Python绘制BOLL布林线指标图

写在前面

本文代码部分总结自Packt出版社的《Learn Algorithmic Trading - Fundamentals of Algorithmic Trading》(图1)。现将该书的布林线技术指标部分进行总结,并对数据处理及图形绘制等函数做了相应改动,供有需要的读者学习研究。

布林线(BOLL)技术指标简介

布林线(Bollinger Bands,BOLL)又称布林带,是约翰·布林(John Bollinger)提出的一种行情价格频带分轨,是根据统计学中的标准差原理,设计出来的一种非常实用的技术指标。布林线也建立在移动平均线之上,但包含最近的价格波动,使指标更能适应不同的市场条件。布林线通常可由上轨(压力线)、中轨(行情平衡线)和下轨(支撑线)三条轨道线组成,属于通道式指标或路径式指标[1]。

BOLL公式详解

参数设置

n : n:n: 时间周期数

标准差σ \sigmaσ(STDEV):

σ = ∑ i = 1 n ( P i − M A ) 2 n \sigma=\sqrt\frac{\sum_{i=1}^{n}(P i-MA)^{2}}{n}σ=n∑i=1n(Pi−MA)2

标准差因子β \betaβ(STDEV Factor):

β = 2 \beta=2β=2

中界线:n nn日内收盘价的算术平均

阻力线:中界线+ ++标准差因子× \times×标准差

支撑线:中界线− -−标准差因子× \times×标准差

B B A N D M i d = M A n − p e r i o d s B B A N D U p = B B A N D M i d + β × σ B B A N D L o w = B B A N D M i d − β × σ

BBANDMid=MAn−periodsBBANDUp=BBANDMid+β×σBBANDLow=BBANDMid−β×σ

用到的主要Python库

Python绘图库Matplotlib 3.2.1

Python金融数据处理库Pandas 1.0.2

Python矩阵计算库Numpy 1.16.0

Python代码&详解

# 导入及处理数据

import pandas as pd

import numpy as np

# 绘图

import matplotlib.pyplot as plt

# 设置图像标签显示中文

plt.rcParams['font.sans-serif'] = ['SimHei']

plt.rcParams['axes.unicode_minus'] = False

import matplotlib as mpl

# 解决一些编辑器(VSCode)或IDE(PyCharm)等存在的图片显示问题,

# 应用Tkinter绘图,以便对图形进行放缩操作

mpl.use('TkAgg')

# 导入数据并做处理

def import_csv(stock_code):

df = pd.read_csv(stock_code + '.csv')

df.rename(columns={

'date': 'Date',

'open': 'Open',

'high': 'High',

'low': 'Low',

'close': 'Close',

'volume': 'Volume'

},

inplace=True)

df['Date'] = pd.to_datetime(df['Date'], format='%Y/%m/%d')

df.set_index(['Date'], inplace=True)

return df

stock_code = 'sh600519'

# 绘制数据的规模

scale = 500

df = import_csv(stock_code)[-scale:]

# SMA:简单移动平均(Simple Moving Average)

time_period = 20 # SMA的计算周期,默认为20

stdev_factor = 2 # 上下频带的标准偏差比例因子

history = [] # 每个计算周期所需的价格数据

sma_values = [] # 初始化SMA值

upper_band = [] # 初始化阻力线价格

lower_band = [] # 初始化支撑线价格

# 构造列表形式的绘图数据

for close_price in df['Close']:

#

history.append(close_price)

# 计算移动平均时先确保时间周期不大于20

if len(history) > time_period:

del (history[0])

# 将计算的SMA值存入列表

sma = np.mean(history)

sma_values.append(sma)

# 计算标准差

stdev = np.sqrt(np.sum((history - sma) ** 2) / len(history))

upper_band.append(sma + stdev_factor * stdev)

lower_band.append(sma - stdev_factor * stdev)

# 将计算的数据合并到DataFrame

df = df.assign(收盘价=pd.Series(df['Close'], index=df.index))

df = df.assign(中界线=pd.Series(sma_values, index=df.index))

df = df.assign(阻力线=pd.Series(upper_band, index=df.index))

df = df.assign(支撑线=pd.Series(lower_band, index=df.index))

# 绘图

ax = plt.figure()

# 设定y轴标签

ax.ylabel = '%s price in ¥' % (stock_code)

df['收盘价'].plot(color='k', lw=1., legend=True)

df['中界线'].plot(color='b', lw=1., legend=True)

df['阻力线'].plot(color='r', lw=1., legend=True)

df['支撑线'].plot(color='g', lw=1., legend=True)

plt.show()所得图像如下:

参考文献

[1] 麻道明.如何看懂技术指标.北京:中国宇航出版社,2015.207页

[1] Sebastien Donadio,Sourav Ghosh.Learn Algorithmic Trading - Fundamentals of Algorithmic Trading.Birmingham:Packt Press,2019.P59-62.

推荐阅读

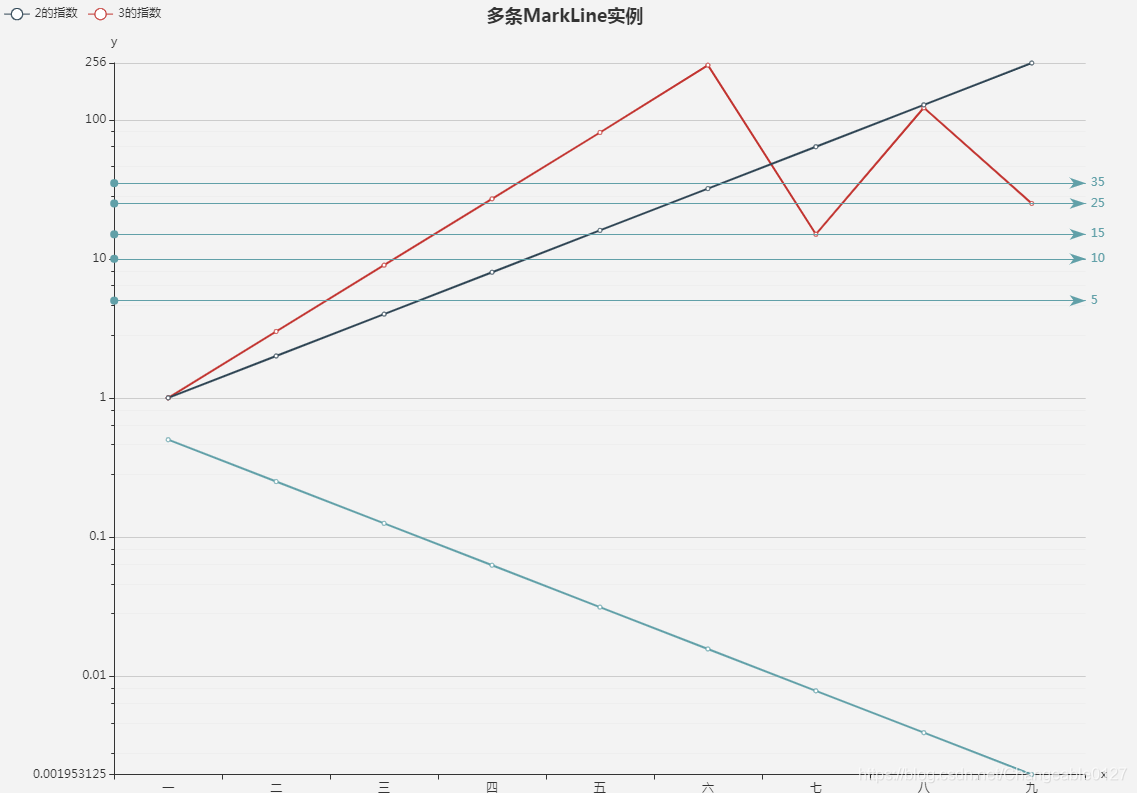

echarts添加多条辅助线(MarkLine)_echarts minorsplitline_夕降巫咸的博客-CSDN博客

先上效果图

下面贴option代码

-

option = {

-

title: {

-

text: '多条MarkLine实例',

-

left: 'center'

-

},

-

tooltip: {

-

trigger: 'item',

-

formatter: '{a} <br/>{b} : {c}'

-

},

-

legend: {

-

left: 'left',

-

data: ['2的指数', '3的指数']

-

},

-

xAxis: {

-

type: 'category',

-

name: 'x',

-

splitLine: {show: false},

-

data: ['一', '二', '三', '四', '五', '六', '七', '八', '九']

-

},

-

grid: {

-

left: '3%',

-

right: '4%',

-

bottom: '3%',

-

containLabel: true

-

},

-

yAxis: {

-

type: 'log',

-

name: 'y',

-

minorTick: {

-

show: true

-

},

-

minorSplitLine: {

-

show: true

-

},

-

max:'dataMax',

-

min:'dataMin'

-

-

},

-

series: [

-

{

-

name: '3的指数',

-

type: 'line',

-

data: [1, 3, 9, 27, 81, 247, 15, 122, 25]

-

},

-

{

-

name: '2的指数',

-

type: 'line',

-

data: [1, 2, 4, 8, 16, 32, 64, 128, 256]

-

},

-

{

-

name: '1/2的指数',

-

type: 'line',

-

data: [1/2, 1/4, 1/8, 1/16, 1/32, 1/64, 1/128, 1/256, 1/512],

-

-

//实现辅助线部分

-

-

-

markLine: {

-

silent: true,

-

data: [{

-

yAxis: 5

-

}, {

-

yAxis: 10

-

}, {

-

yAxis: 15

-

}, {

-

yAxis: 25

-

}, {

-

yAxis: 35

-

}],

-

lineStyle: {

-

normal: {

-

type: 'solid',

-

},

-

},

-

-

}

-

}

-

]

-

};

pyecharts显示K线、均线、成交量和MACD_yaxis_opts=opts.axisopts(is_scale=true)是什么意思?_lrobinson的博客-CSDN博客

安装 Ta-lib:

pip install Ta-lib

安装pyecharts:

pip install pyecharts

npm install -g phantomjs-prebuilt

安装图片保存插件:

pip install pyecharts-snapshot

-

import pandas as pd

-

import numpy as np

-

import talib as ta

-

from decimal import Decimal

-

-

from pyecharts.charts import Kline, Line, Bar, Grid

-

from pyecharts.commons.utils import JsCode

-

from pyecharts import options as opts

-

from pyecharts.globals import CurrentConfig, NotebookType

-

CurrentConfig.NOTEBOOK_TYPE = NotebookType.JUPYTER_NOTEBOOK

-

-

# 精度计算

-

def digital_utils(temps):

-

temps = str(temps)

-

if temps.find('E'):

-

temps = '{:.8f}'.format(Decimal(temps))

-

nums = temps.split('.')

-

if int(nums[1]) == 0:

-

return nums[0]

-

else:

-

num = str(int(nums[1][::-1]))

-

result = '{}.{}'.format(nums[0], num[::-1])

-

return result

-

-

def sum_resampler(df):

-

if df.shape[0] < 1:

-

return float("nan")

-

return np.sum(df)

-

def low_resampler(df):

-

return np.min(df)

-

def high_resampler(df):

-

return np.max(df)

-

def avg_resampler(df):

-

return digital_utils(np.average(df))

-

def open_resampler(df):

-

if df.shape[0] < 1:

-

return float("nan")

-

return np.asarray(df)[0]

-

def close_resampler(df):

-

if df.shape[0] < 1:

-

return float("nan")

-

return np.asarray(df)[-1]

-

def volume_resampler(df):

-

if df.shape[0] < 1:

-

return float("nan")

-

volume = np.asarray(df)[-1] - np.asarray(df)[0]

-

if volume < 1:

-

return float("nan")

-

return volume

-

# 根据tikt数据合成K线数据

-

def getKline(price, volume):

-

data_close = price.resample('T', label='right').apply(close_resampler) # 1分钟聚合,使用最右边的index作为新的index

-

data_open = price.resample('T', label='right').apply(open_resampler) # 1分钟聚合,使用最右边的index作为新的index

-

data_high = price.resample('T', label='right').apply(high_resampler) # 1分钟聚合,使用最右边的index作为新的index

-

data_low = price.resample('T', label='right').apply(low_resampler) # 1分钟聚合,使用最右边的index作为新的index

-

data_volume = volume.resample('T', label='right').apply(volume_resampler) # 1分钟聚合,使用最右边的index作为新的index

-

-

data = pd.concat([data_open, data_close, data_low, data_high, data_volume],axis=1)

-

data.columns = ['open', 'close', 'low', 'high', 'volume']

-

-

return data

-

-

def process(data):

-

#去掉数据中的第一行(集合竞价值)和最后一行数据(结算值)

-

data.columns = ['localtime', 'InstrumentID', 'TradingDay', 'ActionDay', 'UpdateTime', 'UpdateMillisec', 'LastPrice', 'Volume', 'HighestPrice', 'LowestPrice', 'OpenPrice', 'ClosePrice', 'AveragePrice', 'AskPrice1', 'AskVolume1', 'BidPrice1', 'BidVolume1', 'UpperLimitPrice', 'LowerLimitPrice', 'OpenInterest', 'Turnover', 'PreClosePrice', 'PreOpenInterest', 'PreSettlementPrice']

-

data = data[:-1]

-

#用交易日期(TradingDay),会把前一天晚上的数据当成今天数据处理 ActionDay

-

index = pd.DatetimeIndex(data['TradingDay'].map(str) + ' ' + data['UpdateTime'].map(str) + '.' + data['UpdateMillisec'].map(str))

-

data.index = index

-

data = data[['LastPrice', 'Volume', 'HighestPrice', 'LowestPrice', 'OpenPrice', 'AveragePrice', 'AskPrice1', 'AskVolume1', 'BidPrice1', 'BidVolume1', 'UpperLimitPrice', 'LowerLimitPrice', 'OpenInterest', 'PreClosePrice', 'PreOpenInterest', 'PreSettlementPrice']]

-

return data

-

-

# 绘制K线

-

def drawKline(kdata):

-

kline=Kline()

-

kline.add_xaxis(xaxis_data=kdata.index.map(str).tolist())

-

-

kline.add_yaxis(series_name="kline",

-

y_axis=kdata.values.tolist(),

-

itemstyle_opts=opts.ItemStyleOpts( #自定义颜色

-

color="#ec0000",

-

color0="#00da3c",

-

border_color="#8A0000",

-

border_color0="#008F28",)

-

)

-

kline.set_global_opts(

-

title_opts=opts.TitleOpts(title="K线周期图表", pos_left="0"),

-

# yaxis_opts=opts.AxisOpts(is_scale=True,splitarea_opts=opts.SplitAreaOpts(is_show=True, areastyle_opts=opts.AreaStyleOpts(opacity=1)),),

-

yaxis_opts=opts.AxisOpts(is_scale=True, splitline_opts=opts.SplitLineOpts(is_show=True)),

-

# tooltip_opts=opts.TooltipOpts(trigger="axis", axis_pointer_type="line"),

-

datazoom_opts=[

-

opts.DataZoomOpts(is_show=False, type_="inside", xaxis_index=[0, 0], range_end=100),#xaxis_index=[0, 0]设置第一幅图为内部缩放

-

opts.DataZoomOpts(is_show=True, xaxis_index=[0, 1], pos_top="97%", range_end=100), #xaxis_index=[0, 1]连接第二幅图的axis

-

opts.DataZoomOpts(is_show=False, xaxis_index=[0, 2], range_end=100), #xaxis_index=[0, 2]连接第三幅图的axis

-

],

-

# 三个图的 axis 连在一块

-

# axispointer_opts=opts.AxisPointerOpts(

-

# is_show=True,

-

# link=[{"xAxisIndex": "all"}],

-

# label=opts.LabelOpts(background_color="#777"),

-

# ),

-

)

-

# Ma均线

-

maLine = Line()

-

maLine.add_xaxis(kdata.index.map(str).tolist())

-

maLine.add_yaxis(

-

series_name="MA5",

-

y_axis=kdata['close'].rolling(5).mean(),

-

is_smooth=True,

-

linestyle_opts=opts.LineStyleOpts(opacity=0.5),

-

label_opts=opts.LabelOpts(is_show=False),

-

)

-

maLine.add_yaxis(

-

series_name="MA10",

-

y_axis=kdata['close'].rolling(10).mean(),

-

is_smooth=True,

-

linestyle_opts=opts.LineStyleOpts(opacity=0.5),

-

label_opts=opts.LabelOpts(is_show=False),

-

)

-

maLine.set_global_opts(

-

xaxis_opts=opts.AxisOpts(

-

type_="category",

-

grid_index=1,

-

axislabel_opts=opts.LabelOpts(is_show=False),

-

),

-

yaxis_opts=opts.AxisOpts(

-

grid_index=1,

-

split_number=3,

-

axisline_opts=opts.AxisLineOpts(is_on_zero=False),

-

axistick_opts=opts.AxisTickOpts(is_show=False),

-

splitline_opts=opts.SplitLineOpts(is_show=False),

-

axislabel_opts=opts.LabelOpts(is_show=True),

-

),

-

)

-

# Overlap Kline + ma

-

overlap_kline_ma = kline.overlap(maLine)

-

return overlap_kline_ma

-

-

#绘制成交量图

-

def drawVolume(kdata):

-

volumeFlag = kdata['close'] - kdata['open']

-

barVolume = Bar()

-

barVolume.add_xaxis(kdata.index.map(str).tolist())

-

barVolume.add_yaxis(

-

series_name="Volumn",

-

y_axis=kdata['volume'].values.tolist(),

-

xaxis_index=1,

-

yaxis_index=1,

-

label_opts=opts.LabelOpts(is_show=False),

-

itemstyle_opts=opts.ItemStyleOpts(

-

color=JsCode(

-

"""

-

function(params) {

-

var colorList;

-

if (volumeFlag[params.dataIndex] > 0) {

-

colorList = '#ef232a';

-

} else {

-

colorList = '#14b143';

-

}

-

return colorList;

-

}

-

"""

-

)

-

)

-

)

-

barVolume.set_global_opts(

-

xaxis_opts=opts.AxisOpts(

-

type_="category",

-

grid_index=1,

-

axislabel_opts=opts.LabelOpts(is_show=False),

-

),

-

legend_opts=opts.LegendOpts(is_show=False),

-

)

-

-

return volumeFlag, barVolume

-

-

def drawMACD(kdata):

-

dw = pd.DataFrame()

-

dw['DIF'], dw['DEA'], dw['MACD'] = ta.MACD(kdata['close'], fastperiod=12, slowperiod=26, signalperiod=9)

-

-

bar_2 = Bar()

-

bar_2.add_xaxis(kdata.index.map(str).tolist())

-

-

-

bar_2.add_yaxis(

-

series_name="MACD",

-

y_axis=dw["MACD"].values.tolist(),

-

xaxis_index=1, # 用于合并显示时排列位置,单独显示不要添加

-

yaxis_index=1, # 用于合并显示时排列位置,单独显示不要添加

-

label_opts=opts.LabelOpts(is_show=False),

-

itemstyle_opts=opts.ItemStyleOpts(

-

color=JsCode(

-

"""

-

function(params) {

-

var colorList;

-

if (params.data >= 0) {

-

colorList = '#ef232a';

-

} else {

-

colorList = '#14b143';

-

}

-

return colorList;

-

}

-

"""

-

)

-

),

-

)

-

bar_2.set_global_opts(

-

xaxis_opts=opts.AxisOpts(

-

type_="category",

-

grid_index=1, # 用于合并显示时排列位置,单独显示不要添加

-

axislabel_opts=opts.LabelOpts(is_show=False),

-

),

-

yaxis_opts=opts.AxisOpts(

-

grid_index=1, # 用于合并显示时排列位置,单独显示不要添加

-

split_number=4,

-

axisline_opts=opts.AxisLineOpts(is_on_zero=False),

-

axistick_opts=opts.AxisTickOpts(is_show=False),

-

splitline_opts=opts.SplitLineOpts(is_show=False),

-

axislabel_opts=opts.LabelOpts(is_show=True),

-

),

-

legend_opts=opts.LegendOpts(is_show=False),

-

)

-

line_2 = Line()

-

line_2.add_xaxis(kdata.index.map(str).tolist())

-

line_2.add_yaxis(

-

series_name="DIF",

-

y_axis=dw["DIF"],

-

xaxis_index=1,

-

yaxis_index=2,

-

label_opts=opts.LabelOpts(is_show=False),

-

)

-

line_2.add_yaxis(

-

series_name="DEA",

-

y_axis=dw["DEA"],

-

xaxis_index=1,

-

yaxis_index=2,

-

label_opts=opts.LabelOpts(is_show=False),

-

)

-

line_2.set_global_opts(legend_opts=opts.LegendOpts(is_show=False))

-

overlap_bar_line = bar_2.overlap(line_2)

-

return overlap_bar_line

-

-

def drawAll(overlap_kline_ma, barVolume, overlap_bar_line, volumeFlag):

-

# 最后的 Grid

-

grid_chart = Grid(init_opts=opts.InitOpts(width="1400px", height="800px"))

-

# 这个是为了把 volumeFlag 这个数据写入到 html 中,还没想到怎么跨 series 传值

-

# demo 中的代码也是用全局变量传的

-

grid_chart.add_js_funcs("var volumeFlag = {}".format(volumeFlag.values.tolist()))# 传递涨跌数据给vomume绘图,用红色显示上涨成交量,绿色显示下跌成交量

-

# K线图和 MA5 的折线图

-

grid_chart.add(

-

overlap_kline_ma,

-

grid_opts=opts.GridOpts(pos_left="3%", pos_right="1%", height="60%"),

-

)

-

# Volumn 柱状图

-

grid_chart.add(

-

barVolume,

-

grid_opts=opts.GridOpts(

-

pos_left="3%", pos_right="1%", pos_top="71%", height="10%"

-

),

-

)

-

# MACD DIFS DEAS

-

grid_chart.add(

-

overlap_bar_line,

-

grid_opts=opts.GridOpts(

-

pos_left="3%", pos_right="1%", pos_top="82%", height="14%"

-

),

-

)

-

# grid_chart.render_notebook()

-

return grid_chart

-

-

def getGrid(kdata):

-

k = drawKline(kdata)

-

vflag, v = drawVolume(kdata)

-

m = drawMACD(kdata)

-

return drawAll(k, v, m, vflag)

-

-

def getKdata(path):

-

data = pd.read_csv(path)

-

data = process(data)

-

price = data['LastPrice']

-

volume = data['Volume']

-

kdata = getKline(price, volume)

-

kdata.drop(kdata[np.isnan(kdata['volume'])].index, inplace=True)#删除 volume列中为nan的行

-

return kdata

-

-

def showCsvKline(path):

-

kdata = getKdata(path)

-

return getGrid(kdata)

-

-

path = 'c:\\QiHuoData\\20200204_fu2005.csv'

-

grid_chart =showCsvKline(path)

-

grid_chart.render_notebook()

![[图片上传中...(kline3.gif-3cd3ef-1542639059861-0)]](https://upload-images.jianshu.io/upload_images/8694874-8d9b1cf2ad2e5916.gif?imageMogr2/auto-orient/strip)

浙公网安备 33010602011771号

浙公网安备 33010602011771号