Kaggle房价预测

之前在kaggle上做了关于房价预测的比赛,现整理如下。

解决问题的大概步骤是:

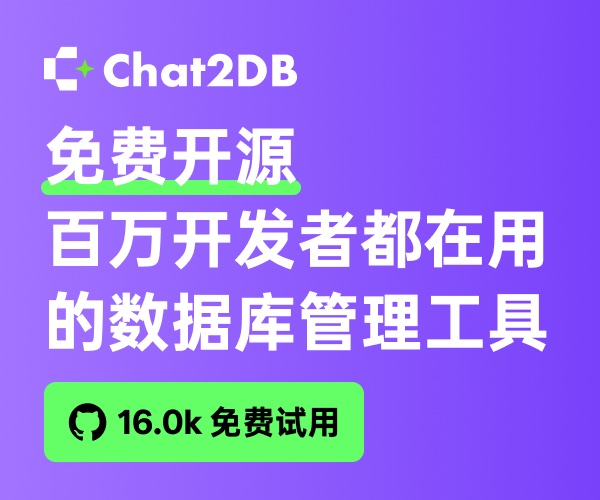

1、通过画图查看目标变量SalePrice是否偏分布,若是,则进行log(x+1)变换。并查看数值变量,若偏度大于0.75,也做log(x+1)变换

2、缺失值处理。分类变量NA NA值赋值为0,数值变量中的NA赋值为其平均值

3、将分类变量转化为哑变量

4、回归分析。分别用Ridge回归与Lasso回归进行回归分析,因为Lasso回归的误差平均值更小,所以选取Lasso回归的结果作为最终预测结果

具体代码如下:

library(ggplot2)

library(plyr)

library(dplyr)

library(caret)

library(moments)

library(glmnet)

library(elasticnet)

library(knitr)

train=read.csv("train.csv",stringsAsFactors = F,header = T)

test=read.csv("test.csv",stringsAsFactors = F,header = T)

all_data=rbind(select(train,MSSubClass:SaleCondition),select(test,MSSubClass:SaleCondition))

#画出售价的直方图,发现左偏,用log(x+1)进行调整

df=rbind(data.frame(version="log(price+1)",x=log(train$SalePrice+1)),data.frame(version="price",x=train$SalePrice))

ggplot(data=df)+facet_wrap(~version,ncol=2,scales="free_x")+geom_histogram(aes(x=x))

train$SalePrice=log(train$SalePrice+1)

#数值变量偏度》0.75时做log变换

feature_classes <- sapply(names(all_data),function(x){class(all_data[[x]])})

numeric_feats <-names(feature_classes[feature_classes != "character"])

skewed_feats <- sapply(numeric_feats,function(x){skewness(all_data[[x]],na.rm=TRUE)})

skewed_feats <- skewed_feats[skewed_feats > 0.75]

for(x in names(skewed_feats)) {

all_data[[x]] <- log(all_data[[x]] + 1)

}

#分类变量,dummy variables

categorical_feats <- names(feature_classes[feature_classes == "character"])

dummies <- dummyVars(~.,all_data[categorical_feats])

categorical_1_hot <- predict(dummies,all_data[categorical_feats])

categorical_1_hot[is.na(categorical_1_hot)] <- 0

#数值变量,用平均值弥补缺失值

numeric_df <- all_data[numeric_feats]

for (x in numeric_feats) {

mean_value <- mean(train[[x]],na.rm = TRUE)

all_data[[x]][is.na(all_data[[x]])] <- mean_value

}

#预处理后的重建data

all_data <- cbind(all_data[numeric_feats],categorical_1_hot)

X_train <- all_data[1:nrow(train),]

X_test <- all_data[(nrow(train)+1):nrow(all_data),]

y <- train$SalePrice

#models

CARET.TRAIN.CTRL <- trainControl(method="repeatedcv",

number=5,

repeats=5,

verboseIter=FALSE)

lambdas <- seq(1,0,-0.001)

set.seed(123) # for reproducibility

model_ridge <- train(x=X_train,y=y,

method="glmnet",

metric="RMSE",

maximize=FALSE,

trControl=CARET.TRAIN.CTRL,

tuneGrid=expand.grid(alpha=0, # Ridge regression

lambda=lambdas))

ggplot(data=filter(model_ridge$result,RMSE<0.14)) +

geom_line(aes(x=lambda,y=RMSE))

mean(model_ridge$resample$RMSE)

# [1] 0.1308965

set.seed(123) # for reproducibility

model_lasso <- train(x=X_train,y=y,

method="glmnet",

metric="RMSE",

maximize=FALSE,

trControl=CARET.TRAIN.CTRL,

tuneGrid=expand.grid(alpha=1, # Lasso regression

lambda=c(1,0.1,0.05,0.01,seq(0.009,0.001,-0.001),

0.00075,0.0005,0.0001)))

model_lasso

mean(model_lasso$resample$RMSE)

# [1] 0.1260769

coef <- data.frame(coef.name = dimnames(coef(model_lasso$finalModel,s=model_lasso$bestTune$lambda))[[1]],

coef.value = matrix(coef(model_lasso$finalModel,s=model_lasso$bestTune$lambda)))

coef <- coef[-1,]

picked_features <- nrow(filter(coef,coef.value!=0))

not_picked_features <- nrow(filter(coef,coef.value==0))

cat("Lasso picked",picked_features,"variables and eliminated the other",

not_picked_features,"variables\n")

coef <- arrange(coef,-coef.value)

imp_coef <- rbind(head(coef,10),

tail(coef,10))

ggplot(imp_coef) +

geom_bar(aes(x=reorder(coef.name,coef.value),y=coef.value),

stat="identity") +

ylim(-1.5,0.6) +

coord_flip() +

ggtitle("Coefficents in the Lasso Model") +

theme(axis.title=element_blank())

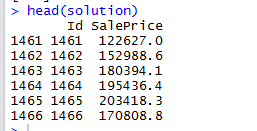

preds <- exp(predict(model_lasso,newdata=X_test)) - 1

solution <- data.frame(Id=as.integer(rownames(X_test)),SalePrice=preds)

write.csv(solution," lasso_sol.csv",row.names=FALSE)

预测结果如下:

其他的尝试:

尝试将lasso和ridge方法的预测结果,按照权重相加得到最终预测结果,但是结果并不理想,还没有单独lasso的效果好。可能跟设置的权重有关系,但在这个问题上本来ridge的方法就没有lasso好,权重相加本身可能就拉低了lasso预测效果。

听闻XGBoost在此方面效果比较好,或可一试。