矢量化

矢量化

矢量化指的是用数组代替标量来操作数组里的每个元素。

numpy提供了vectorize函数,可以把处理标量的函数矢量化,返回的函数可以直接处理ndarray数组。

#函数矢量化 import math as m import numpy as np def foo(x, y): return m.sqrt(x ** 2 + y ** 2) x, y = 3, 4 print(foo(x, y)) # 5.0 x, y = np.array([3, 4, 5, 6]), np.array([4, 5, 6, 7]) # foo 函数矢量化 返回矢量化函数 foo_vec = np.vectorize(foo) print(foo_vec(x, y)) # [5. 6.40312424 7.81024968 9.21954446] print(np.vectorize(foo)(x, y)) # [5. 6.40312424 7.81024968 9.21954446]

numpy还提供了frompyfunc函数,也可以完成与vectorize相同的功能

# 把foo转换成矢量函数,该矢量函数接收2个参数,返回一个结果 fun = np.frompyfunc(foo, 2, 1) d = fun(x, y)

print(d)

# [5.0 6.4031242374328485 7.810249675906654 9.219544457292887]

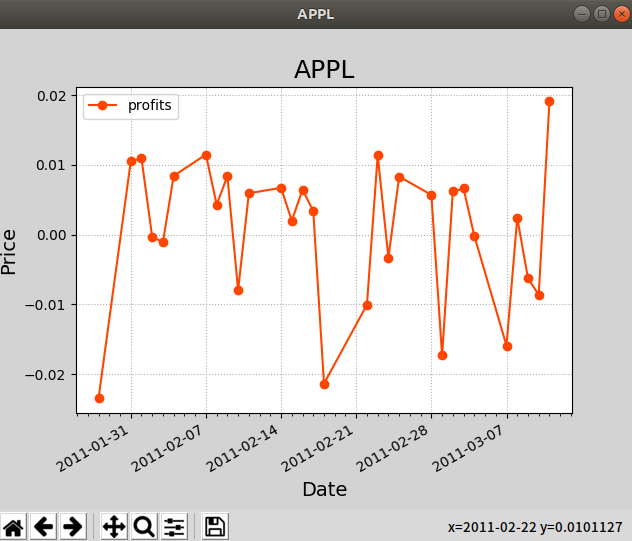

案例:定义一种买进卖出策略,通过历史数据判断这种策略是否值得实施。

# 矢量化 import numpy as np import matplotlib.pyplot as mp import datetime as dt import matplotlib.dates as md def dmy2ymd(dmy): """ 把日月年转年月日 :param day: :return: """ dmy = str(dmy, encoding='utf-8') t = dt.datetime.strptime(dmy, '%d-%m-%Y') s = t.date().strftime('%Y-%m-%d') return s dates, opening_prices, \ highest_prices, lowest_prices, \ closing_prices = \ np.loadtxt('aapl.csv', delimiter=',', usecols=(1, 3, 4, 5, 6), unpack=True, dtype='M8[D],f8,f8,f8,f8', converters={1: dmy2ymd}) # 日月年转年月日 # print(dates) # 绘制收盘价的折现图 mp.figure('APPL', facecolor='lightgray') mp.title('APPL', fontsize=18) mp.xlabel('Date', fontsize=14) mp.ylabel('Price', fontsize=14) mp.grid(linestyle=":") # 设置刻度定位器 # 每周一一个主刻度,一天一个次刻度 ax = mp.gca() ma_loc = md.WeekdayLocator(byweekday=md.MO) ax.xaxis.set_major_locator(ma_loc) ax.xaxis.set_major_formatter(md.DateFormatter('%Y-%m-%d')) ax.xaxis.set_minor_locator(md.DayLocator()) # 修改dates的dtype为md.datetime.datetiem dates = dates.astype(md.datetime.datetime) # 定义买入卖出策略,计算每天的收益率 def profit(opening_price, highest_price, lowset_priec, closing_price): buying_price = opening_price * 1 if (highest_price > buying_price > lowset_priec): return (closing_price - buying_price) / buying_price return np.nan #计算每天的收益率: profits = np.vectorize(profit)(opening_prices,highest_prices,lowest_prices,closing_prices) print(profits) isnan_mask = np.isnan(profits) #取反 dates,profits = dates[~isnan_mask],profits[~isnan_mask] mp.plot(dates,profits,'o-',color='orangered',label='profits') print(profits.mean())#-0.0015498765393923365 mp.legend() mp.gcf().autofmt_xdate() mp.show()