去年年终奖比前年涨了一些,但实际到手反而少了,当时只知道是因为税率提了一档导致的,但没有深究为什么

最近研究了一下,发现这就是著名的年终奖一元陷阱

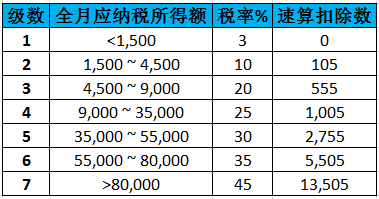

年终奖的税率计算是,先把年终奖平分到12个月,根据个人所得税税率表找到对应的税率

于是年终奖扣税 = 年终奖×对应税率 - 速算扣除数

如果年终奖多了1块钱,进入下一档税率,根据跨度,会多扣5到15个点,但对应的速扣数没有增加12倍,就导致了年终奖多发一元,实际到手少很多的年终奖一元陷阱

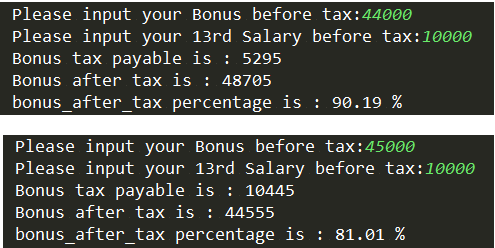

举例说明,假如13薪和年终奖一起发,两个加一起算总年终奖。

比如13薪是10000,年终奖44000,总年终奖是54000,得出54000/12 = 1500, 查表得出用10%那档税率, 实际到手 = 54000 - (54000 × 10% - 105) = 48705

假如年终奖涨了1000,总年终奖变成55000,55000/12 = 4583, 查表得出用20% 那档税率, 实际到手 = 55000 - (55000 × 20% - 555) =44555

税率档从10%升到20%,所以虽然总年终奖多了1000,但扣的税多了5150,导致实际到手反而少了4150

代码如下

def taxRate(bonus,thirteen_month_salary): total = bonus + thirteen_month_salary base = total/12 if base < 0: bonus_tax = 0 if base <= 1500: bonus_tax = total * 0.03 elif base > 1500 and base <= 4500: bonus_tax = total * 0.1 - 105 elif base > 4500 and base <= 9000: bonus_tax = total * 0.2 - 555 elif base > 9000 and base <= 35000: bonus_tax = total * 0.25 - 1005 elif base > 35000 and base <= 55000: bonus_tax = total * 0.3 - 2755 elif base > 55000 and base <= 80000: bonus_tax = total * 0.35 - 5505 elif base > 80000: bonus_tax = total * 0.45 - 13505 print('Bonus tax payable is : %d' % bonus_tax) return bonus_tax def BonusAfterTax(bonus, thirteen_month_salary): # 纳税额 tax = taxRate(bonus,thirteen_month_salary) # 税后bonus bonus_after_tax = bonus + thirteen_month_salary - tax print('Bonus after tax is : %d' % bonus_after_tax) print('bonus_after_tax percentage is : %.2f %%' % float(bonus_after_tax * 100 / (bonus + thirteen_month_salary))) return bonus_after_tax if __name__ == '__main__': bonus_before_tax = int(input('Please input your Bonus before tax:')) thirteen_month_salary = int(input('Please input your 13rd Salary before tax:')) BonusAfterTax(bonus_before_tax, thirteen_month_salary)

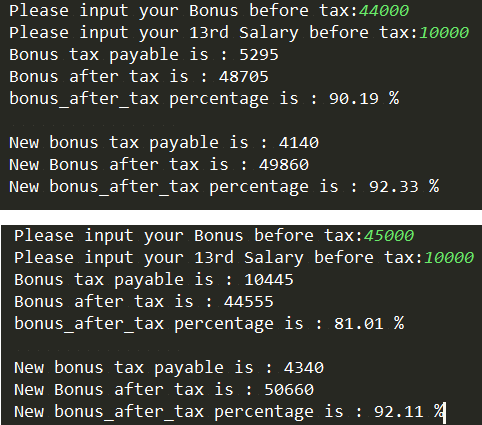

如果速扣数也能对应增加12倍,年终奖一元陷阱就解决了

同样总年终奖从54000涨到55000,如果速扣数相应增加12倍,得出税后年终奖从49860涨到50660

这样税前年终奖涨1000,实际到手涨800,而不是少4150,这才符合期望

期待税法能早点把这个失误改过来

代码如下

def bonusTaxRate(bonus,thirteen_month_salary): total = bonus + thirteen_month_salary base = total/12 if base < 0: bonus_tax = 0 if base <= 1500: bonus_tax = total * 0.03 elif base > 1500 and base <= 4500: bonus_tax = total * 0.1 - 105 elif base > 4500 and base <= 9000: bonus_tax = total * 0.2 - 555 elif base > 9000 and base <= 35000: bonus_tax = total * 0.25 - 1005 elif base > 35000 and base <= 55000: bonus_tax = total * 0.3 - 2755 elif base > 55000 and base <= 80000: bonus_tax = total * 0.35 - 5505 elif base > 80000: bonus_tax = total * 0.45 - 13505 print('Bonus tax payable is : %d' % bonus_tax) return bonus_tax def bonusAfterTax(bonus, thirteen_month_salary): # 纳税额 tax = bonusTaxRate(bonus,thirteen_month_salary) # 税后bonus bonus_after_tax = bonus + thirteen_month_salary - tax print('Bonus after tax is : %d' % bonus_after_tax) print('bonus_after_tax percentage is : %.2f %%' % float(bonus_after_tax * 100 / (bonus + thirteen_month_salary))) print(' ') return bonus_after_tax def newBonusTaxRate(bonus, thirteen_month_salary): total = bonus + thirteen_month_salary base = total / 12 #速扣数相应增大12倍 if base < 0: bonus_tax = 0 if base <= 1500: bonus_tax = total * 0.03 elif base > 1500 and base <= 4500: bonus_tax = total * 0.1 - 105 * 12 elif base > 4500 and base <= 9000: bonus_tax = total * 0.2 - 555 * 12 elif base > 9000 and base <= 35000: bonus_tax = total * 0.25 - 1005 * 12 elif base > 35000 and base <= 55000: bonus_tax = total * 0.3 - 2755 * 12 elif base > 55000 and base <= 80000: bonus_tax = total * 0.35 - 5505 * 12 elif base > 80000: bonus_tax = total * 0.45 - 13505 * 12 print('New bonus tax payable is : %d' % bonus_tax) return bonus_tax def newBonusAfterTax(bonus, thirteen_month_salary): total = bonus + thirteen_month_salary # 纳税额 new_bonus_tax = newBonusTaxRate(bonus,thirteen_month_salary) # 税后bonus bonus_after_tax = total - new_bonus_tax print('New Bonus after tax is : %d' % bonus_after_tax) print('New bonus_after_tax percentage is : %.2f %%' % float(bonus_after_tax * 100 / total)) print(' ') return bonus_after_tax if __name__ == '__main__': bonus_before_tax = int(input('Please input your Bonus before tax:')) thirteen_month_salary = int(input('Please input your 13rd Salary before tax:')) bonusAfterTax(bonus_before_tax, thirteen_month_salary) newBonusAfterTax(bonus_before_tax, thirteen_month_salary)