量化学习 | Tushare和Backtrader初探(一)

昨日2020年03月12日时美股历史的第三次熔断,距离上一次熔断03月09号仅3天时间,受全球疫情的影响,股市出现恐慌性抛盘,导致A股也出现较为明显的震荡,A股能否走出独立行情还是不得而知了。

所以我最近学习了一下量化投资的东西,

量化平台Backtrader用起来还不错,A股历史行情数据可从Tushare中获取:

# Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

super().__init__()

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

def next(self):

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.order_target_size(target=1) # enter long

# self.buy()

elif self.crossover < 0: # in the market & cross to the downside

self.order_target_size(target=0) # close long position

# self.close()

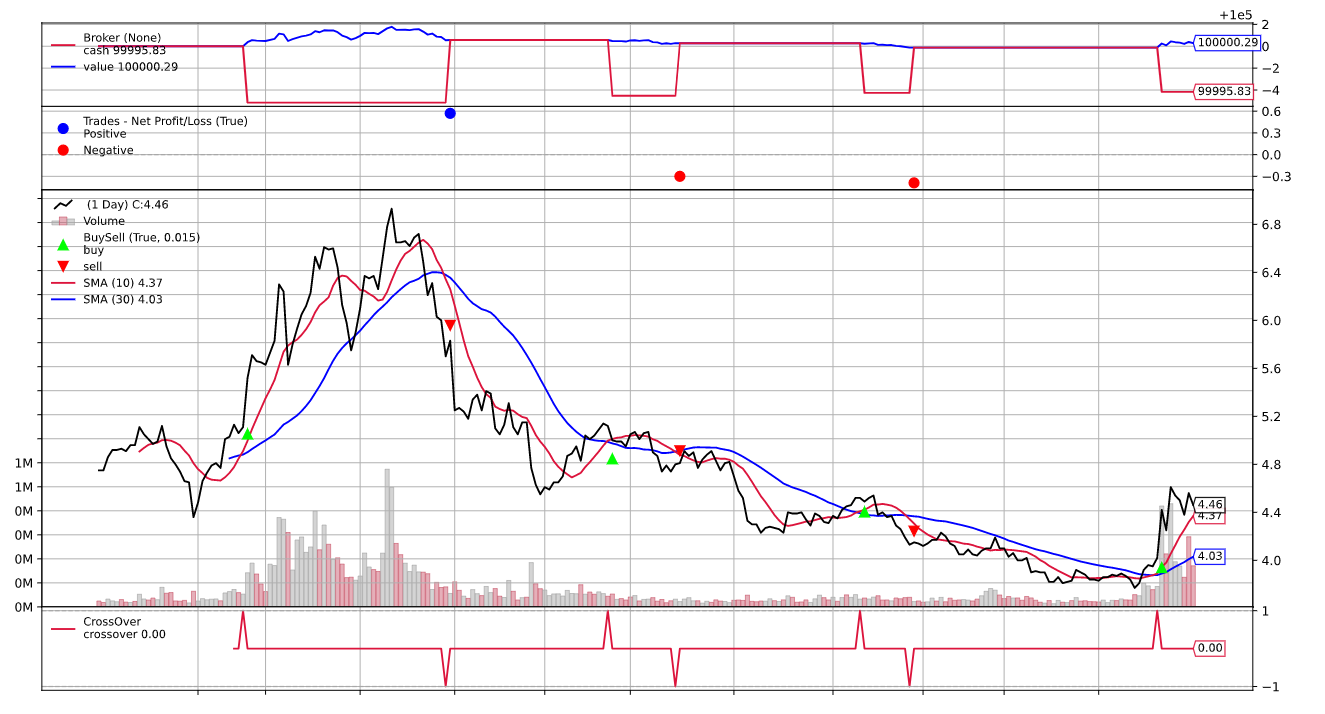

这是一个简单的均值策略,当10日均线超过30日均线时买入,30日均线超过10日均线卖出。

data_path = './data/'

if not os.path.exists(data_path):

os.makedirs(data_path)

mytoken='your_token'

class Strategy_runner:

def __init__(self, strategy, ts_code, start_date, end_date, data_path=data_path, pro=False, token=mytoken):

self.ts_code = ts_code

self.start_date = start_date

self.end_date = end_date

# convert to datetime

self.start_datetime = datetime.strptime(start_date,'%Y%m%d')

self.end_datetime = datetime.strptime(end_date,'%Y%m%d')

if pro:

csv_name = f'pro_day_{str(ts_code)}-{str(start_date)}-{str(end_date)}.csv'

else:

csv_name = f'day_{str(ts_code)}-{str(start_date)}-{str(end_date)}.csv'

csv_path = os.path.join(data_path,csv_name)

if os.path.exists(csv_path):

if pro:

self.df = pd.read_csv(csv_path)

else:

self.df = pd.read_csv(csv_path,index_col=0)

else:

if pro:

ts.set_token(mytoken)

self.pro = ts.pro_api()

self.df = self.pro.daily(ts_code=self.ts_code, start_date=self.start_date, end_date=self.end_date)

if not self.df.empty:

self.df.to_csv(csv_path, index=False)

else:

self.df = ts.get_hist_data(self.ts_code, str(self.start_datetime), str(self.end_datetime))

if not self.df.empty:

self.df.to_csv(csv_path, index=True)

self.df_bt = self.preprocess(self.df, pro)

print(self.df_bt)

self.strategy = strategy

self.cerebro = bt.Cerebro()

def preprocess(self, df, pro=False):

if pro:

features=['open','high','low','close','vol','trade_date']

# convert_datetime = lambda x:datetime.strptime(x,'%Y%m%d')

convert_datetime = lambda x: pd.to_datetime(str(x))

df['trade_date'] = df['trade_date'].apply(convert_datetime)

print(df)

bt_col_dict = {'vol':'volume','trade_date':'datetime'}

df = df.rename(columns=bt_col_dict)

df = df.set_index('datetime')

# df.index = pd.DatetimeIndex(df.index)

else:

features=['open','high','low','close','volume']

df = df[features]

df['openinterest'] = 0

df.index = pd.DatetimeIndex(df.index)

df = df[::-1]

return df

def run(self):

data = bt.feeds.PandasData(dataname=self.df_bt,

fromdate=self.start_datetime,

todate=self.end_datetime)

self.cerebro.adddata(data) # Add the data feed

self.cerebro.addstrategy(self.strategy) # Add the trading strategy

self.cerebro.broker.setcash(100000.0)

# self.cerebro.addsizer(bt.sizers.FixedSize, stake=10)

# self.cerebro.broker.setcommission(commission=0.0)

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio,_name = 'SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

self.results = self.cerebro.run()

strat = self.results[0]

print('Final Portfolio Value: %.2f' % self.cerebro.broker.getvalue())

print('SR:', strat.analyzers.SharpeRatio.get_analysis())

print('DW:', strat.analyzers.DW.get_analysis())

return self.results

def plot(self, iplot=False):

self.cerebro.plot(iplot=iplot)

Tushare有pro版本和普通行情,由于最开始我使用了pro版本但是后面出现了一些连接问题,所以我又写了普通的版本,目前都可以用。

pro:

ts.set_token(mytoken)

self.pro = ts.pro_api()

self.df = self.pro.daily(ts_code=self.ts_code, start_date=self.start_date, end_date=self.end_date)

pro版本需要获取token,这个需要你去官网注册之后可以看到的,之后使用daily即可获取日级历史行情。

ts_code='600515.SH'

start_date='20190101'

end_date='20191231'

strategy_runner = Strategy_runner(strategy=SmaCross, ts_code=ts_code, start_date=start_date, end_date=end_date, pro=True)

results = strategy_runner.run()

strategy_runner.plot()

以去年为例,传入pro=True,即可使用pro接口,然后获取行情,用均值策略分析

添加策略:

self.cerebro.addstrategy(self.strategy)

设置初始资金:

self.cerebro.broker.setcash(100000.0)

加入analyzer为获取夏普率和回撤率:

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio,_name = 'SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

运行模拟策略一遍:

self.cerebro.run()

得到分析结果:

Final Portfolio Value: 100000.29

SR: OrderedDict([('sharperatio', None)])

DW: AutoOrderedDict([('len', 178), ('drawdown', 0.0014899734784627702), ('moneydown', 1.4899999999906868), ('max', AutoOrderedDict([('len', 178), ('drawdown', 0.0019099660025940943), ('moneydown', 1.9099999999889405)]))])

因为夏普率默认需要年化的,这里不到一年的数据所以是None。

如果没有token可以直接使用普通接口:

ts_code='600515'

start_date='20190101'

end_date='20191231'

strategy_runner = Strategy_runner(strategy=SmaCross, ts_code=ts_code, start_date=start_date, end_date=end_date, pro=False)

results = strategy_runner.run()

如果使用日级行情,其实两者并没有太大的差别,只是表格的列名有点差别。我这里如果第一次获取之后我会在本地存下该表格,后面就不需要网络获取了。

浙公网安备 33010602011771号

浙公网安备 33010602011771号