信用卡评分模型(四)

数据来源:https://www.kaggle.com/c/GiveMeSomeCredit

使用statsmodels.api.Logit建模

前面参考了这么多篇文章,现在按照自己平时的思路简单的写了一篇

总结:

1.关于缺失值的问题,首先不用处理,先做iv,再具体要看空值的部分的逾期表现如何,

(1)单独作为一箱:如果逾期率和其他分箱都不接近,或者是异常小,或者异常大,我们就可以单独作为一箱,

(2)均值填充:如果和均值所在的那一箱逾期率接近,则可以用均值填充

(3)中位数填充:如果和中位数所在的那一箱逾期率接近,则可以用中位数填充

(4)使用随机森林模型填充:只要不是上面第一种情况,都可以使用随机森林模型填充

(5)看看是否可以有其他列来补充

2.关于异常值的处理

(1)数值型的类别个数不是很多的话,不建议使用分位数去处理异常值

(2)我们也可以先做iv值,然后在看看箱和箱直接的值得差异,如何差异特别大,即可说明这里面有差异值

(3)差异值是该删除还是修改呢,这得需要我们去判断

3.我们使用woe转化之后还需要做标准化吗?

一、statsmodels

具体看代码吧

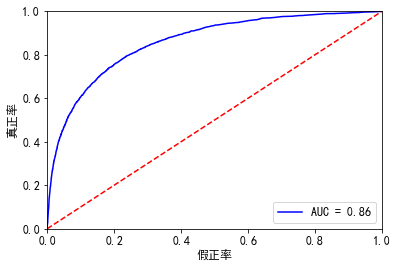

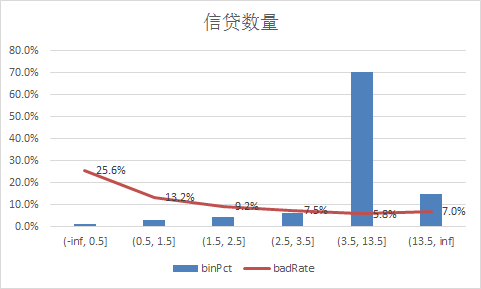

# -*- coding: utf-8 -*- """ Created on Wed Jan 20 19:33:13 2021 @author: Administrator """ #%%导入模块 import pandas as pd import numpy as np from scipy import stats import seaborn as sns import matplotlib.pyplot as plt %matplotlib inline plt.rc("font",family="SimHei",size="12") #解决中文无法显示的问题 #%%导入数据 train=pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-training.csv') train.shape #(150000, 12) train.pop('Unnamed: 0') train.columns ''' [ 'SeriousDlqin2yrs', 'RevolvingUtilizationOfUnsecuredLines', 'age', 'NumberOfTime30-59DaysPastDueNotWorse', 'DebtRatio', 'MonthlyIncome', 'NumberOfOpenCreditLinesAndLoans', 'NumberOfTimes90DaysLate', 'NumberRealEstateLoansOrLines', 'NumberOfTime60-89DaysPastDueNotWorse', 'NumberOfDependents'] {'Unnamed: 0':'id', 'SeriousDlqin2yrs':'好坏客户', 'RevolvingUtilizationOfUnsecuredLines':'可用额度比值', 'age':'年龄', 'NumberOfTime30-59DaysPastDueNotWorse':'逾期30-59天笔数', 'DebtRatio':'负债率', 'MonthlyIncome':'月收入', 'NumberOfOpenCreditLinesAndLoans':'信贷数量', 'NumberOfTimes90DaysLate':'逾期90天笔数', 'NumberRealEstateLoansOrLines':'固定资产贷款量', 'NumberOfTime60-89DaysPastDueNotWorse':'逾期60-89天笔数', 'NumberOfDependents':'家属数量'} ''' #%%查看每个变量的唯一值 for i in list(train.columns): print(i,'的唯一值是:',train[i].nunique()) ''' SeriousDlqin2yrs 的唯一值是: 2 RevolvingUtilizationOfUnsecuredLines 的唯一值是: 125728 age 的唯一值是: 86 NumberOfTime30-59DaysPastDueNotWorse 的唯一值是: 16 DebtRatio 的唯一值是: 114194 MonthlyIncome 的唯一值是: 13594 NumberOfOpenCreditLinesAndLoans 的唯一值是: 58 NumberOfTimes90DaysLate 的唯一值是: 19 NumberRealEstateLoansOrLines 的唯一值是: 28 NumberOfTime60-89DaysPastDueNotWorse 的唯一值是: 13 NumberOfDependents 的唯一值是: 13 ''' #%%查看缺失值 train.isnull().sum() ''' SeriousDlqin2yrs 0 RevolvingUtilizationOfUnsecuredLines 0 age 0 NumberOfTime30-59DaysPastDueNotWorse 0 DebtRatio 0 MonthlyIncome 29731 NumberOfOpenCreditLinesAndLoans 0 NumberOfTimes90DaysLate 0 NumberRealEstateLoansOrLines 0 NumberOfTime60-89DaysPastDueNotWorse 0 NumberOfDependents 3924 dtype: int64 ''' #月收入缺失比例还是很高的,展示不管 #%%按照字面理解。好像都是数值型变量 import pycard as pc num_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in list(train.columns): clf.fit(train[i] ,train.SeriousDlqin2yrs) clf.generate_transform_fun() num_iv_woedf.append(clf.woe_df_) num_iv_woedf.to_excel('tmp18') #上面可知有2个字段是有缺失值得,我们可以将NumberOfDependents填补为-1,收入的填补为均值 train_copy = train.copy() train_copy.NumberOfDependents[train_copy.NumberOfDependents.isnull()] = -1 train_copy.MonthlyIncome.median() train_copy.MonthlyIncome[train_copy.MonthlyIncome.isnull()] = 5400.0 #有iv的计算可知 (35.892, inf] RevolvingUtilizationOfUnsecuredLines,有点问题,删除 train_copy = train_copy[train_copy.RevolvingUtilizationOfUnsecuredLines<=35.892] train_copy.shape #%%异常值处理 #我错了,下面这个异常值处理并不合理,不处理了, #%%分箱 import pycard as pc num_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in list(train_copy.columns)[1:]: clf.fit(train_copy[i] ,train_copy.SeriousDlqin2yrs) clf.generate_transform_fun() num_iv_woedf.append(clf.woe_df_) from numpy import * train_copy['RevolvingUtilizationOfUnsecuredLines_bin'] = pd.cut(train_copy.RevolvingUtilizationOfUnsecuredLines,bins=[-inf, 0.1318, 0.3009, 0.495, 0.6981, 0.8628, 1.0051, 1.0284, inf]) train_copy['age_bin'] = pd.cut(train_copy.age,bins=[-inf, 28.5, 36.5, 43.5, 55.5, 57.5, 62.5, 67.5, inf]) train_copy['NumberOfTime30-59DaysPastDueNotWorse_bin'] = pd.cut(train_copy['NumberOfTime30-59DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 3.5, inf]) train_copy['DebtRatio_bin'] = pd.cut(train_copy.DebtRatio,bins=[-inf, 0.0, 0.0163, 0.4233, 0.6537, 3.9728, 995.5, inf]) train_copy['MonthlyIncome_bin'] = pd.cut(train_copy.MonthlyIncome,bins=[-inf, 270.0, 930.5, 3332.5, 5320.5, 5400.5, 7656.5, 9945.5, inf]) train_copy['NumberOfOpenCreditLinesAndLoans_bin'] = pd.cut(train_copy.NumberOfOpenCreditLinesAndLoans,bins=[-inf, 0.5, 1.5, 2.5, 3.5, 13.5, inf]) train_copy['NumberOfTimes90DaysLate_bin'] = pd.cut(train_copy.NumberOfTimes90DaysLate,bins=[-inf, 0.5, 1.5, 2.5, inf]) train_copy['NumberRealEstateLoansOrLines_bin'] = pd.cut(train_copy.NumberRealEstateLoansOrLines,bins=[-inf, 0.5, 2.5, 4.5, 6.5, inf]) train_copy['NumberOfTime60-89DaysPastDueNotWorse_bin'] = pd.cut(train_copy['NumberOfTime60-89DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 2.5, inf]) train_copy['NumberOfDependents_bin'] = pd.cut(train_copy.NumberOfDependents,bins=[-inf, -0.5, 0.5, 1.5, 2.5, 3.5, inf]) cate_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in ['RevolvingUtilizationOfUnsecuredLines_bin', 'age_bin', 'NumberOfTime30-59DaysPastDueNotWorse_bin', 'DebtRatio_bin', 'MonthlyIncome_bin', 'NumberOfOpenCreditLinesAndLoans_bin', 'NumberOfTimes90DaysLate_bin', 'NumberRealEstateLoansOrLines_bin', 'NumberOfTime60-89DaysPastDueNotWorse_bin', 'NumberOfDependents_bin']: cate_iv_woedf.append(pc.cross_woe(train_copy[i] ,train_copy.SeriousDlqin2yrs)) cate_iv_woedf.to_excel('tmp18') #%%woe转换 iv_col = ['RevolvingUtilizationOfUnsecuredLines_bin', 'age_bin', 'NumberOfTime30-59DaysPastDueNotWorse_bin', 'DebtRatio_bin', 'MonthlyIncome_bin', 'NumberOfOpenCreditLinesAndLoans_bin', 'NumberOfTimes90DaysLate_bin', 'NumberRealEstateLoansOrLines_bin', 'NumberOfTime60-89DaysPastDueNotWorse_bin', 'NumberOfDependents_bin'] cate_iv_woedf.bin2woe(train_copy,iv_col) model_col = [i for i in ['SeriousDlqin2yrs']+list(train_copy.columns)[-10:]] #%%建模 import pandas as pd import matplotlib.pyplot as plt #导入图像库 import matplotlib import seaborn as sns import statsmodels.api as sm from sklearn.metrics import roc_curve, auc from sklearn.model_selection import train_test_split X = train_copy[model_col[1:]] Y = train_copy['SeriousDlqin2yrs'] x_train,x_test,y_train,y_test=train_test_split(X,Y,test_size=0.3,random_state=100) #(10127, 44) X1=sm.add_constant(x_train) #在X前加上一列常数1,方便做带截距项的回归 logit=sm.Logit(y_train.astype(float),X1.astype(float)) result=logit.fit() result.summary() result.params #验证集 X3 = sm.add_constant(x_test) resu = result.predict(X3.astype(float)) fpr, tpr, threshold = roc_curve(y_test, resu) rocauc = auc(fpr, tpr) # 0.8575936062678856 plt.plot(fpr, tpr, 'b', label='AUC = %0.2f' % rocauc) plt.legend(loc='lower right') plt.plot([0, 1], [0, 1], 'r--') plt.xlim([0, 1]) plt.ylim([0, 1]) plt.ylabel('真正率') plt.xlabel('假正率') plt.show() #训练集 resu_1 = result.predict(X1.astype(float)) fpr, tpr, threshold = roc_curve(y_train, resu_1) rocauc = auc(fpr, tpr) #0.8585906092953097 plt.plot(fpr, tpr, 'b', label='AUC = %0.2f' % rocauc) plt.legend(loc='lower right') plt.plot([0, 1], [0, 1], 'r--') plt.xlim([0, 1]) plt.ylim([0, 1]) plt.ylabel('真正率') plt.xlabel('假正率') plt.show() #%%测试集 test = pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-test.csv') test.NumberOfDependents[test.NumberOfDependents.isnull()] = -1 test.MonthlyIncome.median() test.MonthlyIncome[test.MonthlyIncome.isnull()] = 5400.0 test['RevolvingUtilizationOfUnsecuredLines_bin'] = pd.cut(test.RevolvingUtilizationOfUnsecuredLines,bins=[-inf, 0.1318, 0.3009, 0.495, 0.6981, 0.8628, 1.0051, 1.0284, inf]) test['age_bin'] = pd.cut(test.age,bins=[-inf, 28.5, 36.5, 43.5, 55.5, 57.5, 62.5, 67.5, inf]) test['NumberOfTime30-59DaysPastDueNotWorse_bin'] = pd.cut(test['NumberOfTime30-59DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 3.5, inf]) test['DebtRatio_bin'] = pd.cut(test.DebtRatio,bins=[-inf, 0.0, 0.0163, 0.4233, 0.6537, 3.9728, 995.5, inf]) test['MonthlyIncome_bin'] = pd.cut(test.MonthlyIncome,bins=[-inf, 270.0, 930.5, 3332.5, 5320.5, 5400.5, 7656.5, 9945.5, inf]) test['NumberOfOpenCreditLinesAndLoans_bin'] = pd.cut(test.NumberOfOpenCreditLinesAndLoans,bins=[-inf, 0.5, 1.5, 2.5, 3.5, 13.5, inf]) test['NumberOfTimes90DaysLate_bin'] = pd.cut(test.NumberOfTimes90DaysLate,bins=[-inf, 0.5, 1.5, 2.5, inf]) test['NumberRealEstateLoansOrLines_bin'] = pd.cut(test.NumberRealEstateLoansOrLines,bins=[-inf, 0.5, 2.5, 4.5, 6.5, inf]) test['NumberOfTime60-89DaysPastDueNotWorse_bin'] = pd.cut(test['NumberOfTime60-89DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 2.5, inf]) test['NumberOfDependents_bin'] = pd.cut(test.NumberOfDependents,bins=[-inf, -0.5, 0.5, 1.5, 2.5, 3.5, inf]) cate_iv_woedf.bin2woe(test,iv_col) X_test = test[model_col[1:]] X4 = sm.add_constant(X_test.astype(float)) resu_test = result.predict(X4.astype(float))

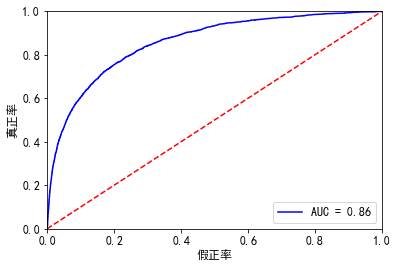

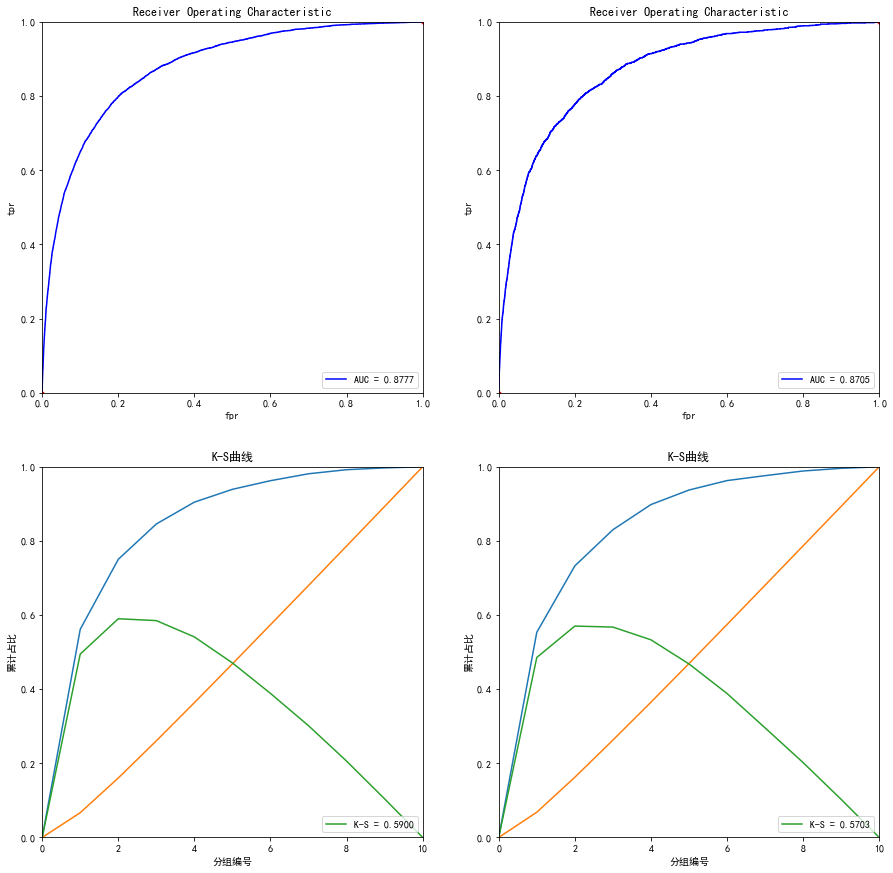

最后训练集,测试集的auc如下:

结果都是差不多,0.8585906092953097

效果还是不错了

2021.01.20更新

本次缺点:没有进行变量挑选,全部都入模了

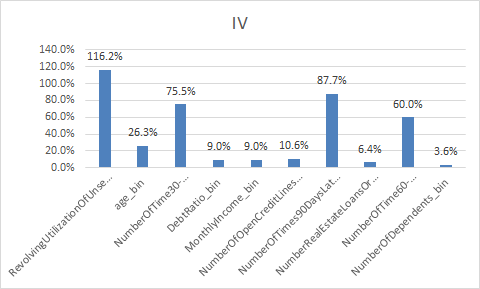

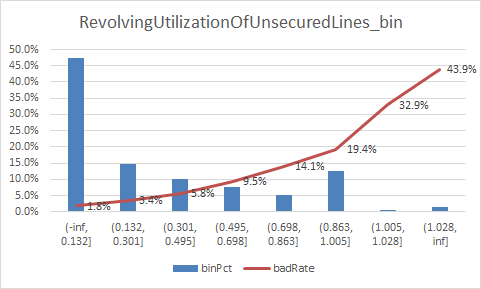

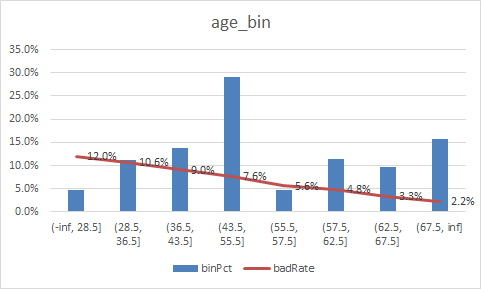

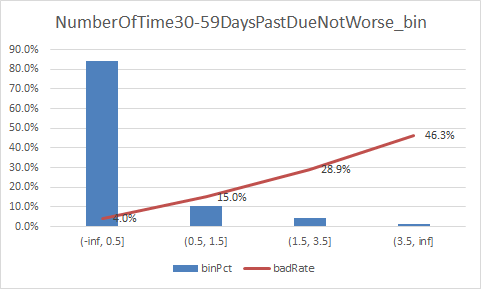

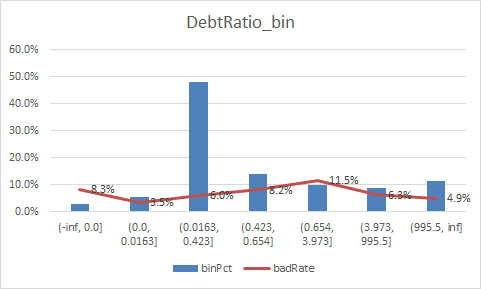

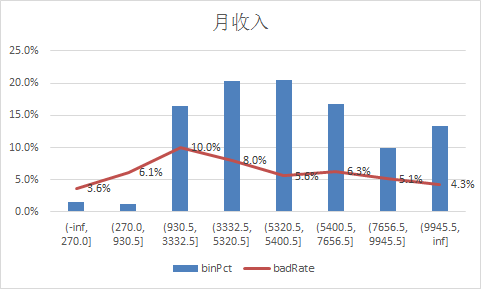

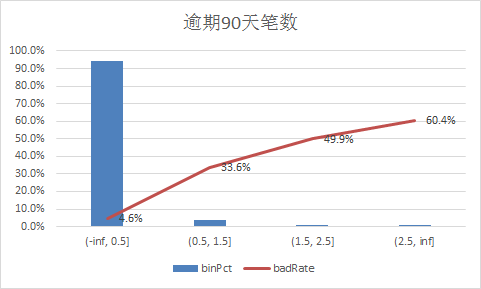

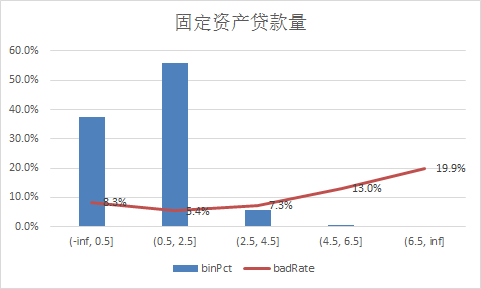

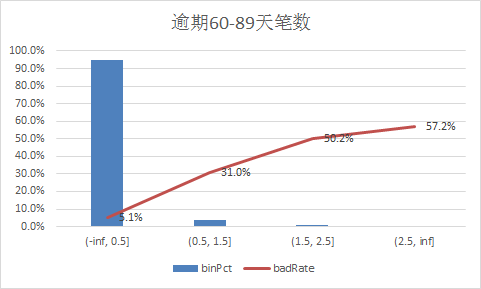

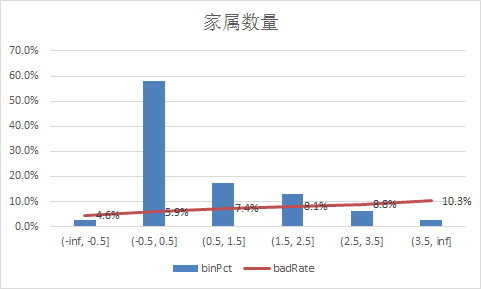

下面补充一下每个变量的iv情况,以及逾期率

二、使用逻辑回归模型

首先是前期的处理

# -*- coding: utf-8 -*- """ Created on Tue Mar 16 09:40:03 2021 @author: Administrator """ #%%导入模块 import pandas as pd import numpy as np from scipy import stats import seaborn as sns import matplotlib.pyplot as plt %matplotlib inline plt.rc("font",family="SimHei",size="12") #解决中文无法显示的问题 #%%导入数据 train=pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-training.csv') train.shape #(150000, 12) train.pop('Unnamed: 0') train_copy = train.copy() train_copy.NumberOfDependents[train_copy.NumberOfDependents.isnull()] = -1 train_copy.MonthlyIncome.median() train_copy.MonthlyIncome[train_copy.MonthlyIncome.isnull()] = 5400.0 #有iv的计算可知 (35.892, inf] RevolvingUtilizationOfUnsecuredLines,有点问题,删除 train_copy = train_copy[train_copy.RevolvingUtilizationOfUnsecuredLines<=35.892] train_copy.shape #%%分箱 num_iv_woedf = pc.WoeDf() clf = pc.NumBin(min_bin_samples=200, min_impurity_decrease=4e-5) for i in ['RevolvingUtilizationOfUnsecuredLines', 'age', 'NumberOfTime30-59DaysPastDueNotWorse', 'DebtRatio', 'MonthlyIncome', 'NumberOfOpenCreditLinesAndLoans', 'NumberOfTimes90DaysLate', 'NumberRealEstateLoansOrLines', 'NumberOfTime60-89DaysPastDueNotWorse', 'NumberOfDependents']: clf.fit(train_copy[i] ,train_copy.SeriousDlqin2yrs) train_copy[i+'_bin'] = clf.transform(train_copy[i]) #这样可以省略掉后面转换成_bin的一步骤 num_iv_woedf.append(clf.woe_df_) #%%woe转换 bin_col = [i for i in list(train_copy.columns) if i[-4:]=='_bin'] cate_iv_woedf = pc.WoeDf() for i in bin_col: cate_iv_woedf.append(pc.cross_woe(train_copy[i] ,train_copy.SeriousDlqin2yrs)) #cate_iv_woedf.to_excel('tmp1') cate_iv_woedf.bin2woe(train_copy,bin_col) #%% model_col = [i for i in list(train_copy.columns) if i[-4:]=='_woe'] x = train_copy[model_col] y = train_copy[['SeriousDlqin2yrs']] y.columns = ['y'] #%%建模 import pandas as pd import matplotlib.pyplot as plt #导入图像库 import matplotlib import seaborn as sns import statsmodels.api as sm from sklearn.metrics import roc_curve, auc from sklearn.model_selection import train_test_split x_train,x_test,y_train,y_test=train_test_split(x,y,test_size=0.3,random_state=100)

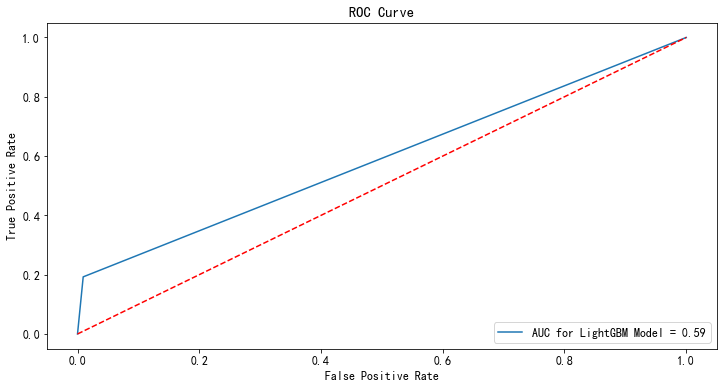

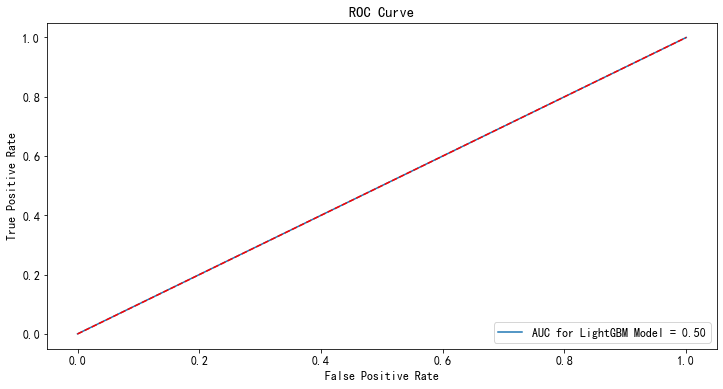

1.逻辑回归不设置参数,即是使用默认的参数

from sklearn.linear_model import LogisticRegression clf = LogisticRegression() clf.fit(x_train,y_train) #用测试集进行检验 p_test = clf.predict(x_test) fpr,tpr,_ = roc_curve(y_test,p_test) rocAuc = auc(fpr, tpr) #0.5917867782621995 plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for LightGBM Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

2.我们又使用第一种模型statsmodels

#%%这个是使用 statsmodels import statsmodels.api as sm X1=sm.add_constant(x_train) #在X前加上一列常数1,方便做带截距项的回归 logit=sm.Logit(y_train.astype(float),X1.astype(float)) result=logit.fit() result.summary() result.params #验证集 X3 = sm.add_constant(x_test) resu = result.predict(X3.astype(float)) fpr, tpr, threshold = roc_curve(y_test, resu) rocauc = auc(fpr, tpr) # 0.8581062561817331 plt.plot(fpr, tpr, 'b', label='AUC = %0.2f' % rocauc) plt.legend(loc='lower right') plt.plot([0, 1], [0, 1], 'r--') plt.xlim([0, 1]) plt.ylim([0, 1]) plt.ylabel('真正率') plt.xlabel('假正率') plt.show()

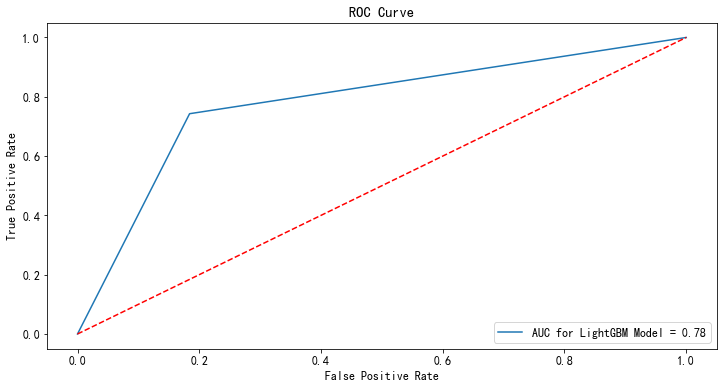

我们知道逻辑回归默认参数处理不均衡数据效果会很惨,因此设置class_weight="balanced",

from sklearn.linear_model import LogisticRegression clf = LogisticRegression(random_state=2021, class_weight="balanced") clf.fit(x_train,y_train) #用测试集进行检验 p_test = clf.predict(x_test) fpr,tpr,_ = roc_curve(y_test,p_test) rocAuc = auc(fpr, tpr) #0.7793665739481085 plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for LightGBM Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

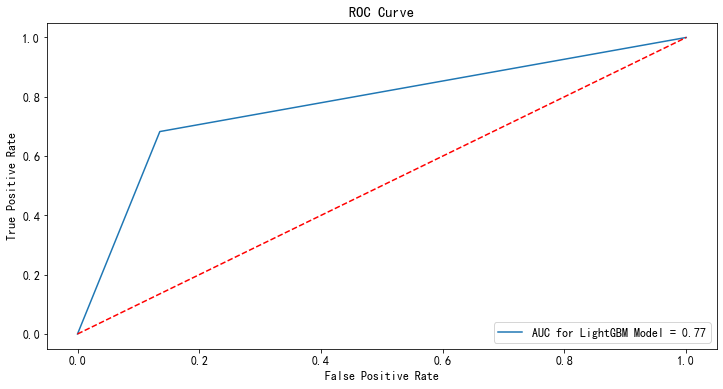

我们知道class_weight还有另外一种设置方法,但是貌似效果更加差

from sklearn.linear_model import LogisticRegression clf = LogisticRegression(random_state=2021, class_weight={0:0.93, 1:0.07}) clf.fit(x_train,y_train) #用测试集进行检验 p_test = clf.predict(x_test) fpr,tpr,_ = roc_curve(y_test,p_test) rocAuc = auc(fpr, tpr) #0.5003326679973387 plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for LightGBM Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

效果真不好,原因是sklearn的逻辑回归对于这种数据不均衡的样本处理能力会弱一点

为了不使用woe转化,我们直接使用lgm建模

# -*- coding: utf-8 -*- """ Created on Thu Jan 21 11:28:35 2021 @author: Administrator """ #%%该版本直接使用lgb #%%导入模块 import pandas as pd import numpy as np from scipy import stats import seaborn as sns import matplotlib.pyplot as plt %matplotlib inline plt.rc("font",family="SimHei",size="12") #解决中文无法显示的问题 #%%导入数据 train=pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-training.csv') train.pop('Unnamed: 0') train_copy = train.copy() train_copy.NumberOfDependents[train_copy.NumberOfDependents.isnull()] = -1 train_copy.MonthlyIncome.median() train_copy.MonthlyIncome[train_copy.MonthlyIncome.isnull()] = 5400.0 #%%划分数据集 from sklearn import preprocessing from sklearn import metrics from sklearn import model_selection from sklearn import ensemble from sklearn import tree from sklearn import linear_model import os, datetime, sys, random, time import seaborn as sns import xgboost as xgs import lightgbm as lgb model_col = list(train_copy.columns) model_col.remove('SeriousDlqin2yrs') X = train_copy[model_col] Y = train_copy['SeriousDlqin2yrs'] x_train,x_test,y_train,y_test=train_test_split(X,Y,test_size=0.3,random_state=100) #%%lgb建模 lgbAttributes = lgb.LGBMClassifier(objective='binary', n_jobs=-1, random_state=100, importance_type='gain') lgbParameters = { 'max_depth' : [2,3,4,5], 'learning_rate': [0.05, 0.1,0.125,0.15], 'colsample_bytree' : [0.2,0.4,0.6,0.8,1], 'n_estimators' : [400,500,600,700,800,900], 'min_split_gain' : [0.15,0.20,0.25,0.3,0.35], #equivalent to gamma in XGBoost 'subsample': [0.6,0.7,0.8,0.9,1], 'min_child_weight': [6,7,8,9,10], 'scale_pos_weight': [10,15,20], 'min_data_in_leaf' : [100,200,300,400,500,600,700,800,900], 'num_leaves' : [20,30,40,50,60,70,80,90,100] } lgbModel = model_selection.RandomizedSearchCV(lgbAttributes, param_distributions = lgbParameters, cv = 5, random_state=100) lgbModel.fit(x_train,y_train,feature_name=model_col) #最佳参数 bestEstimatorLGB = lgbModel.best_estimator_ bestEstimatorLGB #使用最佳参数建模 bestEstimatorLGB = lgb.LGBMClassifier(colsample_bytree=1, importance_type='gain', learning_rate=0.125, max_depth=5, min_child_weight=6, min_data_in_leaf=500, min_split_gain=0.3, n_estimators=500, num_leaves=60, objective='binary', random_state=100, scale_pos_weight=10, subsample=0.7).fit(x_train,y_train,feature_name=model_col) yPredLGB = bestEstimatorLGB.predict_proba(x_test) yPredLGB = yPredLGB[:,1] yTestPredLGB = bestEstimatorLGB.predict(x_test) print(metrics.classification_report(y_test,yTestPredLGB)) #画图 fpr,tpr,_ = metrics.roc_curve(y_test,yTestPredLGB) rocAuc = metrics.auc(fpr, tpr) plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for LightGBM Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

最后结果

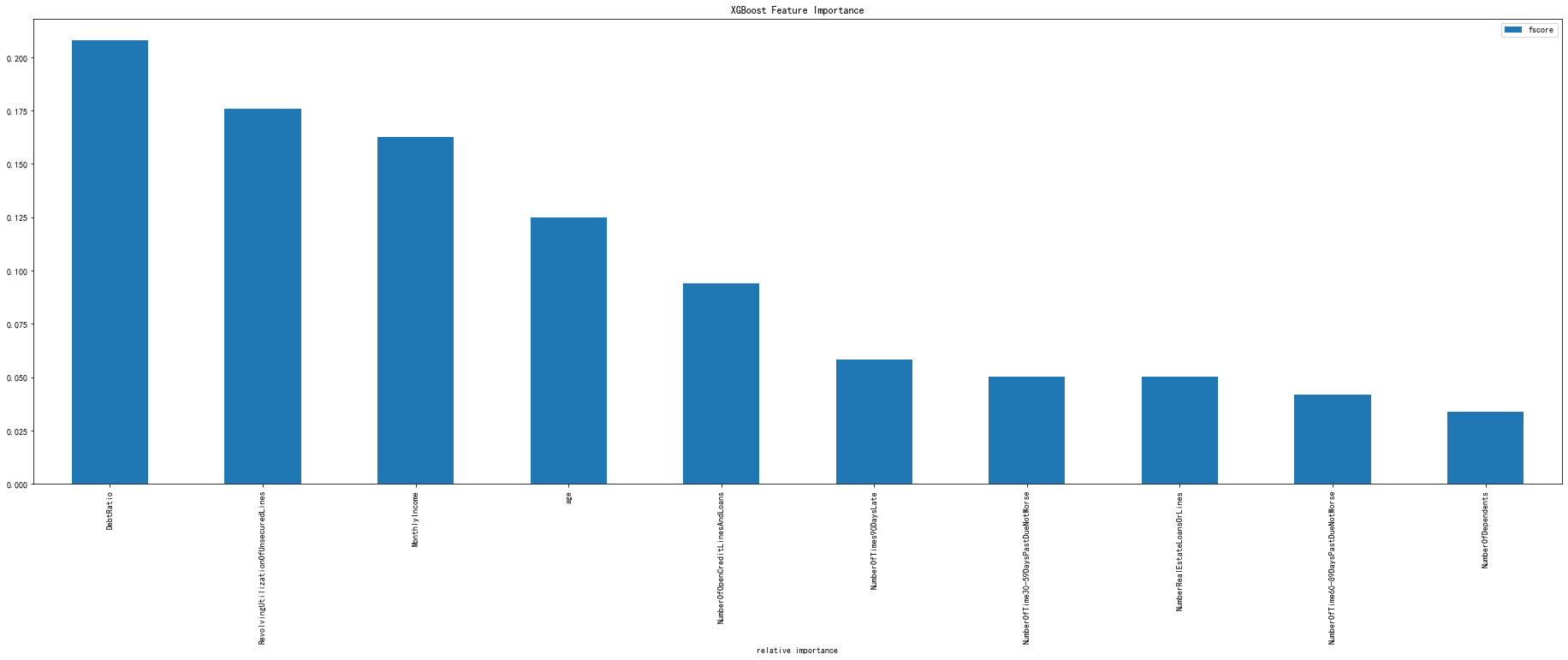

2021.03.15补充xgboost建模的

# -*- coding: utf-8 -*- """ Created on Wed Jan 20 19:33:13 2021 @author: Administrator """ #%%导入模块 import pandas as pd import numpy as np from scipy import stats import seaborn as sns import matplotlib.pyplot as plt %matplotlib inline plt.rc("font",family="SimHei",size="12") #解决中文无法显示的问题 #%%导入数据 train=pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-training.csv') train.shape #(150000, 12) train.pop('Unnamed: 0') train.columns ''' [ 'SeriousDlqin2yrs', 'RevolvingUtilizationOfUnsecuredLines', 'age', 'NumberOfTime30-59DaysPastDueNotWorse', 'DebtRatio', 'MonthlyIncome', 'NumberOfOpenCreditLinesAndLoans', 'NumberOfTimes90DaysLate', 'NumberRealEstateLoansOrLines', 'NumberOfTime60-89DaysPastDueNotWorse', 'NumberOfDependents'] {'Unnamed: 0':'id', 'SeriousDlqin2yrs':'好坏客户', 'RevolvingUtilizationOfUnsecuredLines':'可用额度比值', 'age':'年龄', 'NumberOfTime30-59DaysPastDueNotWorse':'逾期30-59天笔数', 'DebtRatio':'负债率', 'MonthlyIncome':'月收入', 'NumberOfOpenCreditLinesAndLoans':'信贷数量', 'NumberOfTimes90DaysLate':'逾期90天笔数', 'NumberRealEstateLoansOrLines':'固定资产贷款量', 'NumberOfTime60-89DaysPastDueNotWorse':'逾期60-89天笔数', 'NumberOfDependents':'家属数量'} ''' #%%查看每个变量的唯一值 for i in list(train.columns): print(i,'的唯一值是:',train[i].nunique()) ''' SeriousDlqin2yrs 的唯一值是: 2 RevolvingUtilizationOfUnsecuredLines 的唯一值是: 125728 age 的唯一值是: 86 NumberOfTime30-59DaysPastDueNotWorse 的唯一值是: 16 DebtRatio 的唯一值是: 114194 MonthlyIncome 的唯一值是: 13594 NumberOfOpenCreditLinesAndLoans 的唯一值是: 58 NumberOfTimes90DaysLate 的唯一值是: 19 NumberRealEstateLoansOrLines 的唯一值是: 28 NumberOfTime60-89DaysPastDueNotWorse 的唯一值是: 13 NumberOfDependents 的唯一值是: 13 ''' #%%查看缺失值 train.isnull().sum() ''' SeriousDlqin2yrs 0 RevolvingUtilizationOfUnsecuredLines 0 age 0 NumberOfTime30-59DaysPastDueNotWorse 0 DebtRatio 0 MonthlyIncome 29731 NumberOfOpenCreditLinesAndLoans 0 NumberOfTimes90DaysLate 0 NumberRealEstateLoansOrLines 0 NumberOfTime60-89DaysPastDueNotWorse 0 NumberOfDependents 3924 dtype: int64 ''' #月收入缺失比例还是很高的,展示不管 #%%按照字面理解。好像都是数值型变量 import pycard as pc num_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in list(train.columns): clf.fit(train[i] ,train.SeriousDlqin2yrs) clf.generate_transform_fun() num_iv_woedf.append(clf.woe_df_) num_iv_woedf.to_excel('tmp18') #上面可知有2个字段是有缺失值得,我们可以将NumberOfDependents填补为-1,收入的填补为均值 train_copy = train.copy() train_copy.NumberOfDependents[train_copy.NumberOfDependents.isnull()] = -1 train_copy.MonthlyIncome.median() train_copy.MonthlyIncome[train_copy.MonthlyIncome.isnull()] = 5400.0 #有iv的计算可知 (35.892, inf] RevolvingUtilizationOfUnsecuredLines,有点问题,删除 train_copy = train_copy[train_copy.RevolvingUtilizationOfUnsecuredLines<=35.892] train_copy.shape #%%异常值处理 #我错了,下面这个异常值处理并不合理,不处理了, #%%分箱 import pycard as pc num_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in list(train_copy.columns)[1:]: clf.fit(train_copy[i] ,train_copy.SeriousDlqin2yrs) clf.generate_transform_fun() num_iv_woedf.append(clf.woe_df_) from numpy import * train_copy['RevolvingUtilizationOfUnsecuredLines_bin'] = pd.cut(train_copy.RevolvingUtilizationOfUnsecuredLines,bins=[-inf, 0.1318, 0.3009, 0.495, 0.6981, 0.8628, 1.0051, 1.0284, inf]) train_copy['age_bin'] = pd.cut(train_copy.age,bins=[-inf, 28.5, 36.5, 43.5, 55.5, 57.5, 62.5, 67.5, inf]) train_copy['NumberOfTime30-59DaysPastDueNotWorse_bin'] = pd.cut(train_copy['NumberOfTime30-59DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 3.5, inf]) train_copy['DebtRatio_bin'] = pd.cut(train_copy.DebtRatio,bins=[-inf, 0.0, 0.0163, 0.4233, 0.6537, 3.9728, 995.5, inf]) train_copy['MonthlyIncome_bin'] = pd.cut(train_copy.MonthlyIncome,bins=[-inf, 270.0, 930.5, 3332.5, 5320.5, 5400.5, 7656.5, 9945.5, inf]) train_copy['NumberOfOpenCreditLinesAndLoans_bin'] = pd.cut(train_copy.NumberOfOpenCreditLinesAndLoans,bins=[-inf, 0.5, 1.5, 2.5, 3.5, 13.5, inf]) train_copy['NumberOfTimes90DaysLate_bin'] = pd.cut(train_copy.NumberOfTimes90DaysLate,bins=[-inf, 0.5, 1.5, 2.5, inf]) train_copy['NumberRealEstateLoansOrLines_bin'] = pd.cut(train_copy.NumberRealEstateLoansOrLines,bins=[-inf, 0.5, 2.5, 4.5, 6.5, inf]) train_copy['NumberOfTime60-89DaysPastDueNotWorse_bin'] = pd.cut(train_copy['NumberOfTime60-89DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 2.5, inf]) train_copy['NumberOfDependents_bin'] = pd.cut(train_copy.NumberOfDependents,bins=[-inf, -0.5, 0.5, 1.5, 2.5, 3.5, inf]) cate_iv_woedf = pc.WoeDf() clf = pc.NumBin() for i in ['RevolvingUtilizationOfUnsecuredLines_bin', 'age_bin', 'NumberOfTime30-59DaysPastDueNotWorse_bin', 'DebtRatio_bin', 'MonthlyIncome_bin', 'NumberOfOpenCreditLinesAndLoans_bin', 'NumberOfTimes90DaysLate_bin', 'NumberRealEstateLoansOrLines_bin', 'NumberOfTime60-89DaysPastDueNotWorse_bin', 'NumberOfDependents_bin']: cate_iv_woedf.append(pc.cross_woe(train_copy[i] ,train_copy.SeriousDlqin2yrs)) cate_iv_woedf.to_excel('tmp18') #%%woe转换 iv_col = ['RevolvingUtilizationOfUnsecuredLines_bin', 'age_bin', 'NumberOfTime30-59DaysPastDueNotWorse_bin', 'DebtRatio_bin', 'MonthlyIncome_bin', 'NumberOfOpenCreditLinesAndLoans_bin', 'NumberOfTimes90DaysLate_bin', 'NumberRealEstateLoansOrLines_bin', 'NumberOfTime60-89DaysPastDueNotWorse_bin', 'NumberOfDependents_bin'] cate_iv_woedf.bin2woe(train_copy,iv_col) model_col = [i for i in ['SeriousDlqin2yrs']+list(train_copy.columns)[-10:]] #%%建模 import pandas as pd import matplotlib.pyplot as plt #导入图像库 import matplotlib import seaborn as sns import statsmodels.api as sm from sklearn.metrics import roc_curve, auc from sklearn.model_selection import train_test_split X = train_copy[model_col[1:]] Y = train_copy['SeriousDlqin2yrs'] x_train,x_test,y_train,y_test=train_test_split(X,Y,test_size=0.3,random_state=100) #(10127, 44) X1=sm.add_constant(x_train) #在X前加上一列常数1,方便做带截距项的回归 logit=sm.Logit(y_train.astype(float),X1.astype(float)) result=logit.fit() result.summary() result.params #验证集 X3 = sm.add_constant(x_test) resu = result.predict(X3.astype(float)) fpr, tpr, threshold = roc_curve(y_test, resu) rocauc = auc(fpr, tpr) # 0.8575936062678856 plt.plot(fpr, tpr, 'b', label='AUC = %0.2f' % rocauc) plt.legend(loc='lower right') plt.plot([0, 1], [0, 1], 'r--') plt.xlim([0, 1]) plt.ylim([0, 1]) plt.ylabel('真正率') plt.xlabel('假正率') plt.show() #训练集 resu_1 = result.predict(X1.astype(float)) fpr, tpr, threshold = roc_curve(y_train, resu_1) rocauc = auc(fpr, tpr) #0.8585906092953097 plt.plot(fpr, tpr, 'b', label='AUC = %0.2f' % rocauc) plt.legend(loc='lower right') plt.plot([0, 1], [0, 1], 'r--') plt.xlim([0, 1]) plt.ylim([0, 1]) plt.ylabel('真正率') plt.xlabel('假正率') plt.show() #%%测试集 test = pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-test.csv') test.NumberOfDependents[test.NumberOfDependents.isnull()] = -1 test.MonthlyIncome.median() test.MonthlyIncome[test.MonthlyIncome.isnull()] = 5400.0 test['RevolvingUtilizationOfUnsecuredLines_bin'] = pd.cut(test.RevolvingUtilizationOfUnsecuredLines,bins=[-inf, 0.1318, 0.3009, 0.495, 0.6981, 0.8628, 1.0051, 1.0284, inf]) test['age_bin'] = pd.cut(test.age,bins=[-inf, 28.5, 36.5, 43.5, 55.5, 57.5, 62.5, 67.5, inf]) test['NumberOfTime30-59DaysPastDueNotWorse_bin'] = pd.cut(test['NumberOfTime30-59DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 3.5, inf]) test['DebtRatio_bin'] = pd.cut(test.DebtRatio,bins=[-inf, 0.0, 0.0163, 0.4233, 0.6537, 3.9728, 995.5, inf]) test['MonthlyIncome_bin'] = pd.cut(test.MonthlyIncome,bins=[-inf, 270.0, 930.5, 3332.5, 5320.5, 5400.5, 7656.5, 9945.5, inf]) test['NumberOfOpenCreditLinesAndLoans_bin'] = pd.cut(test.NumberOfOpenCreditLinesAndLoans,bins=[-inf, 0.5, 1.5, 2.5, 3.5, 13.5, inf]) test['NumberOfTimes90DaysLate_bin'] = pd.cut(test.NumberOfTimes90DaysLate,bins=[-inf, 0.5, 1.5, 2.5, inf]) test['NumberRealEstateLoansOrLines_bin'] = pd.cut(test.NumberRealEstateLoansOrLines,bins=[-inf, 0.5, 2.5, 4.5, 6.5, inf]) test['NumberOfTime60-89DaysPastDueNotWorse_bin'] = pd.cut(test['NumberOfTime60-89DaysPastDueNotWorse'],bins=[-inf, 0.5, 1.5, 2.5, inf]) test['NumberOfDependents_bin'] = pd.cut(test.NumberOfDependents,bins=[-inf, -0.5, 0.5, 1.5, 2.5, 3.5, inf]) cate_iv_woedf.bin2woe(test,iv_col) X_test = test[model_col[1:]] X4 = sm.add_constant(X_test.astype(float)) resu_test = result.predict(X4.astype(float))

至于后面为什么没有将调参进行到第五步,那是因为后面的效果比前面的还要差,我们就不继续进行了。

补充一些代码

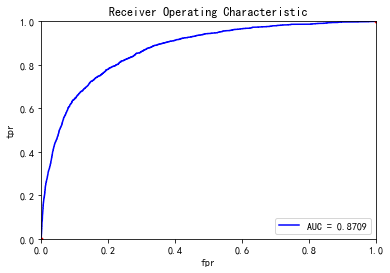

train_x, test_x, train_y, test_y = train_test_split(train_x.values, train_y.values, test_size=0.25, random_state=1234)

plot_roc(test_x, test_y)

如果我们没有那么多时间去调参,我们可以直接使用这个模板

#%% import pandas as pd import xgboost as xgb from sklearn.model_selection import train_test_split from sklearn.externals import joblib import logging train=pd.read_csv('D:\python_home\Give-me-some-credit-master\data\\cs-training.csv') train.pop('Unnamed: 0') data_y = train[['SeriousDlqin2yrs']] data_y.columns = ['y'] data_x = train.drop(['SeriousDlqin2yrs'],axis=1) train_x, test_x, train_y, test_y = train_test_split(data_x.values, data_y.values, test_size=0.2,random_state=1234) d_train = xgb.DMatrix(train_x, label=train_y) d_valid = xgb.DMatrix(test_x, label=test_y) watchlist = [(d_train, 'train'), (d_valid, 'valid')] #参数设置 params={ 'eta': 0.2, # 特征权重 取值范围0~1 通常最后设置eta为0.01~0.2 'max_depth':3, # 通常取值:3-10 树的深度 'min_child_weight':6, # 最小样本的权重,调大参数可以防止过拟合 'gamma':0.3, 'subsample':0.8, #随机取样比例 'colsample_bytree':0.8, #默认为1 ,取值0~1 对特征随机采集比例 'booster':'gbtree', #迭代树 'objective': 'binary:logistic', #逻辑回归,输出为概率 'nthread':8, #设置最大的进程量,若不设置则会使用全部资源 'scale_pos_weight': 10, #默认为0,1可以处理类别不平衡 'lambda':1, #默认为1 'seed':1234, #随机数种子 'silent':1 , #0表示输出结果 'eval_metric': 'auc' # 检验指标 } bst = xgb.train(params, d_train,1000,watchlist,early_stopping_rounds=500, verbose_eval=10) tree_nums=bst.best_ntree_limit print('最优模型树的数量:%s,auc:%s' % (bst.best_ntree_limit, bst.best_score)) #最优模型树的数量:81,auc:0.870911 bst = xgb.train(params, d_train,tree_nums,watchlist,early_stopping_rounds=500, verbose_eval=10) #joblib.dump(bst, 'd:/xgboost.model') #保存模型 plot_roc(test_x, test_y)

其中画roc还是使用上面的函数

浙公网安备 33010602011771号

浙公网安备 33010602011771号