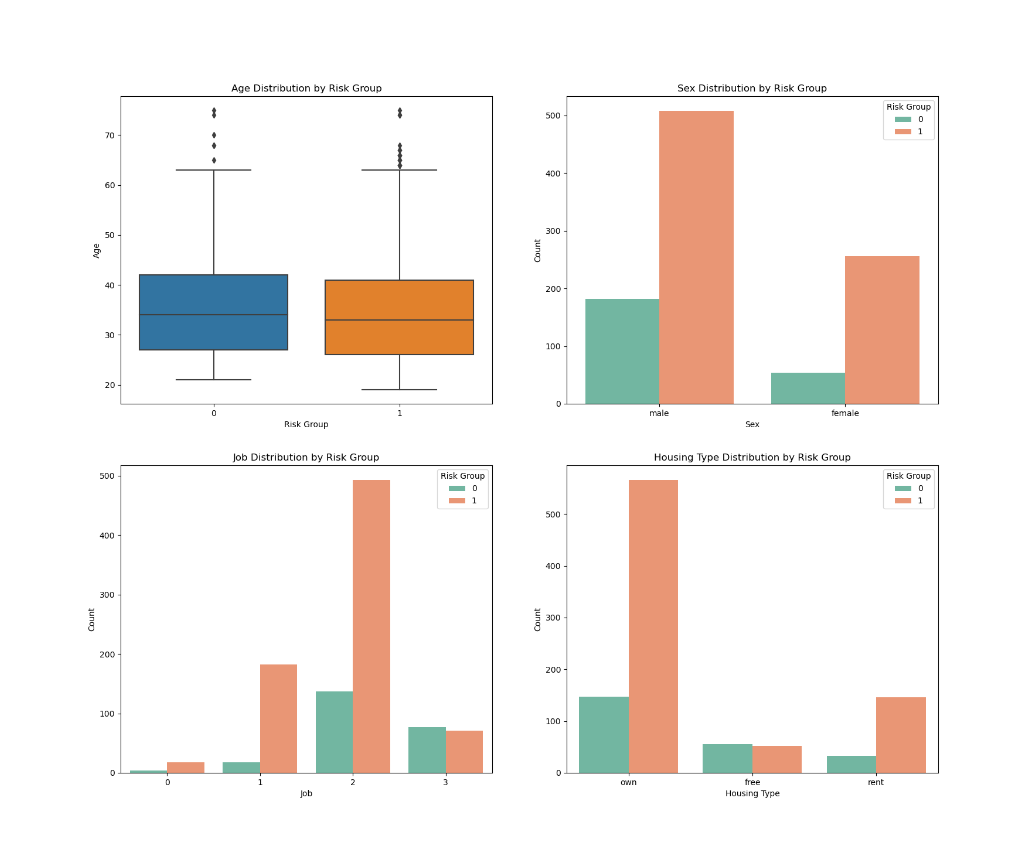

# 6.3两类客户之间对比

# 6.3.1基本情况对比

fig, axs = plt.subplots(2, 2, figsize=(18,15))

sns.boxplot(x='Risk Group', y='Age', data=data, ax=axs[0, 0])

axs[0, 0].set_title('Age Distribution by Risk Group')

axs[0, 0].set_xlabel('Risk Group')

axs[0, 0].set_ylabel('Age')

#

sns.countplot(x='Sex', hue='Risk Group', data=data, palette='Set2', ax=axs[0, 1])

axs[0, 1].set_title('Sex Distribution by Risk Group')

axs[0, 1].set_xlabel('Sex')

axs[0, 1].set_ylabel('Count')

sns.countplot(x='Job', hue='Risk Group', data=data, palette='Set2', ax=axs[1, 0])

axs[1, 0].set_title('Job Distribution by Risk Group')

axs[1, 0].set_xlabel('Job')

axs[1, 0].set_ylabel('Count')

sns.countplot(x='Housing', hue='Risk Group', data=data, palette='Set2', ax=axs[1, 1])

axs[1, 1].set_title('Housing Type Distribution by Risk Group')

axs[1, 1].set_xlabel('Housing Type')

axs[1, 1].set_ylabel('Count')

plt.show()

查看详情

- 控制台打印

Age Sex ... Credit amount Duration

count 1000.000000 1000.000000 ... 1000.000000 1000.00000

mean -0.000080 0.690000 ... -0.000120 -0.00004

std 1.000554 0.462725 ... 1.000532 1.00074

min -1.460000 0.000000 ... -1.070000 -1.40000

25% -0.750000 0.000000 ... -0.680000 -0.74000

50% -0.220000 1.000000 ... -0.340000 -0.24000

75% 0.570000 1.000000 ... 0.250000 0.26000

max 3.470000 1.000000 ... 5.370000 4.24000

[8 rows x 8 columns]

Id Age Sex ... Duration Purpose Risk Group

0 0 67 male ... 6 radio/TV 1

1 1 22 female ... 48 radio/TV 0

2 2 49 male ... 12 education 1

3 3 45 male ... 42 furniture/equipment 0

4 4 53 male ... 24 car 0

5 5 35 male ... 36 education 0

6 6 53 male ... 24 furniture/equipment 1

7 7 35 male ... 36 car 0

8 8 61 male ... 12 radio/TV 1

9 9 28 male ... 30 car 0

- 输出

案例2

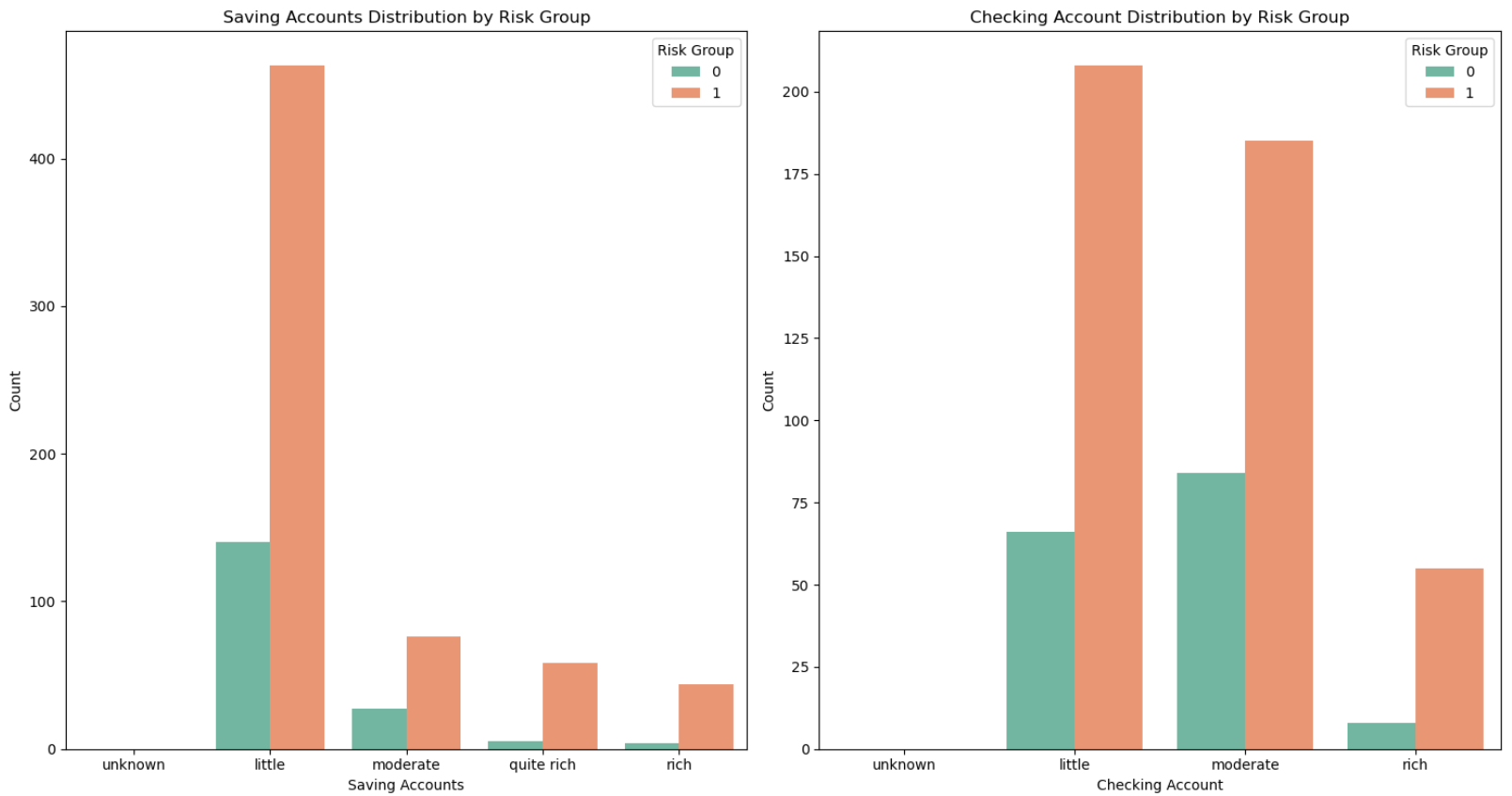

# 经济情况对比

order_savings = ['unknown', 'little', 'moderate', 'quite rich', 'rich']

order_checking = ['unknown', 'little', 'moderate', 'rich']

fig, axs = plt.subplots(1, 2, figsize=(15,8))

sns.countplot(x='Saving accounts', hue='Risk Group', data=data, order=order_savings, palette='Set2', ax=axs[0])

axs[0].set_title('Saving Accounts Distribution by Risk Group')

axs[0].set_xlabel('Saving Accounts')

axs[0].set_ylabel('Count')

sns.countplot(x='Checking account', hue='Risk Group', data=data, order=order_checking, palette='Set2', ax=axs[1])

axs[1].set_title('Checking Account Distribution by Risk Group')

axs[1].set_xlabel('Checking Account')

axs[1].set_ylabel('Count')

plt.tight_layout()

plt.show()

查看详情

案例3

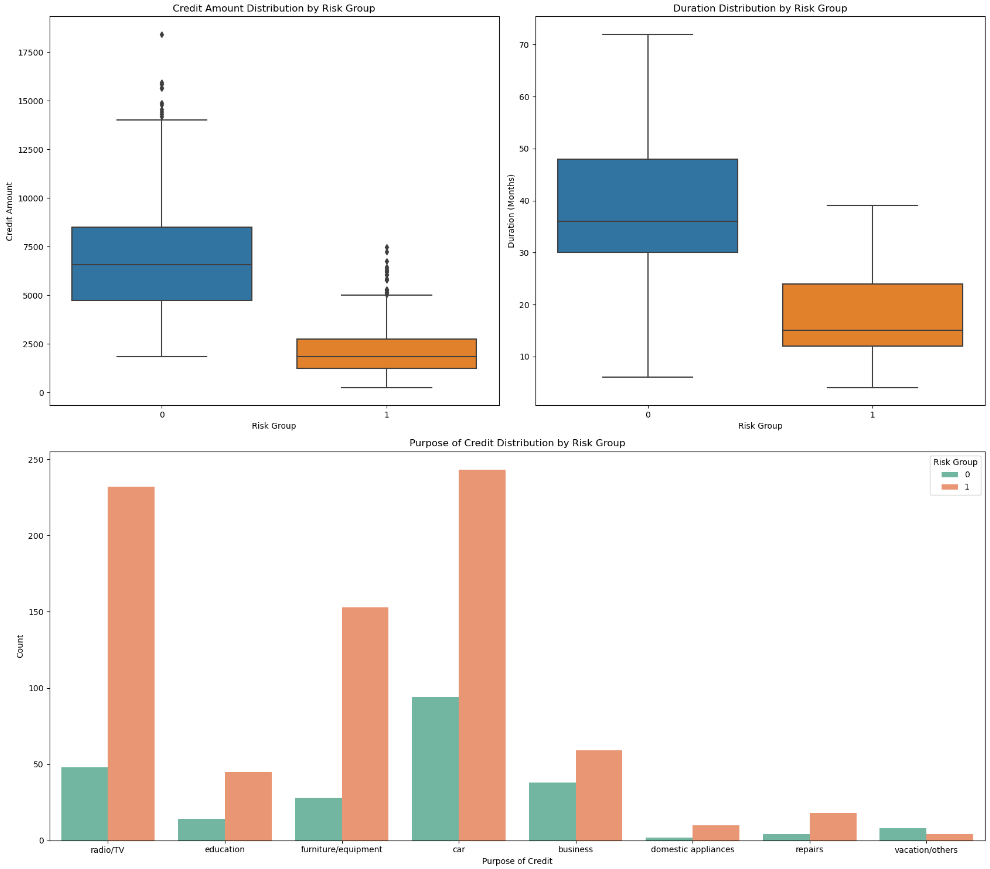

# 贷款情况对比¶

fig = plt.figure(figsize=(17,15))

# 创建2x2的图布局

ax1 = fig.add_subplot(2, 2, 1)

ax2 = fig.add_subplot(2, 2, 2)

ax3 = fig.add_subplot(2, 1, 2)

sns.boxplot(x='Risk Group', y='Credit amount', data=data, ax=ax1)

ax1.set_title('Credit Amount Distribution by Risk Group')

ax1.set_xlabel('Risk Group')

ax1.set_ylabel('Credit Amount')

sns.boxplot(x='Risk Group', y='Duration', data=data, ax=ax2)

ax2.set_title('Duration Distribution by Risk Group')

ax2.set_xlabel('Risk Group')

ax2.set_ylabel('Duration (Months)')

sns.countplot(x='Purpose', hue='Risk Group', data=data, palette='Set2', ax=ax3)

ax3.set_title('Purpose of Credit Distribution by Risk Group')

ax3.set_xlabel('Purpose of Credit')

ax3.set_ylabel('Count')

plt.tight_layout()

plt.show()

查看详情

-

输出

-

结论

通过三类不同情况的分析,可以初步判断,0为高风险人群,1为低风险人群,原因如下:

1.类型1不仅借款金额远小于类型0,并且借款周期也远小于类型0,表明类型0的客户还款负担更重。

2.类型0虽然资金更加充足(储蓄账户状况、支票账户状况),但是通过贷款用途可以看到,主要用于商业和购买车子(占比更大),可以初步判断类型1中,有一些商人,从职业等级也能看出来,大部分在2和3,这一类人群,虽然有钱,但是开销也大,因此风险比类型1高。

因此,可以认为类型1属于低风险用户,类型0属于高风险用户,因为没有违约数据,这里只能通过聚类来简单划分一下。

案例4

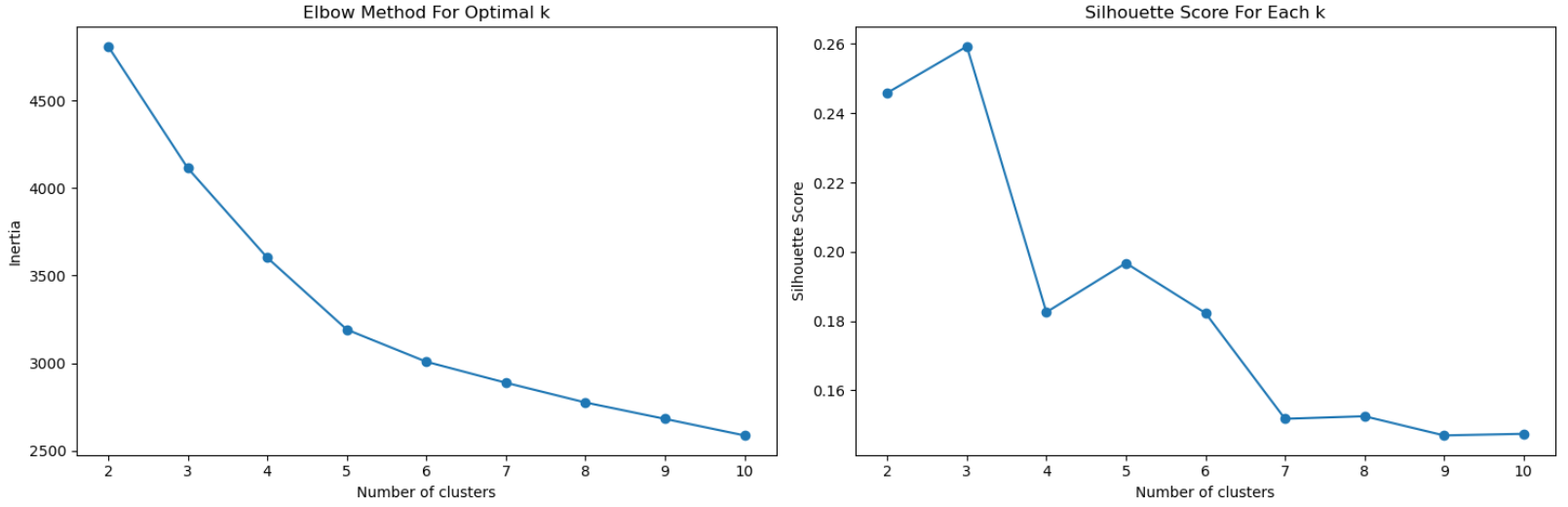

# 用户画像分析

# 这步与上一步不同,我这里并没有将风险评估的情况放到聚类数据中,这样可以通过原始数据更好的确定聚类数与聚类情况,并且可以根据聚类结果判断风险评估是否准确。

# 使用肘部法则来确定最佳聚类数

inertia = []

silhouette_scores = []

k_range = range(2, 11)

for k in k_range:

kmeans = KMeans(n_clusters=k, random_state=10).fit(new_data)

inertia.append(kmeans.inertia_)

silhouette_scores.append(silhouette_score(new_data, kmeans.labels_))

plt.figure(figsize=(15,5))

plt.subplot(1, 2, 1)

plt.plot(k_range, inertia, marker='o')

plt.xlabel('Number of clusters')

plt.ylabel('Inertia')

plt.title('Elbow Method For Optimal k')

plt.subplot(1, 2, 2)

plt.plot(k_range, silhouette_scores, marker='o')

plt.xlabel('Number of clusters')

plt.ylabel('Silhouette Score')

plt.title('Silhouette Score For Each k')

plt.tight_layout()

plt.show()

查看详情

-

输出

-

结论

1.左图为肘部法则图,通过此图可以看到,在4和5的时候,曲线下降速率明显下降。

2.右图为轮廓系数图,在2时,轮廓系数最高,在4时也不错。

结合两个图,我们选择4作为聚类数,此时肘部法则图下降速率有明显下降,且是轮廓系数图中第二高的点。

案例5

# 建立k均值聚类模型

# 执行K-均值聚类,选择4个聚类

kmeans_final = KMeans(n_clusters=4, random_state=15)

kmeans_final.fit(new_data)

# 获取聚类标签

cluster_labels = kmeans_final.labels_

# 将聚类标签添加到原始数据中以进行分析

data['Cluster'] = cluster_labels

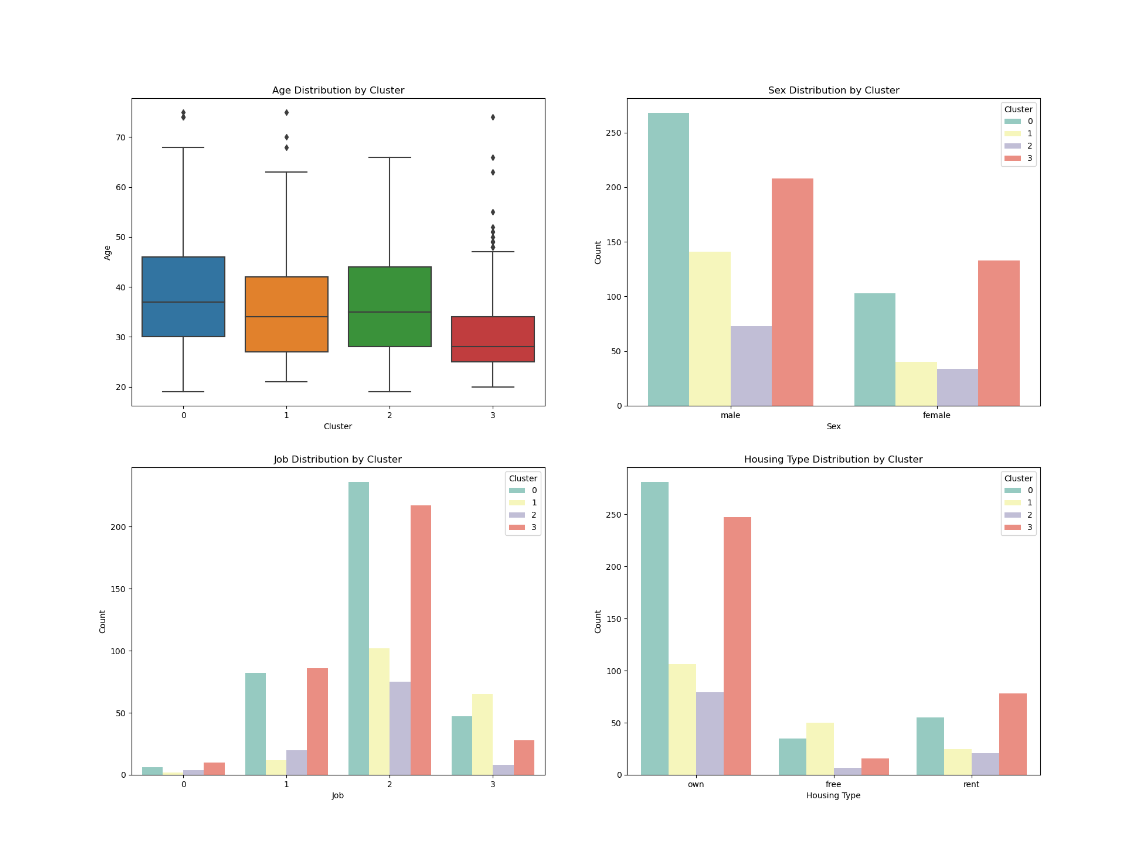

# 四类客户之间对比

# 基本情况对比

fig, axs = plt.subplots(2, 2, figsize=(20,15))

sns.boxplot(x='Cluster', y='Age', data=data, ax=axs[0, 0])

axs[0, 0].set_title('Age Distribution by Cluster')

axs[0, 0].set_xlabel('Cluster')

axs[0, 0].set_ylabel('Age')

sns.countplot(x='Sex', hue='Cluster', data=data, palette='Set3', ax=axs[0, 1])

axs[0, 1].set_title('Sex Distribution by Cluster')

axs[0, 1].set_xlabel('Sex')

axs[0, 1].set_ylabel('Count')

sns.countplot(x='Job', hue='Cluster', data=data, palette='Set3', ax=axs[1, 0])

axs[1, 0].set_title('Job Distribution by Cluster')

axs[1, 0].set_xlabel('Job')

axs[1, 0].set_ylabel('Count')

sns.countplot(x='Housing', hue='Cluster', data=data, palette='Set3', ax=axs[1, 1])

axs[1, 1].set_title('Housing Type Distribution by Cluster')

axs[1, 1].set_xlabel('Housing Type')

axs[1, 1].set_ylabel('Count')

plt.show()

查看详情

- 输出

案例6

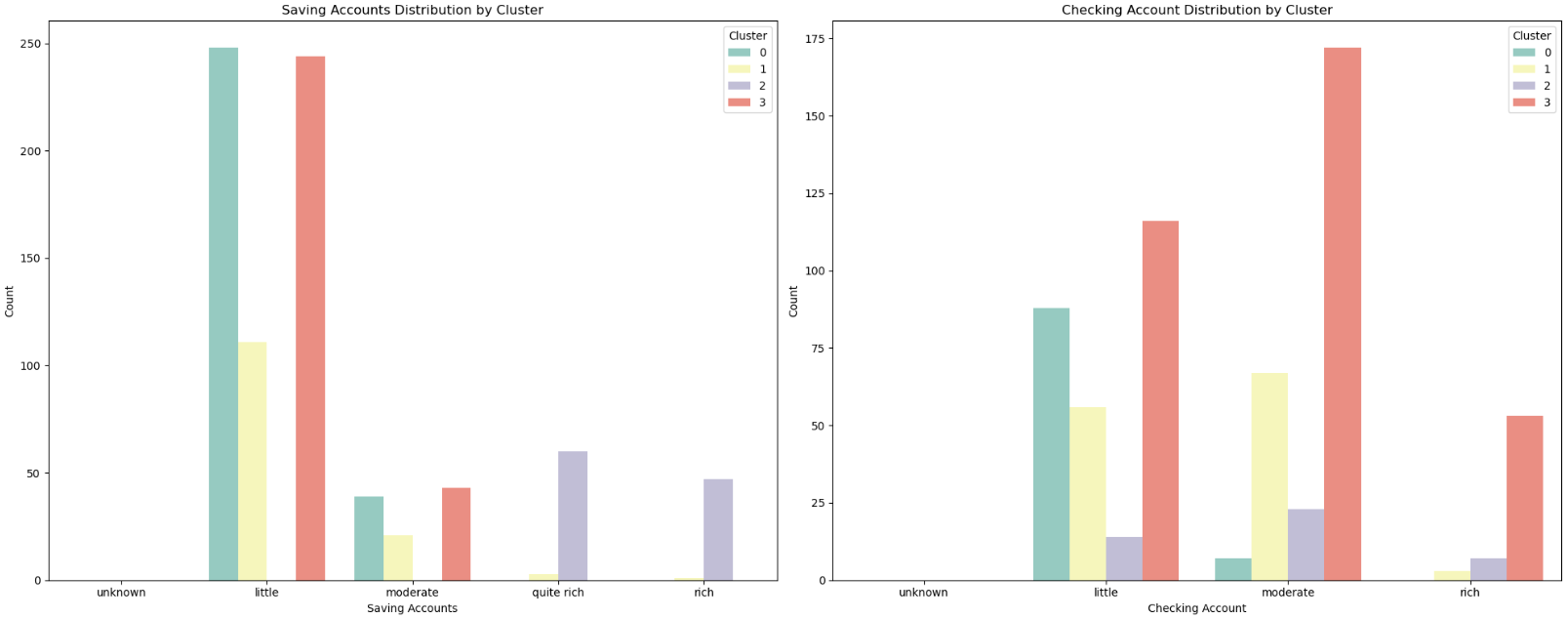

# 经济情况对比

order_savings = ['unknown', 'little', 'moderate', 'quite rich', 'rich']

order_checking = ['unknown', 'little', 'moderate', 'rich']

fig, axs = plt.subplots(1, 2, figsize=(20,8))

sns.countplot(x='Saving accounts', hue='Cluster', data=data, order=order_savings, palette='Set3', ax=axs[0])

axs[0].set_title('Saving Accounts Distribution by Cluster')

axs[0].set_xlabel('Saving Accounts')

axs[0].set_ylabel('Count')

axs[0].legend(title='Cluster', loc='upper right')

sns.countplot(x='Checking account', hue='Cluster', data=data, order=order_checking, palette='Set3', ax=axs[1])

axs[1].set_title('Checking Account Distribution by Cluster')

axs[1].set_xlabel('Checking Account')

axs[1].set_ylabel('Count')

plt.tight_layout()

plt.show()

查看详情

- 输出

案例7

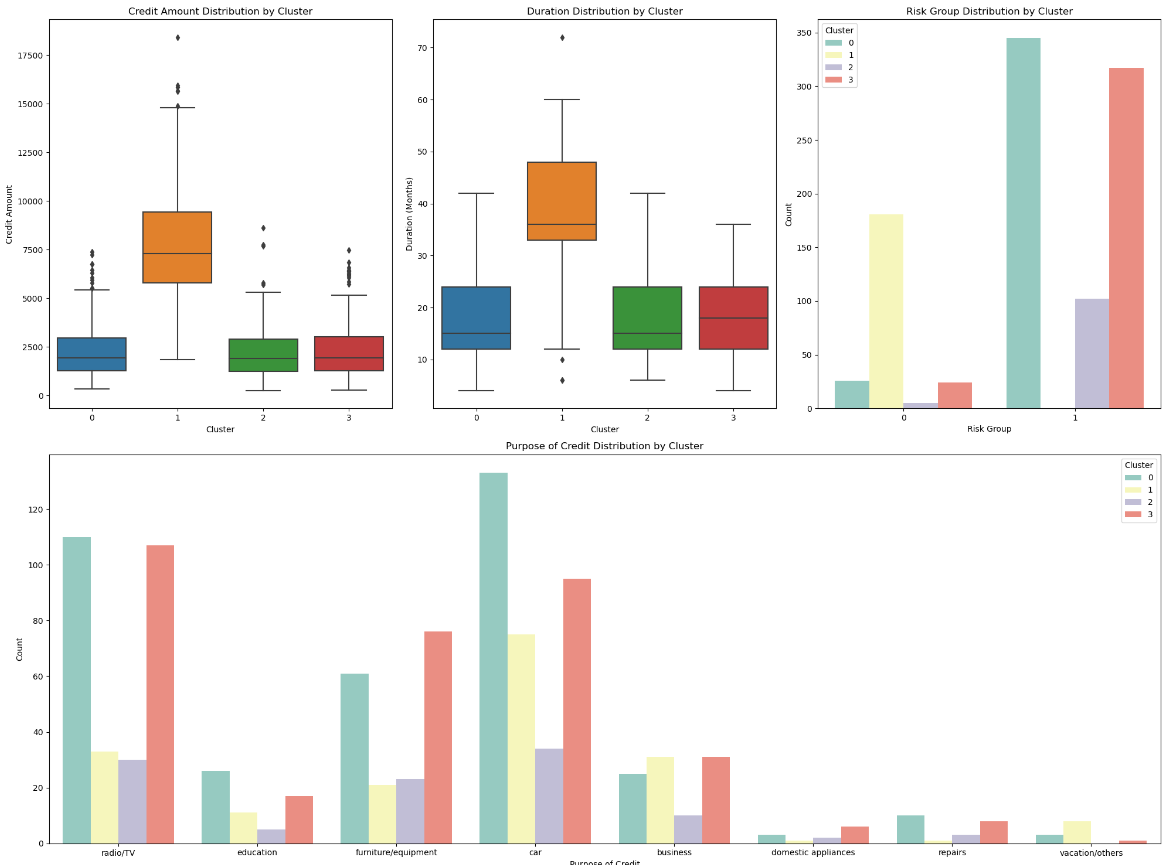

# 贷款情况对比

fig = plt.figure(figsize=(20,15))

# 创建2x2的图布局

ax1 = fig.add_subplot(2, 3, 1)

ax2 = fig.add_subplot(2, 3, 2)

ax3 = fig.add_subplot(2, 3, 3)

ax4 = fig.add_subplot(2, 1, 2)

sns.boxplot(x='Cluster', y='Credit amount', data=data, ax=ax1)

ax1.set_title('Credit Amount Distribution by Cluster')

ax1.set_xlabel('Cluster')

ax1.set_ylabel('Credit Amount')

sns.boxplot(x='Cluster', y='Duration', data=data, ax=ax2)

ax2.set_title('Duration Distribution by Cluster')

ax2.set_xlabel('Cluster')

ax2.set_ylabel('Duration (Months)')

sns.countplot(x='Risk Group', hue='Cluster', data=data, palette='Set3', ax=ax3)

ax3.set_title('Risk Group Distribution by Cluster')

ax3.set_xlabel('Risk Group')

ax3.set_ylabel('Count')

sns.countplot(x='Purpose', hue='Cluster', data=data, palette='Set3', ax=ax4)

ax4.set_title('Purpose of Credit Distribution by Cluster')

ax4.set_xlabel('Purpose of Credit')

ax4.set_ylabel('Count')

plt.tight_layout()

plt.show()

查看详情

-

输出

-

结论

1.类型0(中高等额度需求,倾向于中长期贷款的高职业人群):

用户画像:年龄主要在20-40岁之间,职业主要在2-3级,这一类人是住免租赁或者租房的占比远高于其他三类,储蓄账户状况主要集中在未知和少量,支票账户也是如此,主要集中在未知、少量和适中,贷款金额和贷款周期远超其他三类,贷款主要用于购车,根据风险评估,这类客户全部为高风险。

建议:银行和金融机构可以为这个群体提供中期汽车贷款产品,并且可以通过金融教育来提升他们的储蓄和投资能力。

2.类别1(较高储蓄能力,倾向于短期贷款的人群):

用户画像:年龄分布比较均匀,与类型0相近,职业主要在2级,免租赁的占比较小,储蓄账户状况远超其他三类客户,贷款金额少,周期短,贷款主要用于购买设备,根据风险评估,这类客户全部为低风险。

建议:银行和金融机构可以为这个群体提供短期信用产品,同时考虑他们较高的储蓄能力,可以推广储蓄和投资相关产品。

3.类型2(短期贷款,储蓄能力有限的年轻化人群):

用户画像:平均年龄在30岁以下,最大年龄不超过45岁,比其他三类都更年轻,职业主要集中在2级,但是其他等级都有存在,租房占比高于其他三类,蓄账户状况主要集中在未知和少量,支票账户主要集中在未知、少量和适中,这类客户的资金情况与类型0类似,贷款情况与类型1类似,风险评估绝大多数为低风险。

建议:鉴于他们是信用初建者和年轻消费者,银行和金融机构可以提供小额信用卡产品和财务规划服务。

4.类型3(短期贷款的高龄客户):

用户画像:大龄客户,职业集中在1-2级,大部分有自己的房子,少部分是免租赁,蓄账户状况主要集中在未知和少量,支票账户每个等级均有占比,贷款情况与类型1和类型2类似,也是贷款金额少,周期短,同样的风险评估大多数是低风险。

建议:针对这类客户,银行和金融机构可以提供针对成熟消费者的产品和服务,如退休规划和健康保险,同时关注其稳定的信贷需求。

浙公网安备 33010602011771号

浙公网安备 33010602011771号